VanEck Vectors J.P. Morgan EM Local Currency Bond ETF

Latest VanEck Vectors J.P. Morgan EM Local Currency Bond ETF News and Updates

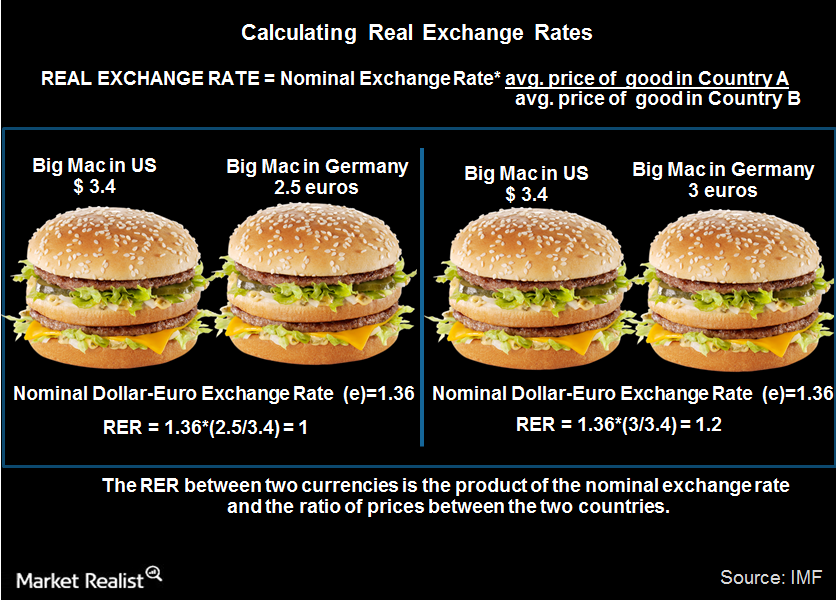

REER 101: An Introduction to Real Effective Exchange Rates

The International Monetary Fund defines REER as an average of the bilateral real exchange rates between a country and its trading partners, weighted by their respective trade shares.

Opportunities in Emerging Market Credit Developments

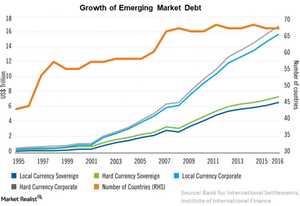

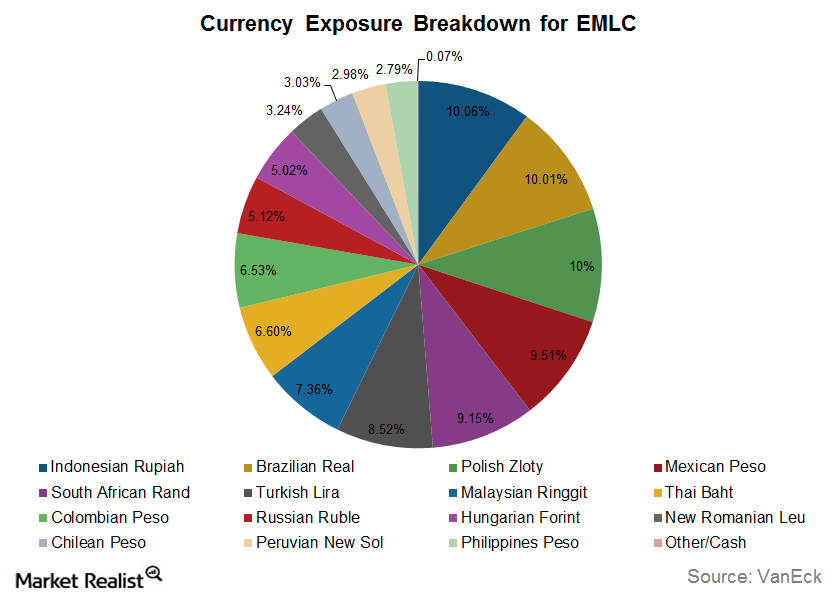

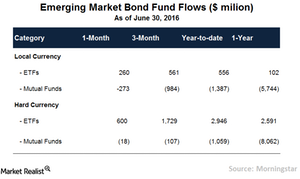

Strong investor interest in emerging market debt (EMLC) (HYEM) has continued despite adverse political and economic issues in some countries.

