AmerisourceBergen Corp

Latest AmerisourceBergen Corp News and Updates

AmerisourceBergen and Walgreens Sign 'Deal of a Lifetime'

AmerisourceBergen is acquiring a hefty portion of Walgreens. Is the stock a buy or sell for investors in 2021? How will the deal with Walgreens help the company?

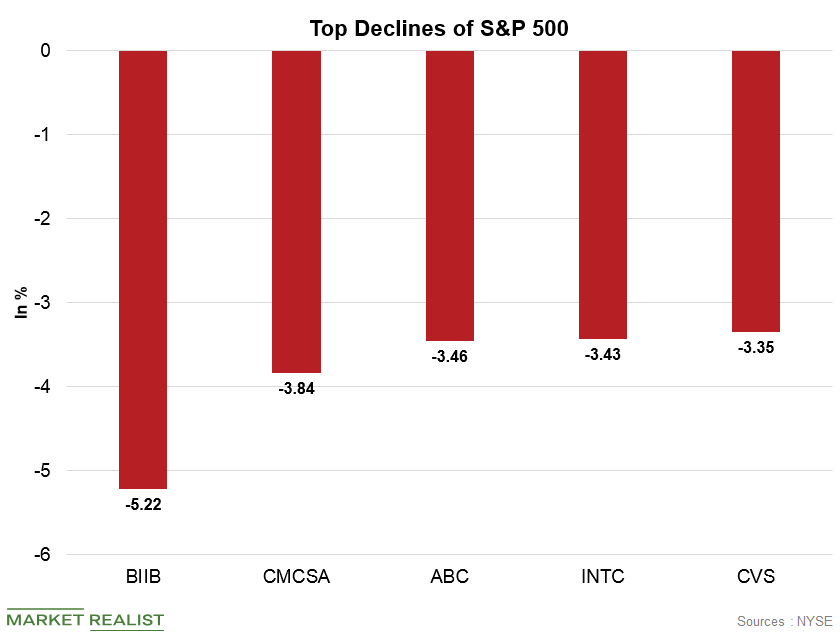

S&P 500’s Top Losses: Why Biogen Declined

Biogen, which is an American multinational biotechnology company, was the S&P 500’s top loss on June 18.

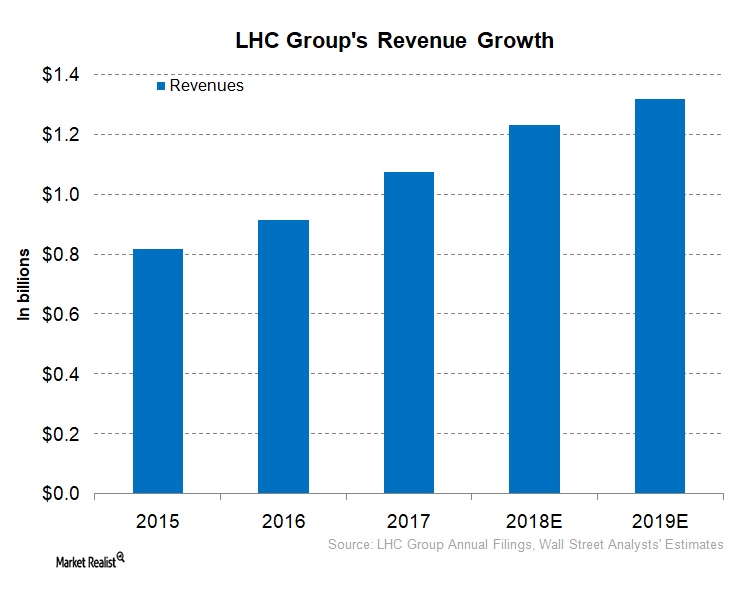

What’s LHC Group’s Business Strategy?

In 2018, LHC Group is expected to report revenue of $1.2 billion. What about its peers?

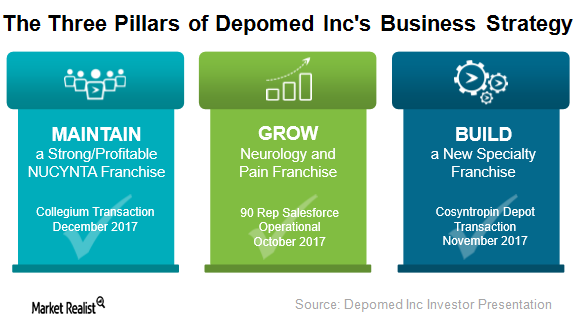

Behind Depomed’s Business Strategy

Depomed (DEPO) has adopted a three-pronged business strategy with three key elements: maintain, build, and grow.

