Aluminum Corporation Of China Limited.

Latest Aluminum Corporation Of China Limited. News and Updates

Magnesium Metal Stocks to Consider During China's Magnesium Shortage

Another bottleneck has formed, this time in China's magnesium supply. What magnesium stocks should investors watch?

China’s Supply-Side Reforms Could Impact Aluminum in 2018

Alcoa (AA) expects global aluminum demand to exceed supply in 2018 on China’s supply-side reforms.

Should Alcoa Bears Like Their Chances in 2017?

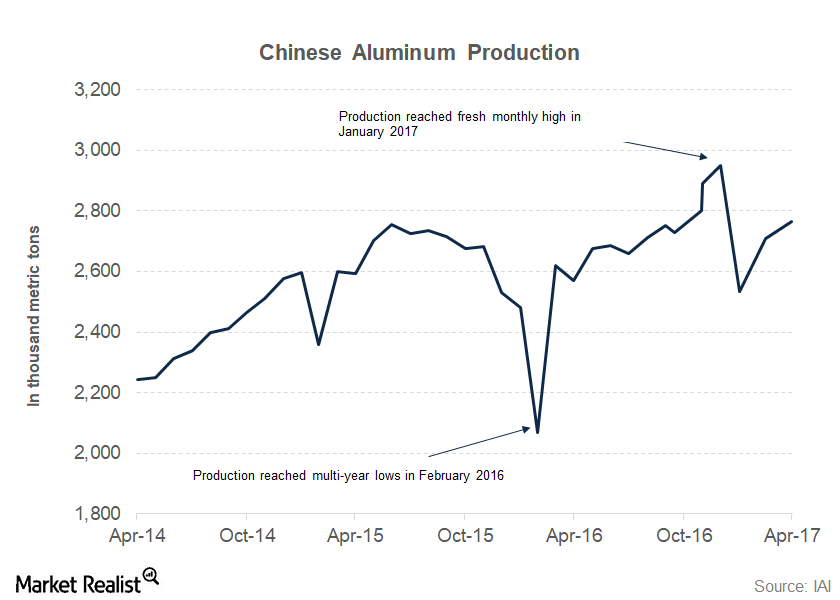

Higher Chinese aluminum production could spoil the party that companies such as Alcoa and Century Aluminum (CENX) are currently enjoying.

Alcoa Continues Its Rally as China Keeps Its Commitment

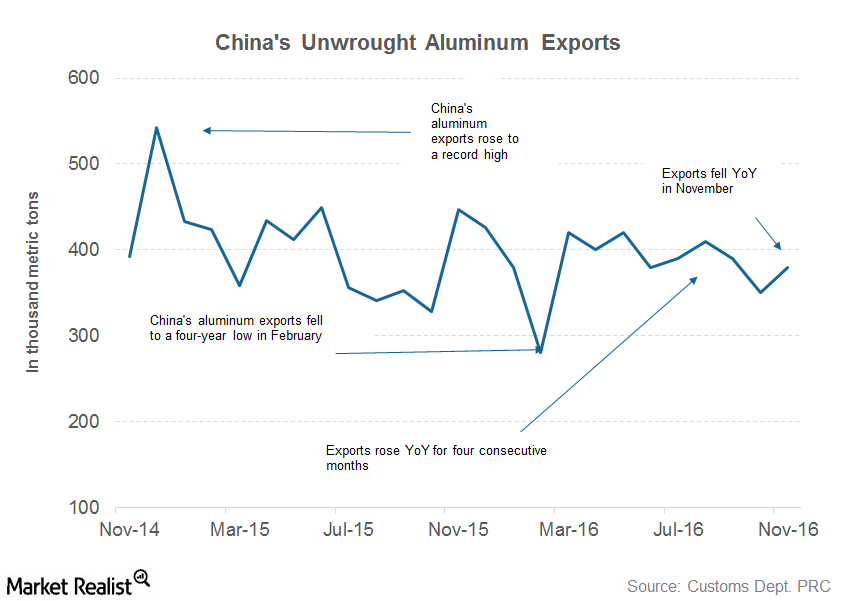

China exported 370,000 metric tons of unwrought aluminum in September, compared to 410,000 metric tons in August.

