Centene Corp

Latest Centene Corp News and Updates

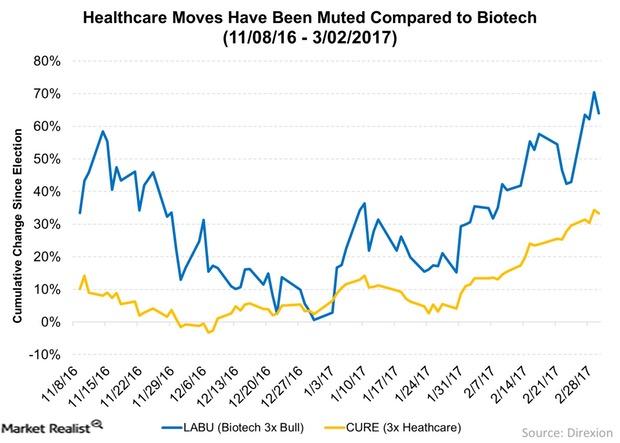

Healthcare Moves Have Been Muted, but Could We Get a Surprise?

Rising interest rates don’t negatively affect healthcare as much as some other industries. But it has still underperformed since the US elections.

Centene Saw Robust Rise in Medicaid Enrollments in 1Q17

In 1Q17, around 12.1 million members were enrolled in Centene’s (CNC) various healthcare plans, which is a year-over-year (or YoY) rise of around 600,000 beneficiaries.

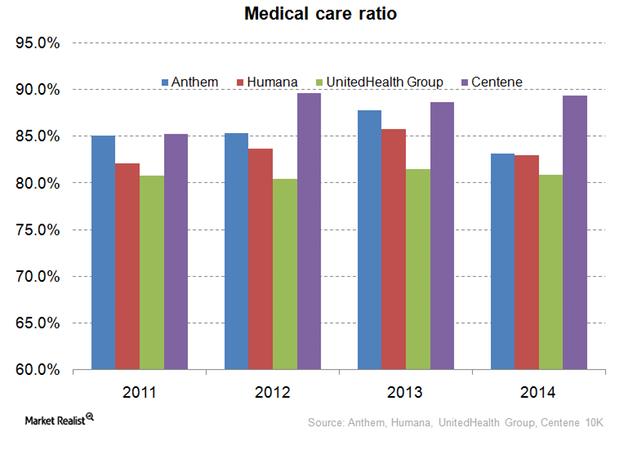

Medical Care Ratio – Centene Compared to Its Peers

For health insurance companies, the medical care ratio is the ratio of total money spent on healthcare claims to premiums earned—adjusted for tax and regulatory expenses.

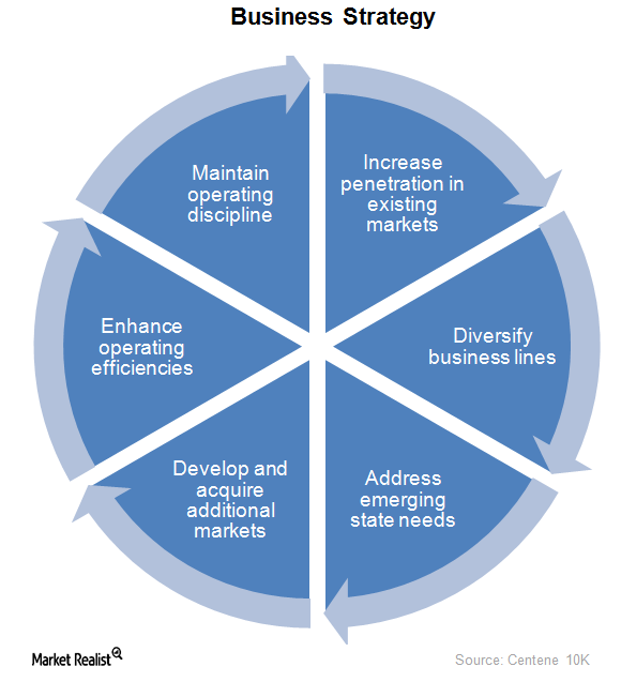

What’s Centene’s Business Strategy?

Centene’s business strategy focuses on improving the quality of its services. It provides services to the uninsured and underinsured population in 22 states in the US.

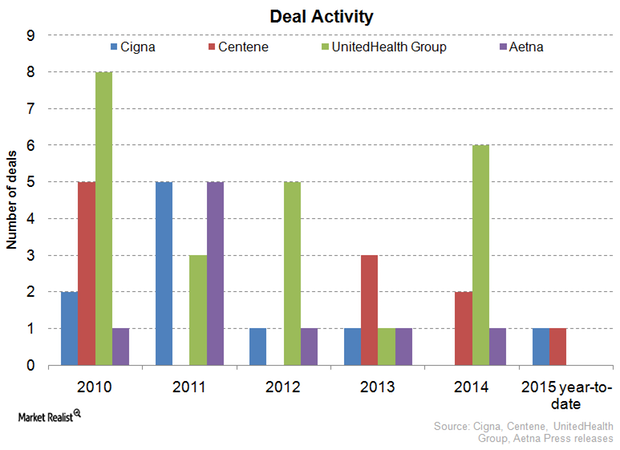

Cigna Diversifies Via Mergers and Acquisitions

Among Cigna’s major strategic mergers and acquisitions was HealthSpring, acquired in 2012 for a consideration of $3.8 billion.

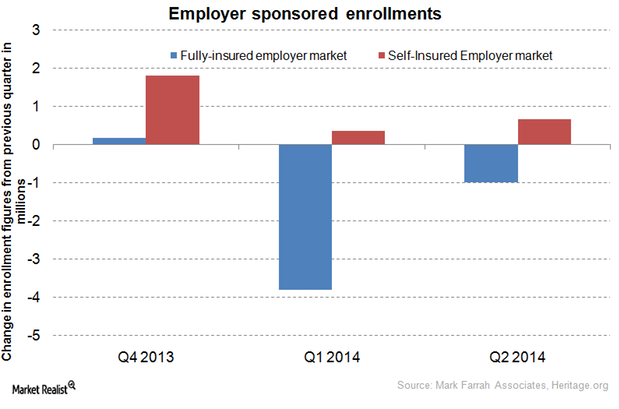

Shift to self-insurance plans affects health insurance stocks

As hospital utilization remains low, more employers are exploring the option of self-insurance to reduce their employee benefit costs.