Keurig Dr. Pepper

Latest Keurig Dr. Pepper News and Updates

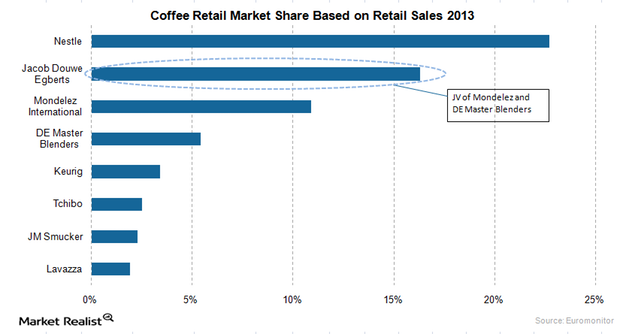

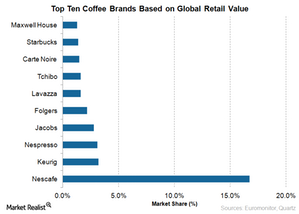

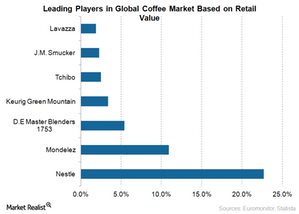

JAB to Challenge Nestle, Global Leader of Portioned Coffee Market

JAB’s share in the global coffee market is estimated to reach approximately 20% with the addition of Keurig’s brands and products to its portfolio.

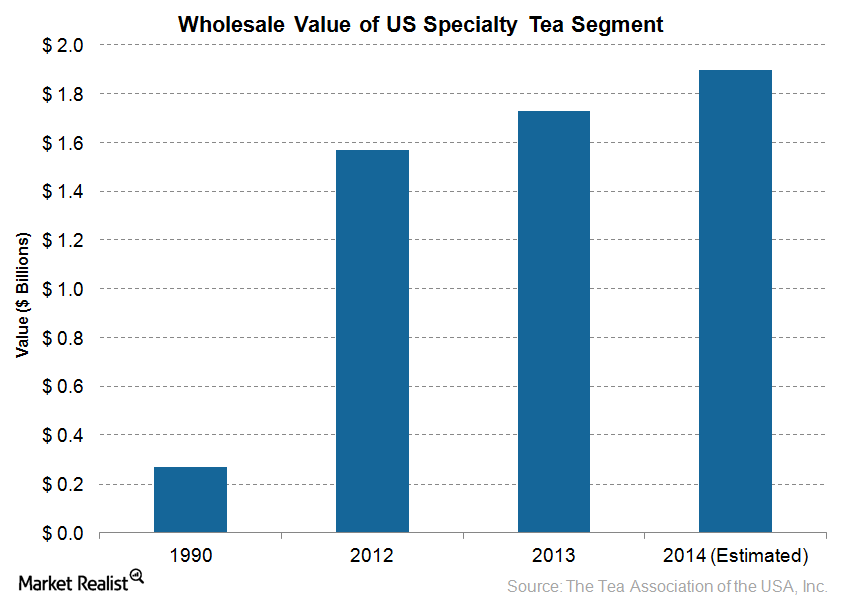

What’s So Special About Specialty Tea?

According to the Tea Association of the USA, the specialty tea segment wholesale value increased to an estimated $1.9 billion in 2014, up 9.8% from 2013.

Will Coffee Peers Step Up Their Game with Jacobs Douwe Egberts?

With the emergence of Jacobs Douwe Egberts, Keurig and other coffee producers will focus more on expanding their product portfolios. They’ll also focus on an international presence to capture the growing global demand for coffee.

Understanding PepsiCo’s Business Segments and More

PepsiCo (PEP) is one of two beverage-industry behemoths. We break down everything investors should know about the stock and the business.

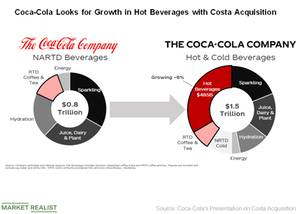

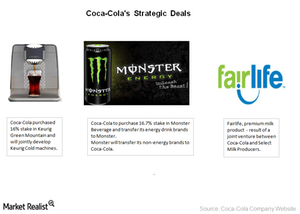

Can Coca-Cola and Its Peers Benefit from Strategic Acquisitions?

The nonalcoholic beverage space saw some major deals in 2018. Dr Pepper Snapple merged with Keurig Green Mountain to form Keurig Dr Pepper (KDP).

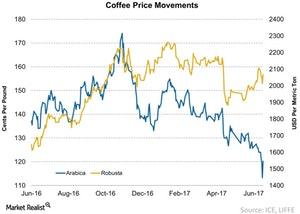

Coffee Futures: Arabica Down, Robusta Up in the Week Ended June 23

In this series, we’ll explore the price movements of five soft commodities—coffee, sugar, cocoa, orange juice, and cotton. Arabica coffee, which is considered superior in flavor and quality to Robusta coffee, has seen its futures price falling during the past six months.