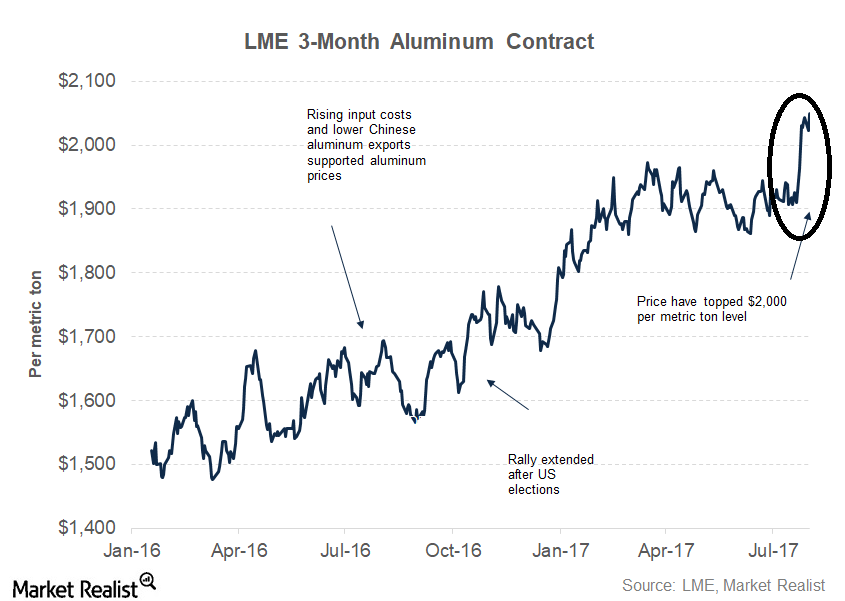

Aluminum Prices Defy Gravity and Maintain the $2,000 Level

Aluminum prices have gained more than 22% so far in 2017. This trend was preceded by a 13.6% rise in 2016.

Analyzing China’s Aluminum Production Data

China produced ~2.76 million metric tons of aluminum in April—a YoY increase of 7.6%. Its production has risen 12.0% YoY in the first four months of 2017.

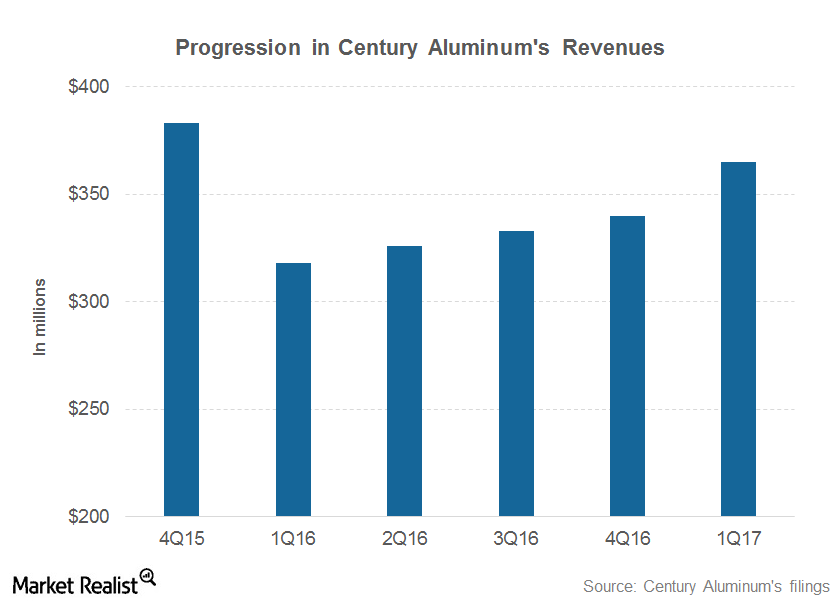

What Investors Should Know about Century Aluminum’s 1Q17 Results

Century Aluminum (CENX) was among the best-performing aluminum stocks (NHYDY) (ACH) (SOUHY) last year with gains of 94%.

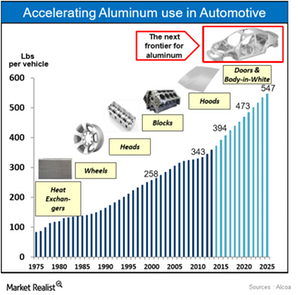

The Auto Industry’s Aluminum Usage Is Increasing

The usage of aluminum in automobiles has been gradually increasing, as it improves vehicle performance, reduces CO2 emissions, and boosts fuel economy.