Cypress Semiconductor Corp

Latest Cypress Semiconductor Corp News and Updates

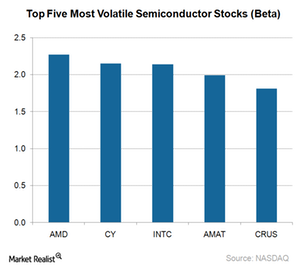

Why AMD and Intel Are in the Top 5 Most Volatile Semi Stocks

Short-term investors and traders are interested in highly volatile stocks as they look to profit from strong price movements through options trading.

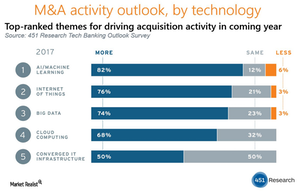

Which Semiconductor Companies Are Potential Acquisition Targets in 2018?

Analysts at Morgan Stanley and KeyBanc Capital Markets have listed Cypress Semiconductor (CY) as a potential acquisition target.

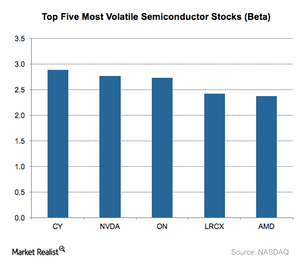

Inside the Top 5 Most Volatile Semiconductor Stocks

Intel (INTC) is the world’s largest semiconductor company and also the least volatile semiconductor stock, though it has a beta of 1.23.

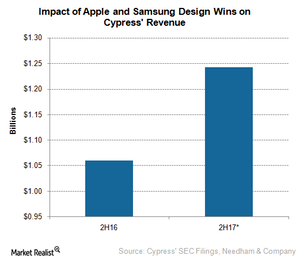

How Much Does Cypress Stand to Benefit from Apple’s and Samsung’s Latest Designs?

Cypress (CY) is rumored to be in the process of securing a smartphone design win for its USB type-C port from Apple (AAPL) and Samsung (SSNLF).

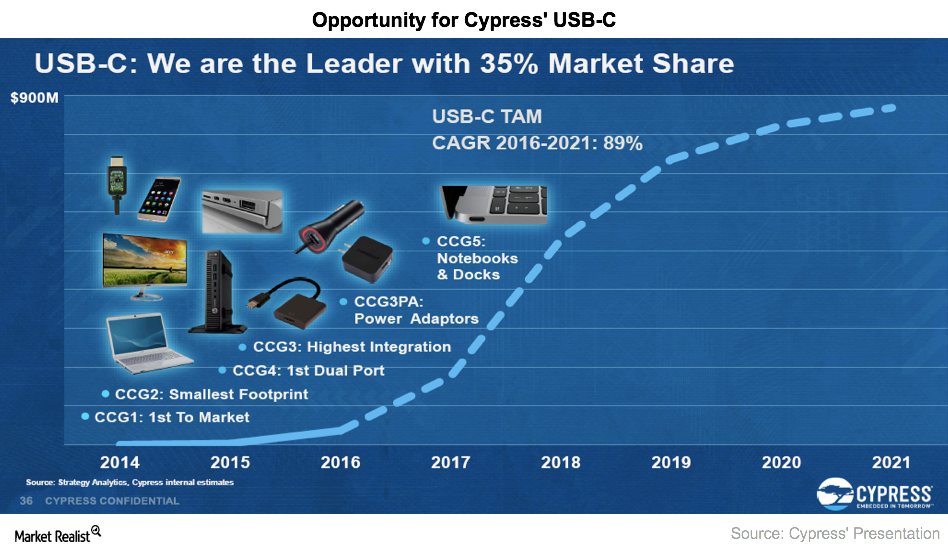

This Is Making Cypress a Market Leader in USB-C

Cypress (CY) is aiming to gain more market share in the USB space with its new USB-C port, a common connector for all electronics devices.

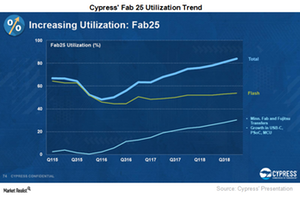

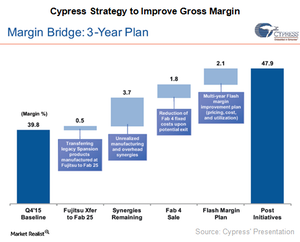

Cypress Semiconductor’s Strategy to Improve Gross Margin

Cypress Semiconductor (CY) aims to increase its gross margin from 40.0% currently to 43.0% by fiscal 4Q17 and 47.9% by fiscal 4Q18.

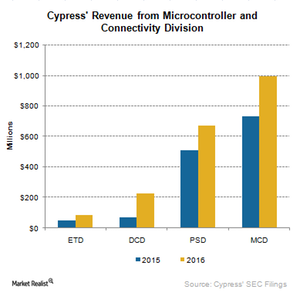

Why Cypress Semiconductor Restructured Its Business Segments

Cypress has combined its four business segments into two: MCD (Microcontroller and Connectivity Division) and MPD (Memory Products Division).

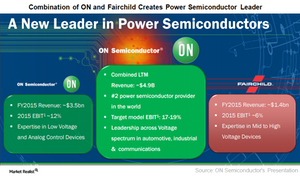

Synergies from the ON–Fairchild Semiconductor Merger

ON Semiconductor (ON) expects the Fairchild Semiconductor merger to bring in annual cost synergies of $225 million by 2019 compared with just $160 million in 2017.

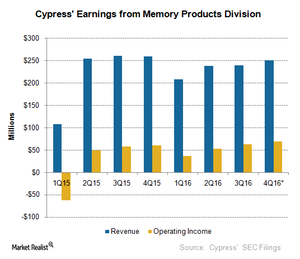

Cypress Depends on Memory Business to Improve Profits

Cypress Semiconductor (CY) is becoming a complete embedded solutions provider.

Inside Cypress’s Strategy to Improve Its Gross Margin

Cypress reported strong revenues on the integration of Broadcom’s wireless IoT business, which improved its gross margin until the Spansion merger in 1Q15.

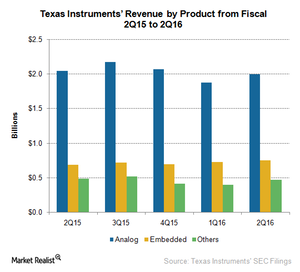

Which Segment Is Most Profitable for Texas Instruments?

Texas Instruments’ Analog segment contributes 62% to the company’s total revenue and is made up of high volume analog and other products.

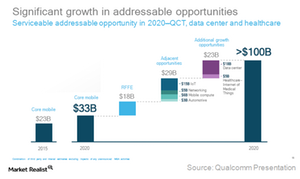

Which Industrial and Macroeconomic Factors Are Influencing Qualcomm’s Growth?

Qualcomm expects its core mobile chip business to grow at a CAGR (compounded annual growth rate) of around 8%–9% between 2015 and 2020.