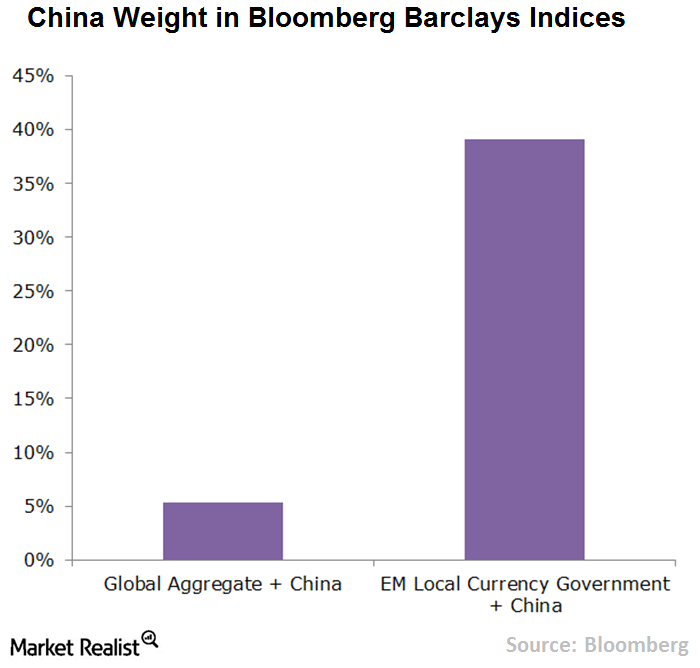

Inclusion of Chinese Onshore Bonds in Global Indexes

In March 2017, Citi’s fixed income indexes decided to include onshore Chinese bonds (EMB) (PCY) in its three government bond indexes.

How Did Emerging Market Debt Perform in 2016?

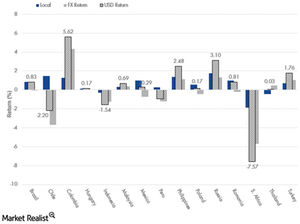

In the emerging market bond space (PCY) (EMLC), high-yield bonds and local currency bonds outperformed hard currency sovereign bonds.

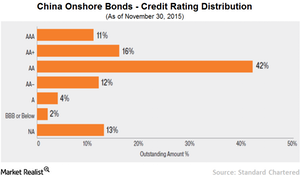

China’s Baby Steps to Open Its Onshore Bond Market

The opening of China’s onshore bond market (EMB) (PCY) was a gradual process that included a number of cautious measures.

Quality May Provide Attractive Risk-Adjusted Returns

It’s useful to analyze the historical returns of credit rating categories within emerging markets bonds.

Improving Economies Make Strong Case for EM Local Debt

As the emerging market local debt assets (EBND) (ELD) continue to evolve and expand, investors are increasingly looking for opportunities in the space to enhance returns.

What’s Driving Emerging Markets Local Currency Debt?

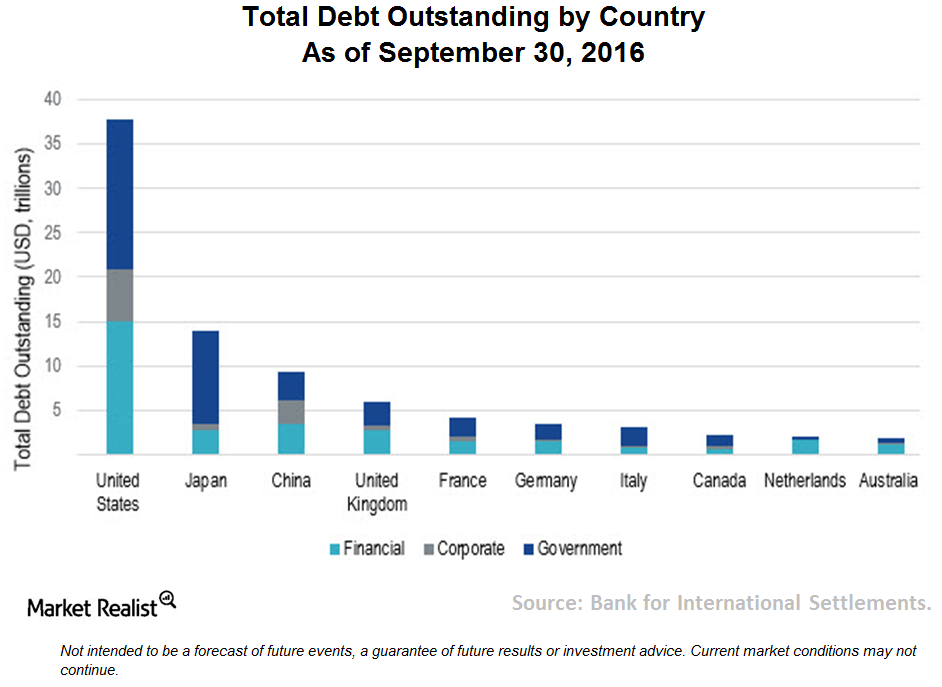

During the past two decades, EM (emerging markets) local debt has evolved to become the largest and most liquid debt market within the emerging market bond space.

