ARM Holdings PLC

Latest ARM Holdings PLC News and Updates

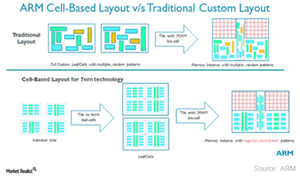

Xilinx Prepares Gears up with ARM’s IP

Xilinx (XLNX) is moving ahead of Intel (INTC), not only in FPGA (field programmable gate array) adoption but also in technology node.

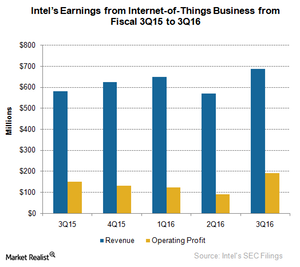

How Is Intel Placed among Competitors in the IoT Space?

Intel’s IoT group revenues grew 19% year-over-year to $689 million in fiscal 3Q16, driven by strong demand from retail, video, and transportation.

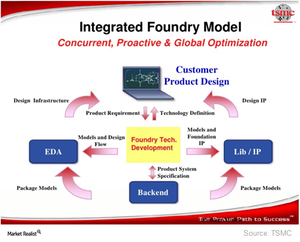

What Is Intel’s Strategy behind Its Foundry Model?

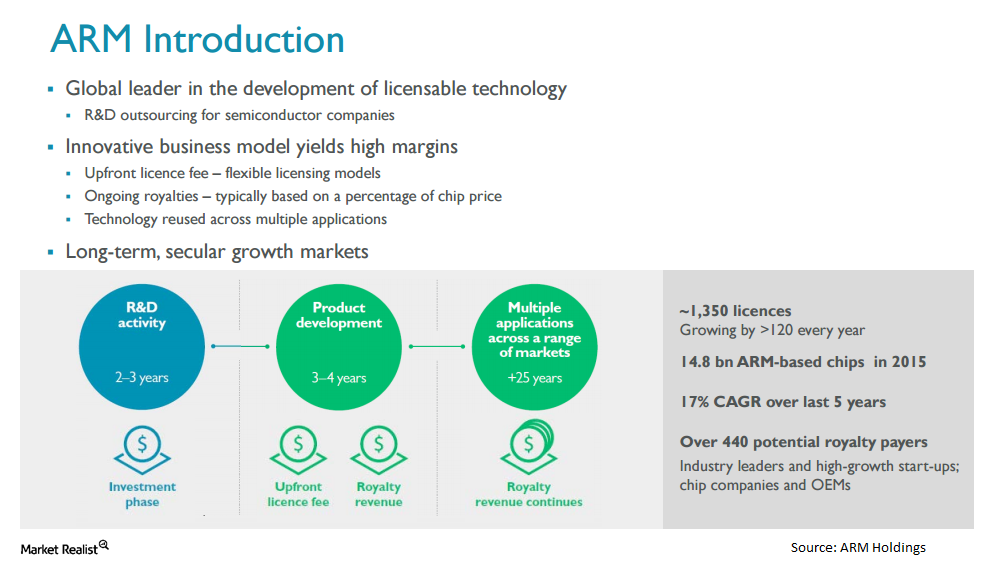

In fiscal 3Q16, Intel (INTC) partnered with ARM Holdings (ARMH) to provide foundry services for ARM-based chips. Intel announced another foundry partnership with Spreadtrum, but it did not identify the products that would be manufactured.

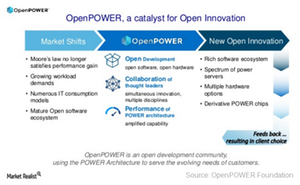

How Will IBM Compete with Intel in the Data Center Space?

In 2013, IBM decided to make its technology available to third parties and launched the OpenPower Foundation.

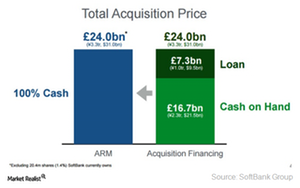

Inside the Key Financials Involved in the SoftBank-ARM Deal

In the biggest YTD semiconductor acquisition of 2016, SoftBank has offered to acquire UK-based designer ARM for a cash consideration of $32 billion.

What Are the Conditions for the ARM Holdings-Softbank Merger?

ARM Holdings and Softbank are merging in a cash transaction. In an unusual step, there aren’t regulatory or antitrust conditions to the transaction.

Which Industrial and Macroeconomic Factors Are Influencing Qualcomm’s Growth?

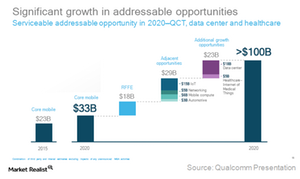

Qualcomm expects its core mobile chip business to grow at a CAGR (compounded annual growth rate) of around 8%–9% between 2015 and 2020.

Intel and the History of the Semiconductor Industry

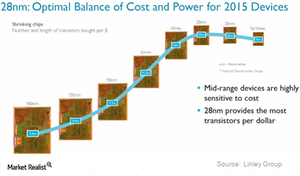

Since 2014 when a slowdown in PC shipments hit its revenue, Intel has shifted its focus toward chips for smartphones and tablets.

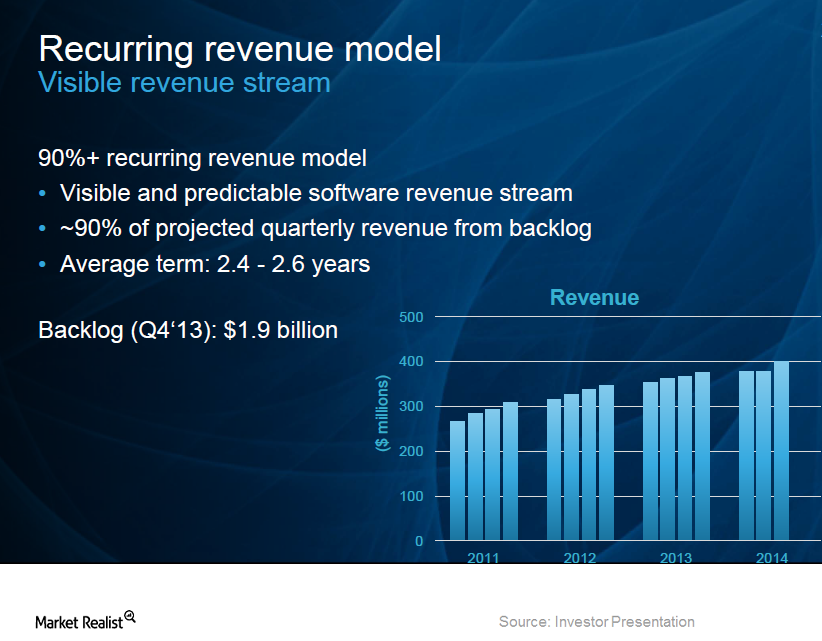

How Cadence generates a steady revenue stream

Aggressive acquisitions and a focus on systems enabled Cadence to grow its revenues at a faster pace than its competition in the last five years.Earnings Report The main challenges facing Texas instruments

Consumer demand for the latest features and applications is huge. Endless technological innovation addresses that demand to a point, but has led to consistently shorter product life cycles.