Eni SpA

Latest Eni SpA News and Updates

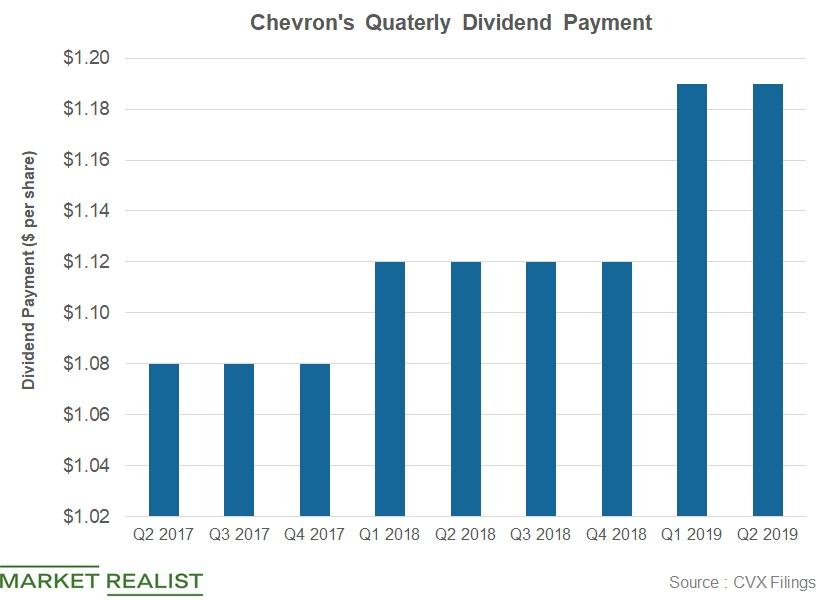

How Will Chevon’s Dividend Payment Trend in Q2?

Chevron (CVX) released its first-quarter earnings on April 26. The company paid $2.2 billion in dividends in the first quarter.

Integrated Energy Stocks: The Top Eight Dividend Yielders

In this series, we’ll look at eight integrated energy stocks and rank them on dividend yields. Royal Dutch Shell (RDS.A) holds the top spot.

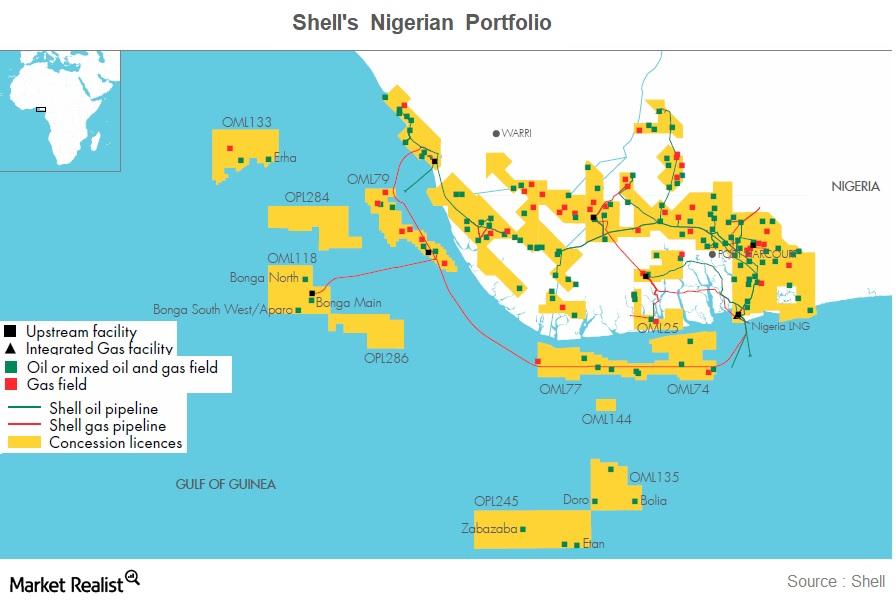

Why Shell’s Gbaran-Ubie Project Is Vital to Upstream Portfolio

In this series, we’ll look at Shell’s overall performance, its robust upstream portfolio, its changing downstream portfolio, and the company’s overall strategy.