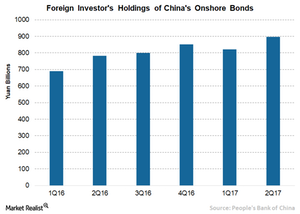

Could China Attract Higher Inflows after Bond Market Reforms?

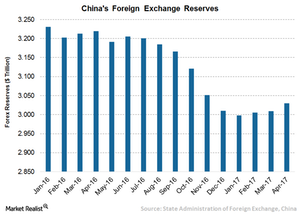

The yuan remains a focus of attention of the international community and a key risk for China’s macroeconomic stability in recent years.

What Difference Does Index Inclusion Make?

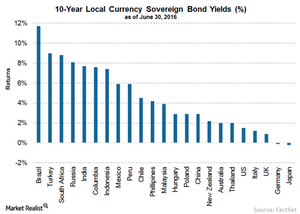

Government bond yields in China are higher than its Asian counterparts such as South Korea and Singapore and much higher than major developed markets.

How Higher Inflows to China Could Impact Other Emerging Markets

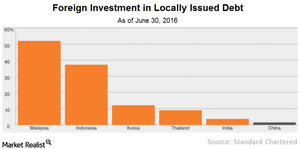

With the onset of reforms, foreign holdings in China’s onshore bond (EMB) (PCY) market is gradually increasing.

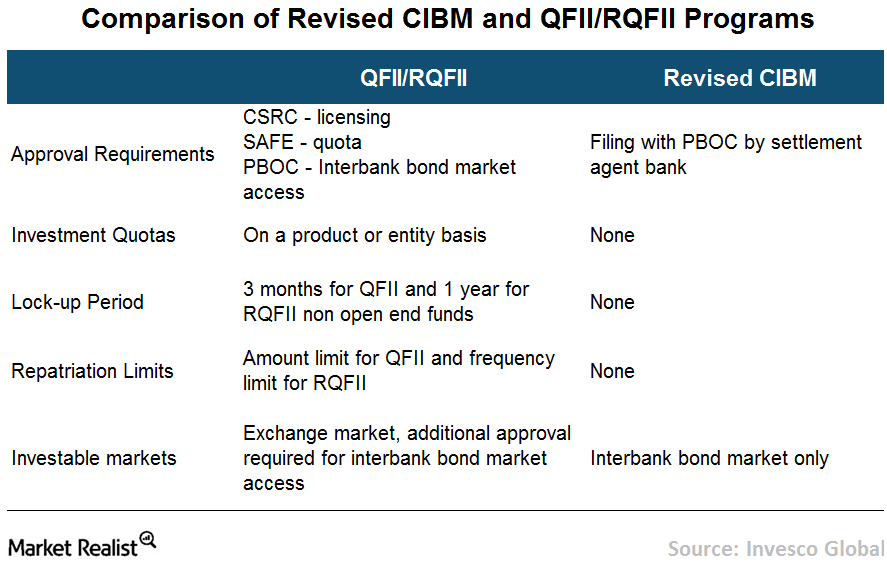

What’s Holding Back Foreign Investors from China?

Many leading bond index providers are still not including China’s onshore bonds in their benchmark indexes due to various regulatory and operational concerns.

China’s Onshore Bond Market Reforms

China’s onshore bond market (EMB), consisting of locally denominated and issued bonds, is larger than the offshore bond market.

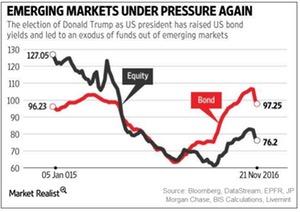

Why Was November Important for Global Financial Markets?

Trump’s unexpected presidential victory caused short-term uncertainty about markets and policies. His win reinforced a reflationary theme in global markets.

