DuPont de Nemours Inc

Latest DuPont de Nemours Inc News and Updates

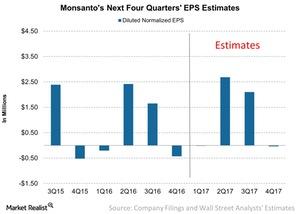

Can Monsanto Report Earnings Growth in Fiscal 1Q17?

For 2017, Wall Street analysts are estimating that Monsanto (MON) could report EPS of $4.70, which would translate into earnings growth of 5.3% year-over-year.

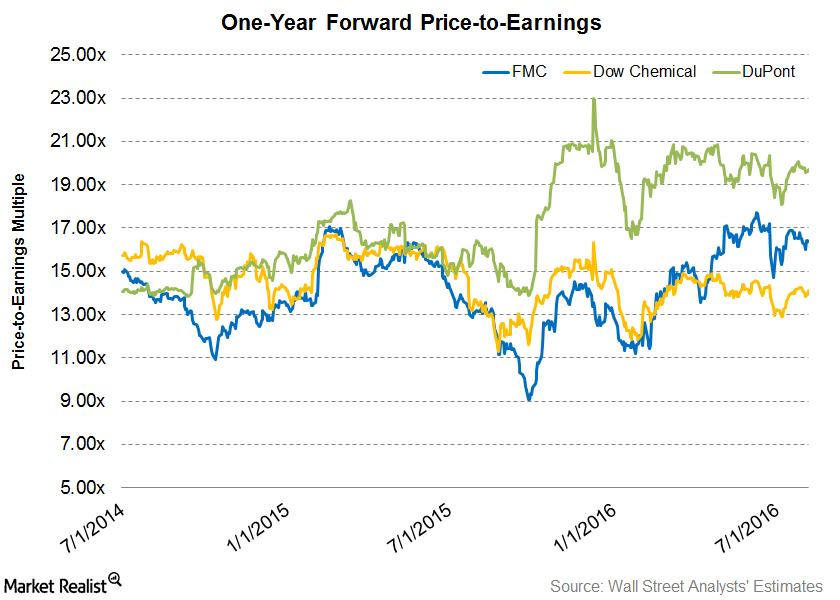

Where Do FMC’s Valuations Stand after Its 2Q16 Earnings?

Forward price-to-earnings (or PE) is a relative valuation method that considers a company’s future earnings for calculation.

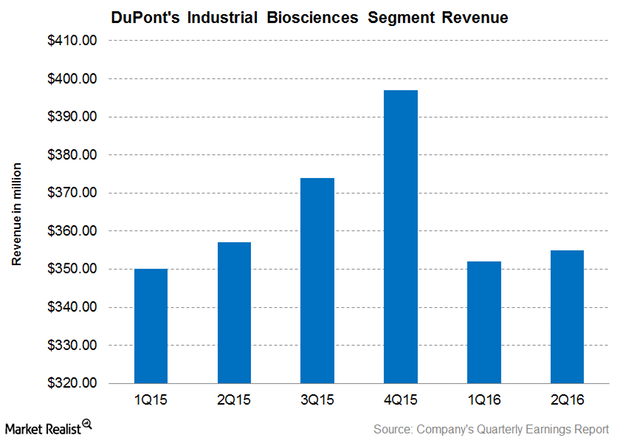

Why Did DuPont’s Industrial Biosciences Segment Revenue Fall in 2Q16?

For 2Q16, DuPont’s Industrial Biosciences segment reported revenues of $355 million, representing 5% of the company’s total revenue.

How the 15% Rule Became a Stepping Stone for 3M’s Innovation

3M company owes much of its innovative culture to William McKnight, who became the General Manager of the company in 1914.

Introducing 3M Company: A Jack of All Trades

Few companies have the kind of ubiquitous presence that 3M Company (MMM) likely does in your everyday life.

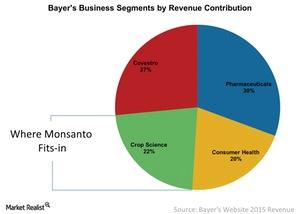

How Monsanto’s Business Fits into Bayer’s Portfolio

What’s in it for Bayer when it comes to acquiring Monsanto (MON)? The answer lies in Bayer’s business segments and geographic reach.

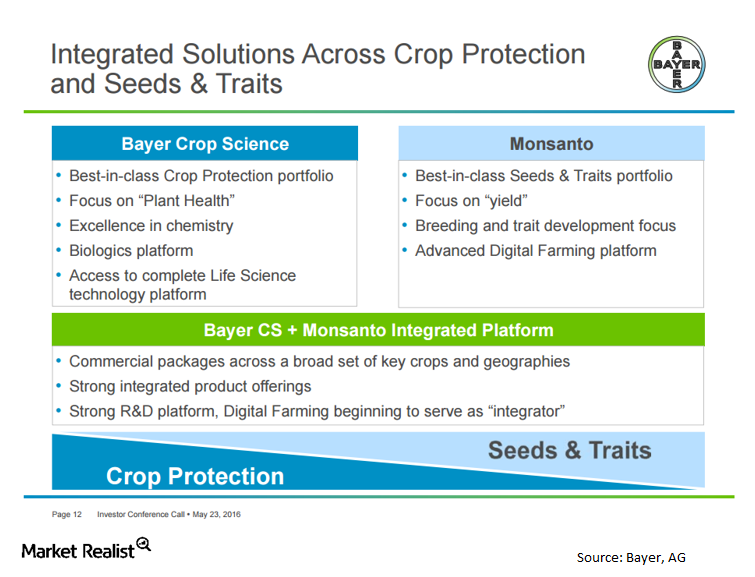

What’s the Rationale for the Bayer-Monsanto Deal?