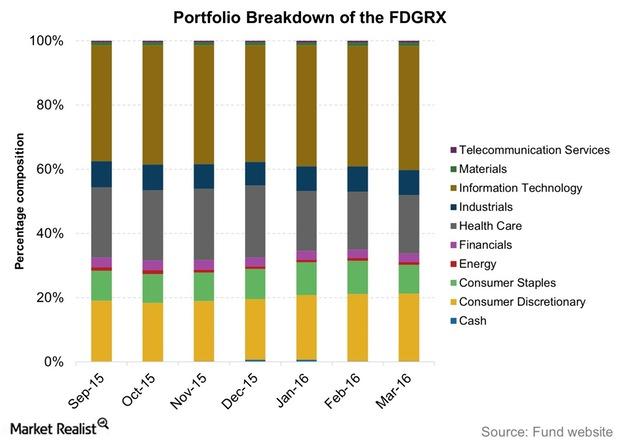

What Moves Did FDGRX Make Leading Up to 1Q16?

FDGRX’s assets were invested across 394 holdings as of March 2016, two more than a quarter ago. It was managing assets worth $37.8 billion as of March’s end.

Campbell Soup’s New Segments Impacted the Operating Profit

The Americas Simple Meals and Beverages segment reported operating earnings of $290 million—a rise of 22% compared to fiscal 2Q15.

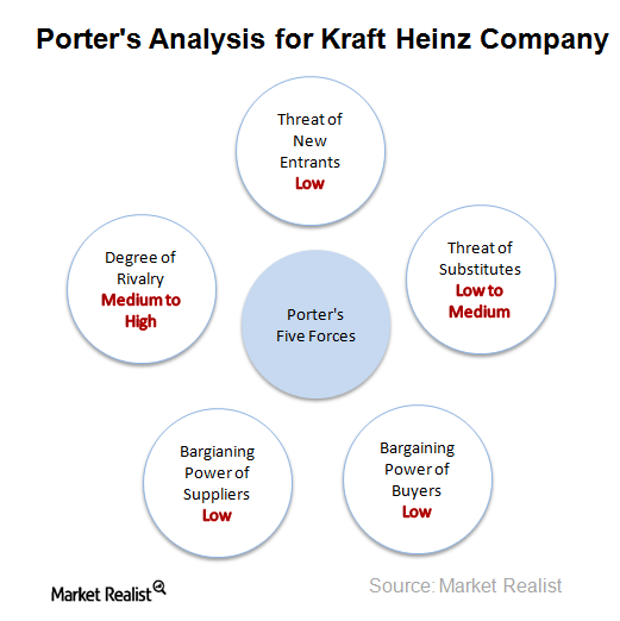

A Porter’s Five Forces Analysis of Kraft Heinz Company

Kraft Heinz faces competition from a huge number of players in the food market, but product differentiation is low between its competitors.

What Challenges Has Keurig Green Mountain Been Facing?

Keurig Green Mountain (GMCR) has been facing struggles in the coffee market (XLP), as Keurig’s patent for K-Cup pods, the single-serve coffee containers, expired in September 2012.

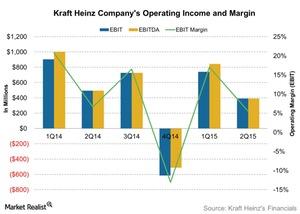

The Kraft Heinz Merger and Its Benefits

Pittsburgh-based H.J. Heinz Holding Corporation acquired Kraft Foods in October. After the merger, the company changed its name to Kraft Heinz.

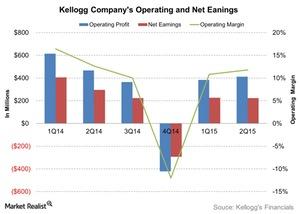

Kellogg’s Acquisitions and Their Benefits

The price of Kellogg’s acquisition of Diamond Foods is expected to reach over $1.5 billion, and Kellogg could offer the company between $35 and $40 per share.

Jacobs Douwe Egberts: Its Impact on Coffee Industry Rivals

Jacobs Douwe Egberts will be a leading player in the coffee industry with powerful brands like Jacobs, Maxwell House, and Pilão. It will have a strong presence in emerging countries like China.

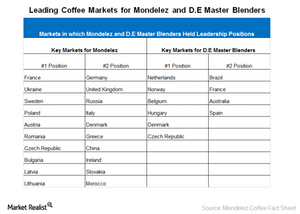

Jacobs Douwe Egberts: What It Took to Seal the Deal

According to Jacobs Douwe Egberts’s website, the company holds either the number-one or number-two position in coffee markets for more than 18 countries in Europe, Latin America, and Australia.

Coca-Cola’s joint ventures set the stage for future growth

The company is focused on expanding its product portfolio through strategic deals. Coca-Cola’s joint ventures will set the stage for future growth.