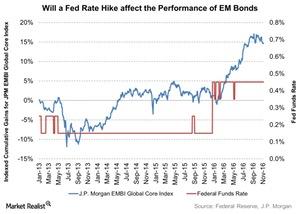

Can a Rate Hike Affect the Performances of Emerging Market Bonds?

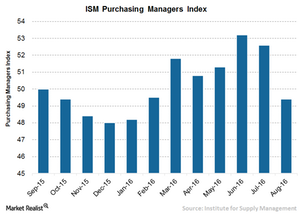

In her speech at the Jackson Hole Economic Symposium, Fed chair Janet Yellen expressed optimism about another rate hike in the United States.

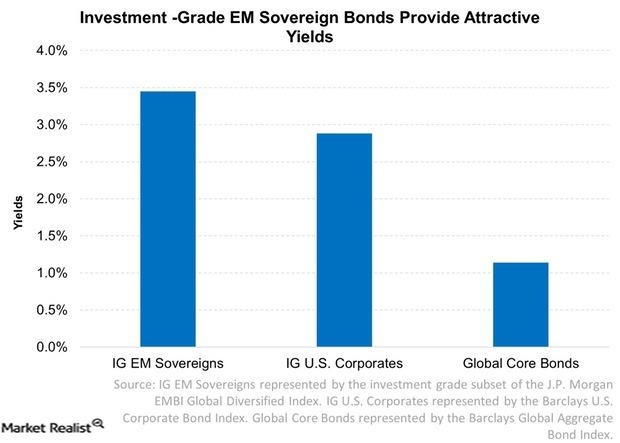

Looking to Local-Currency Emerging Market Bonds for Opportunities

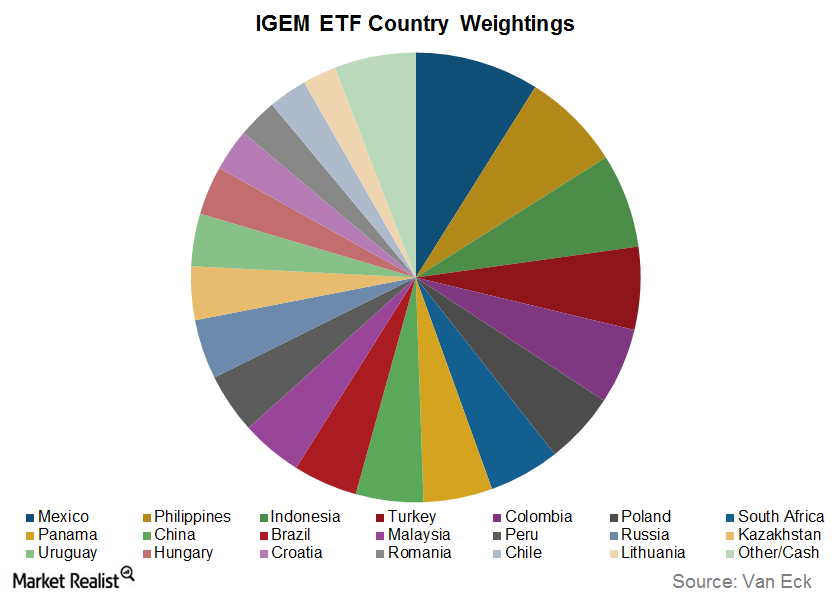

In today’s context, emerging market bonds (IGEM) look like good opportunities for investors.