In the Monsanto-Bayer deal, Bayer’s shareholders should expect to see mid-single-digit accretion to core EPS (earnings per share) in the first year and double-digit accretion thereafter.

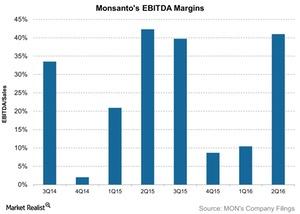

What’s Monsanto’s Outlook for the Next 12 Months?

For fiscal 2Q16, Monsanto reported EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.8 billion.

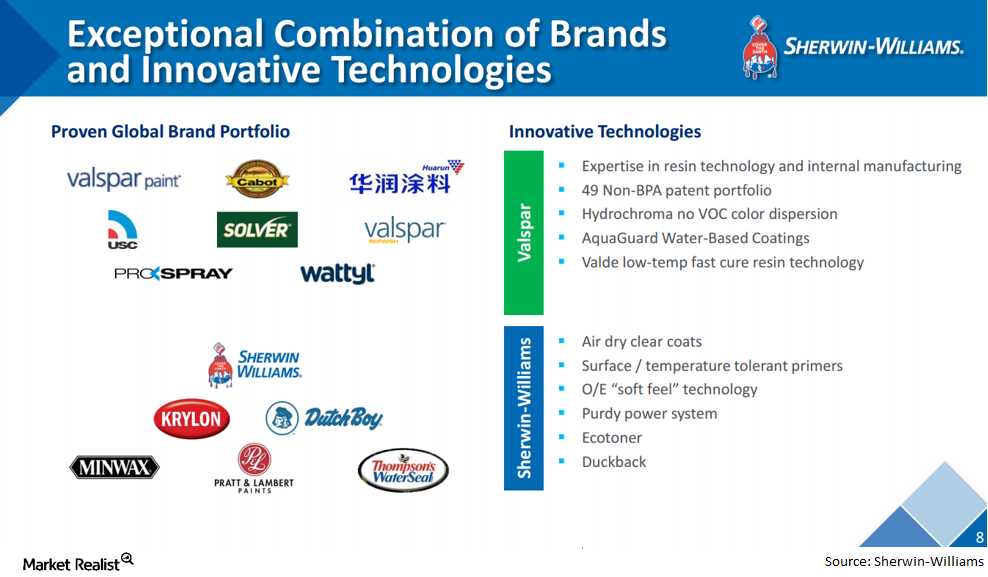

What’s the Rationale for the Valspar and Sherwin-Williams Merger?

Sherwin-Williams is buying coatings manufacturer Valspar in a $11.3 billion cash transaction. The companies stress that this is a complementary transaction.

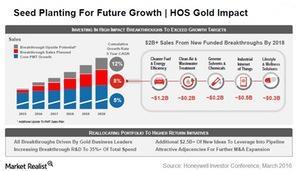

Honeywell PMT: Winning by Innovating

Environmental regulations in emerging markets such as China and India present a high-growth area for Honeywell and other companies with significant scale advantages to access.

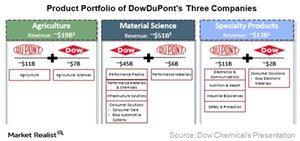

DowDuPont Will Spin Off into 3 Independent Public Companies

After the merger, DowDuPont will spin off into three independent and public companies—agriculture, material science, and specialty products.

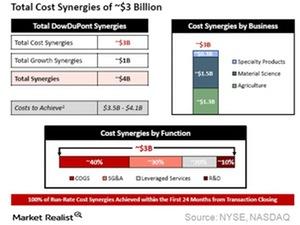

Will the Dow Chemical and DuPont Merger Have Operational Synergy?

With corporate changes, the combined company is expected to generate total cost savings of $3 billion over the next two years after the merger.

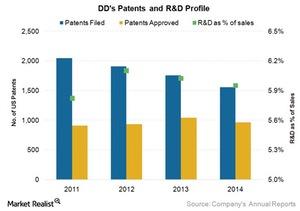

DuPont’s Research and Development Spending Compared to Its Peers’

DuPont is a technology and research and development driven company. It spent an average of 6% of its revenues on R&D activities during the 2011–2014 period.

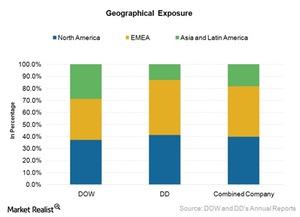

Will the Merger Have Geographical Synergy for the New Company?

After the merger, the merged entity is expected to have a better geographical presence than its individual global presence.

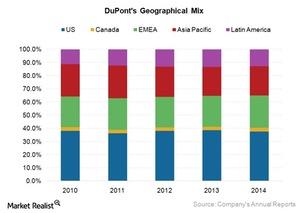

How Is DuPont’s Geographical Sales Exposure and Global Presence?

DuPont is a global company with operations in more than 90 countries. In 2014, the company’s North America region contributed 41% to its total revenue.

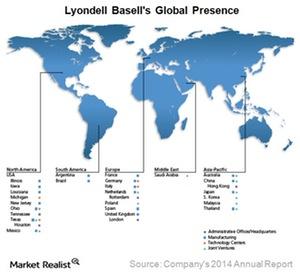

How Does LyondellBasell’s Geographical Exposure Compare to Peers?

LyondellBasell (LYB) has a presence throughout the world. However, the company generates around 50% of its revenue from the United States.

What Will Drive Dow Chemical’s Future Growth?

The Dow Chemical Company has significantly changed its business model to improve its earnings profile and returns to shareholders.