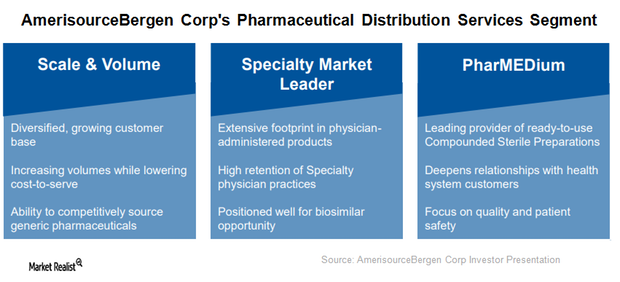

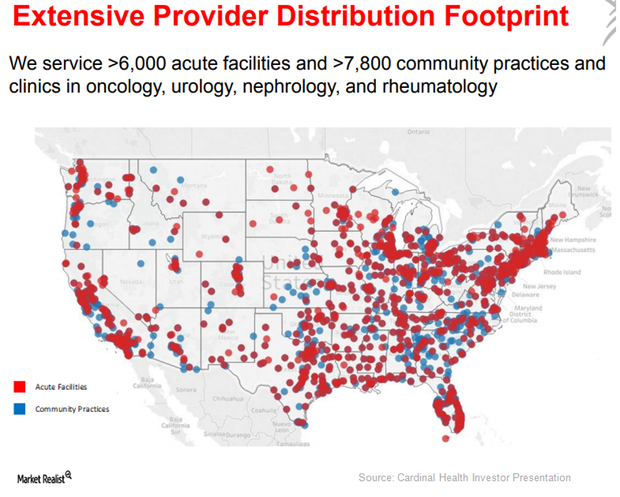

AmerisourceBergen’s Business Segments

AmerisourceBergen’s (ABC) operations are organized based on the products and services it provides to customers.

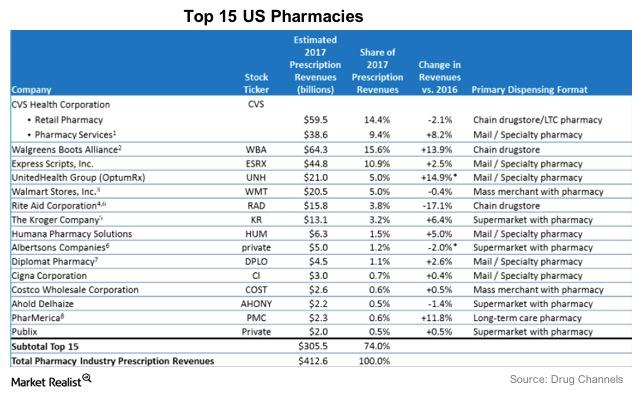

How the Drug Store Industry Is Changing

The top three drugstore chains in the US are in the process of forming new associations through mergers and acquisitions to create a more diversified portfolio and protect themselves from the growing online threat.

Robust Growth Expected for Cardinal Health’s Specialty Solutions

Cardinal Health’s (CAH) Specialty Solutions segment provides two types of services: upstream to pharmaceutical and biopharmaceutical manufacturers and downstream to healthcare providers.

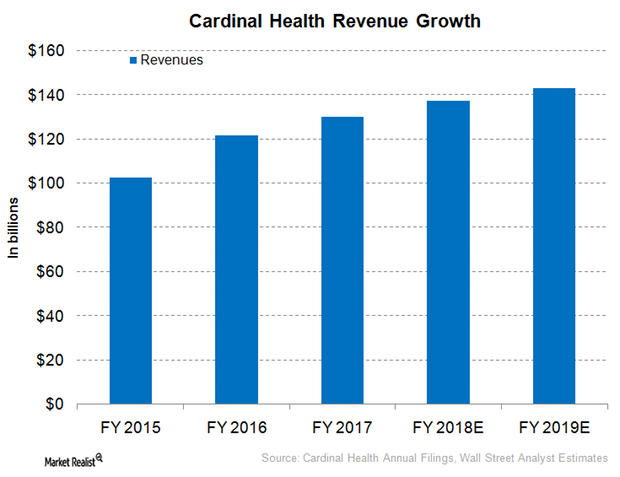

Cardinal Health Expected to Report Modest Revenue Growth

For fiscal 2018, Cardinal Health (CAH) has projected mid-single-digit revenue growth on a YoY basis, partially driven by the company’s high customer retention rates.