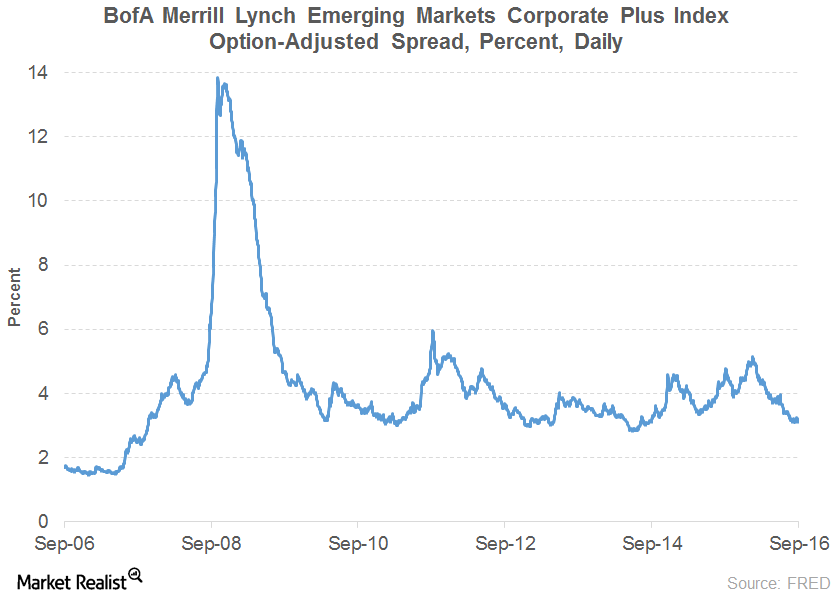

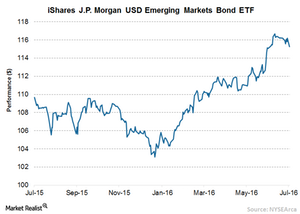

The Rally in Emerging Market Debt

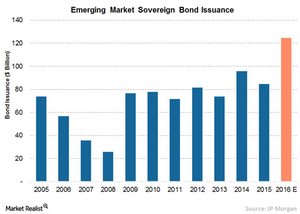

Emerging markets’ nonfinancial corporate debt breached the $26 trillion mark in the first half of 2016.

Investment-Grade Emerging Market Bonds Appear Attractive

Investment-grade emerging market sovereigns have been given BBB or higher credit ratings by one of the credit rating companies. They’re relatively safe.

Is Emerging Market Debt Immune to Rate Hikes?

The Federal Reserve kept its key interest rate unchanged in its policy meeting this week while signaling a possible rate hike in December.

Emerging Market Debt Outperforms Other Risk Assets

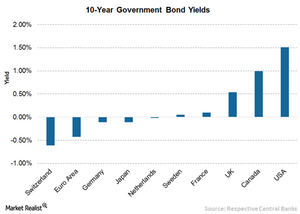

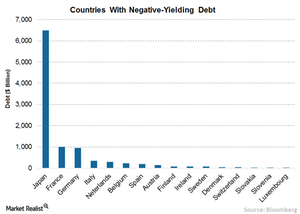

While around 30% of developed market bonds (IHY) are trading at negative yields, emerging market debts (HYEM) are offering attractive returns.

Fed’s Rate Hike Decision to Drive the Markets

In the wake of disappointing economic indicators over the past month, the Federal Reserve kept the interest rate unchanged in its policy meeting this week.

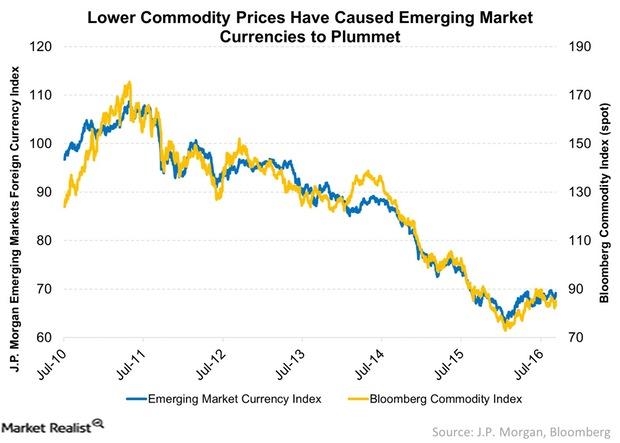

Stable Commodity Prices Have Supported Emerging Market Bonds

Perhaps one of the biggest tailwinds recently, particularly for local currency strategies, has been the stabilization and rebound in commodity prices this year.

Why Does Emerging Market Debt Still Look Attractive?

Emerging market debt (EMB) offers plenty of opportunities to investors. Markets are expected to continue their outperformance for the next few quarters.

Intense Search for Yield Leads to Emerging Market Debt

Under the current uncertain economic circumstances, investors flocked to emerging market debts in search of higher yields.

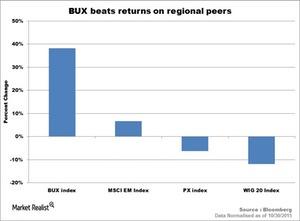

Central and Eastern Europe Have the Brexit Blues

In the long term, Eastern Europe is largely affected by the United Kingdom’s exit from the European Union because of its strong trade links.

How Negative Rates Intensify the Hunt for Yield

By early July, some $11.5 trillion in bonds were trading at negative rates, with 58% of the Barclays US Aggregate Bond Index1 trading below 1%.

Time to Look at Emerging Market Debt

Global emerging markets (“EM”) debt, both hard and local currency, rebounded strongly in June after a significant retracement in May.