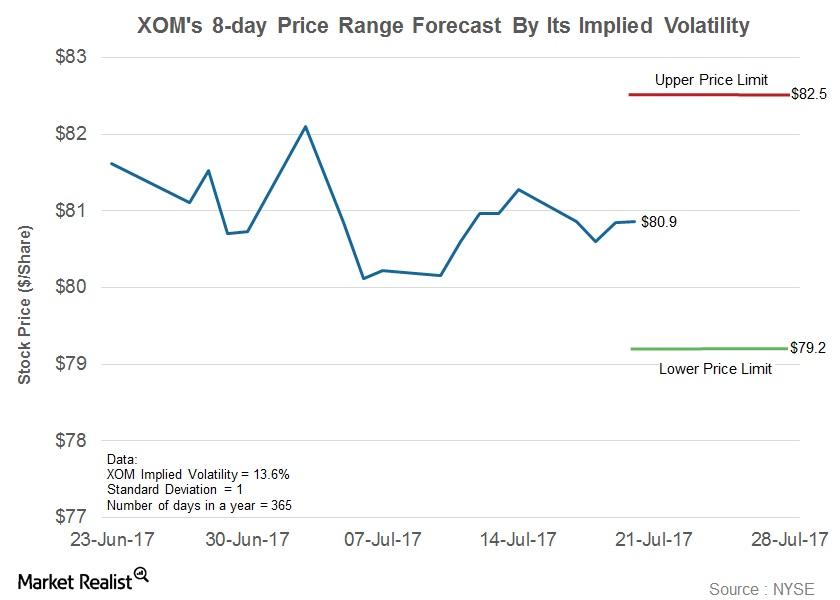

What’s the Forecast for ExxonMobil’s Stock Price?

Implied volatility in ExxonMobil has fallen from 14.9% on April 3, 2017, to 13.6% to date.

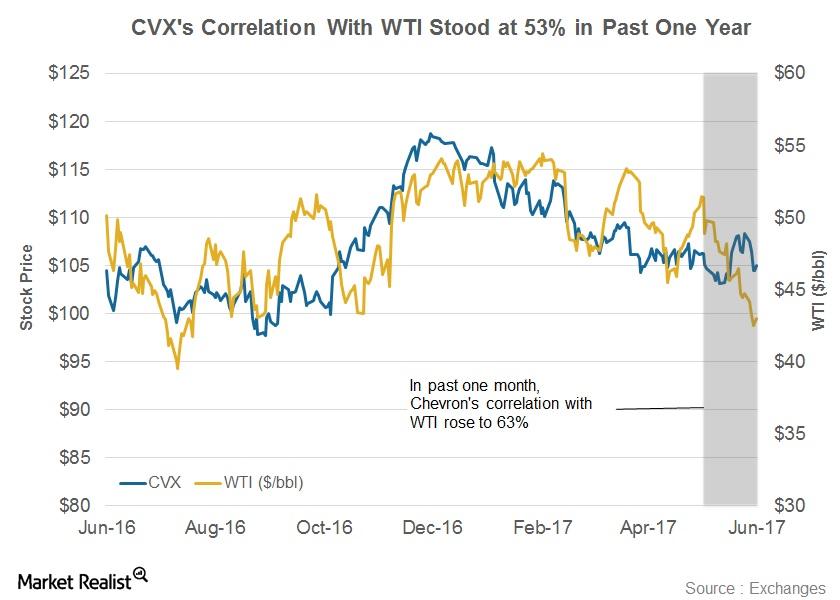

Correlation of Chevron Stock with WTI Crude Oil

The correlation coefficient of Chevron (CVX) versus WTI stood at 0.53 in the last one-year period.

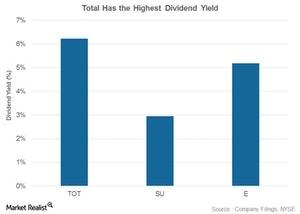

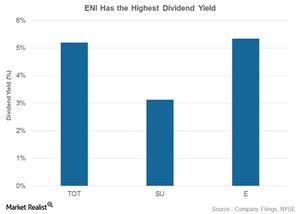

TOT, SU, E, and PBR: Comparing Their Dividend Yields

Total (TOT), Suncor Energy (SU), ENI (E), and Petrobras (PBR) have provided steady returns to their shareholders in the form of dividends.

TOT, SU, E, PBR: Who Has Highest Dividend Yield?

Total (TOT), Suncor Energy (SU), ENI (E), and Petrobras (PBR) have consistently given returns to shareholders in the form of dividends.

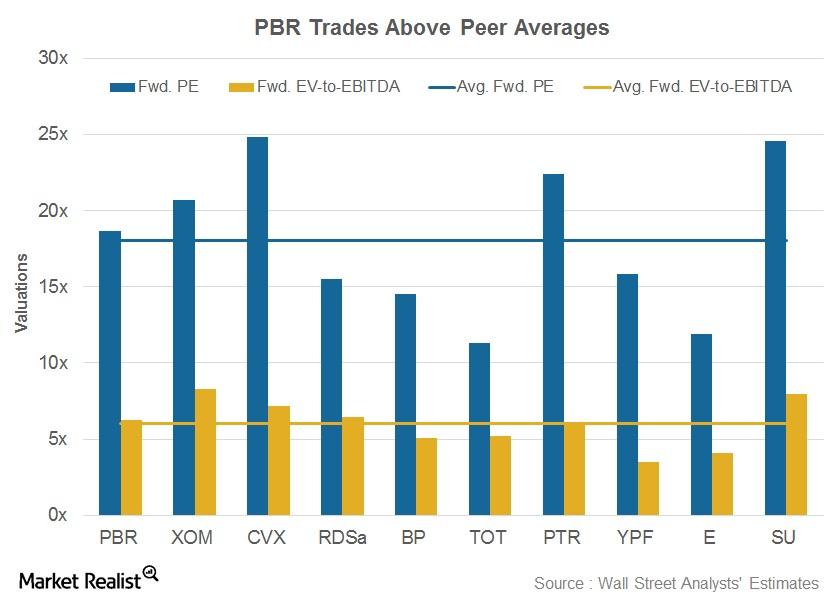

Why Is Petrobras’s Valuation Higher Than Peer Average?

After its production update news, Petrobas’s forward PE and EV-to-EBITDA stood at 18.7x and 6.3x, respectively.

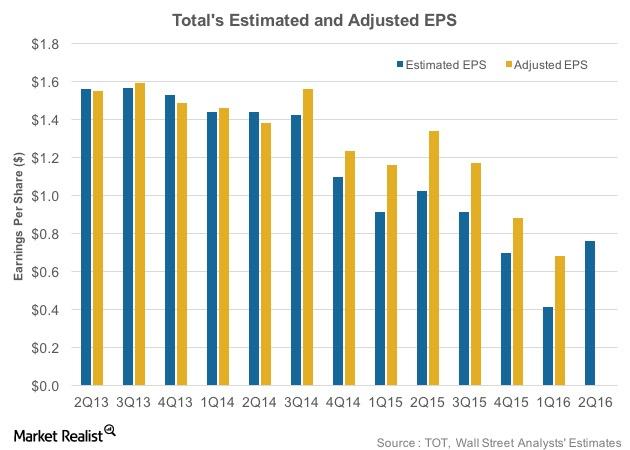

Total’s 2Q16 Earnings Outlook: Will It Beat Estimates?

Total SA (TOT) is expected to post its 2Q16 results on July 28, 2016. In 1Q16, TOT’s revenues of $27.5 billion surpassed Wall Street estimates.

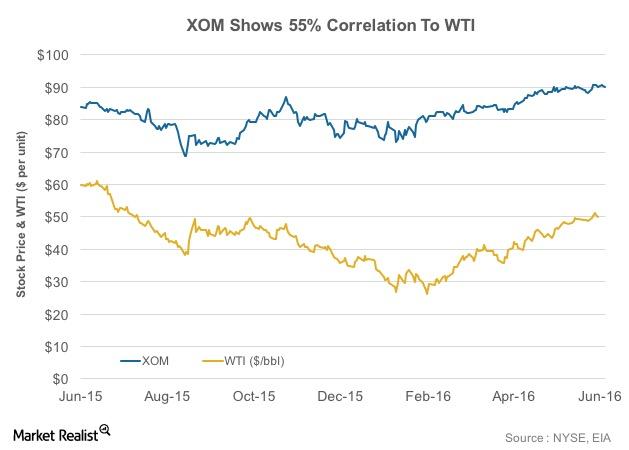

What’s the Correlation between XOM’s Stock and Crude Oil?

Integrated energy companies such as ExxonMobil (XOM) are affected by volatility in crude oil prices. To what degree? This varies from company to company.

A Forward Valuation Comparison of BP’s Competitors

BP’s market cap stands at ~$100 billion. Among the company’s peers, ExxonMobil (XOM) has the highest market cap of ~$371 billion.

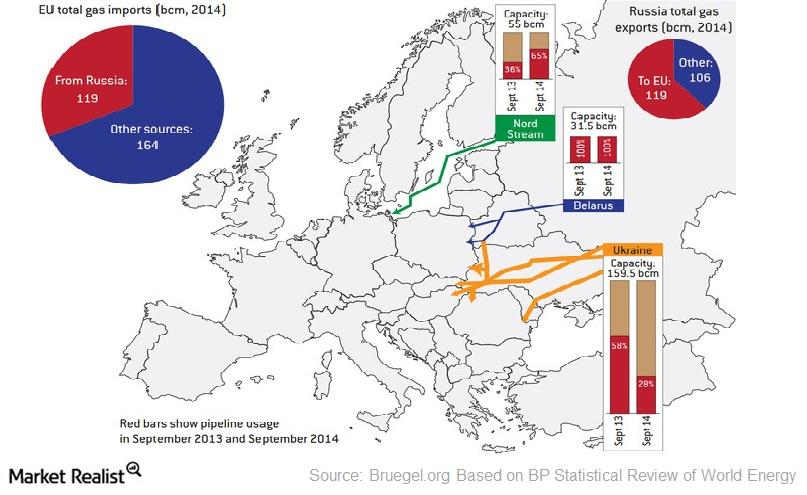

Russia’s Gas Pipeline Network in Europe

The European Union (FEZ) depends mostly on imports to meet its gas needs. Europe accounts for a significant portion of Russia’s gas exports.