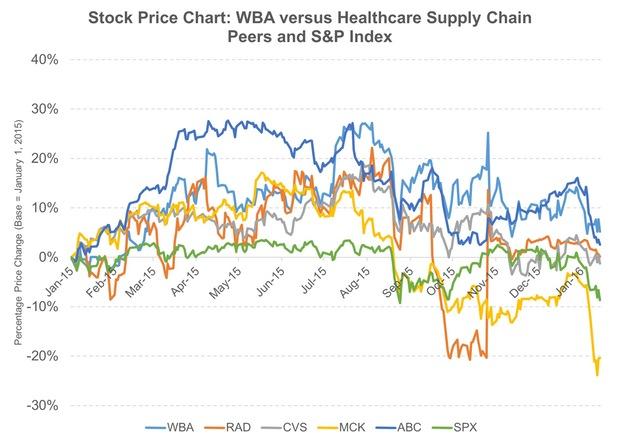

An Analysis of Walgreens Boots Alliance’s Stock Returns

Walgreen Boots Alliance’s (WBA) common stock trades on the NASDAQ under the symbol “WBA.”

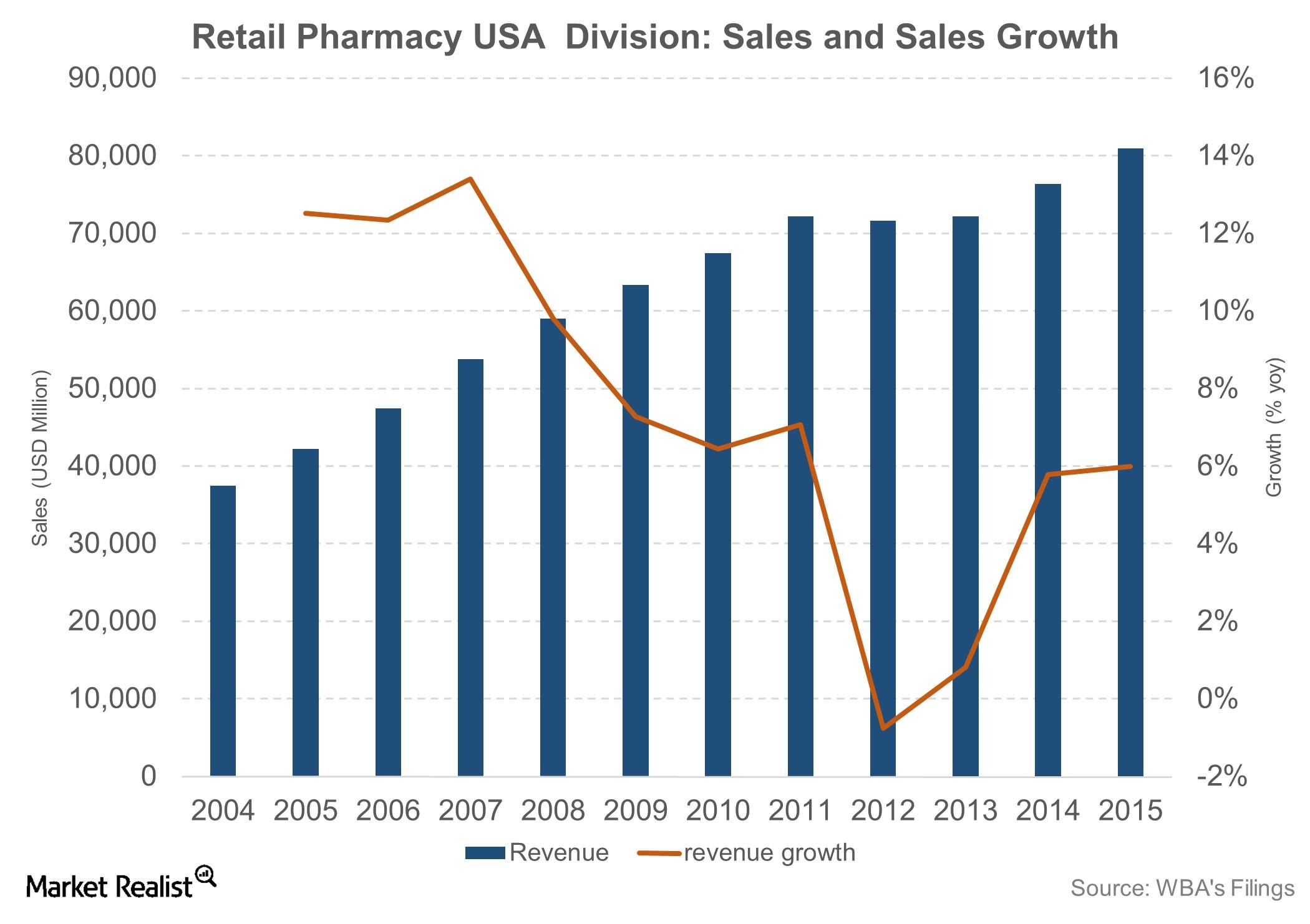

A Look at Walgreens Boots Alliance’s Retail Pharmacy USA Division

The Retail Pharmacy USA division is Walgreens Boots Alliance’s (WBA) largest revenue generator.

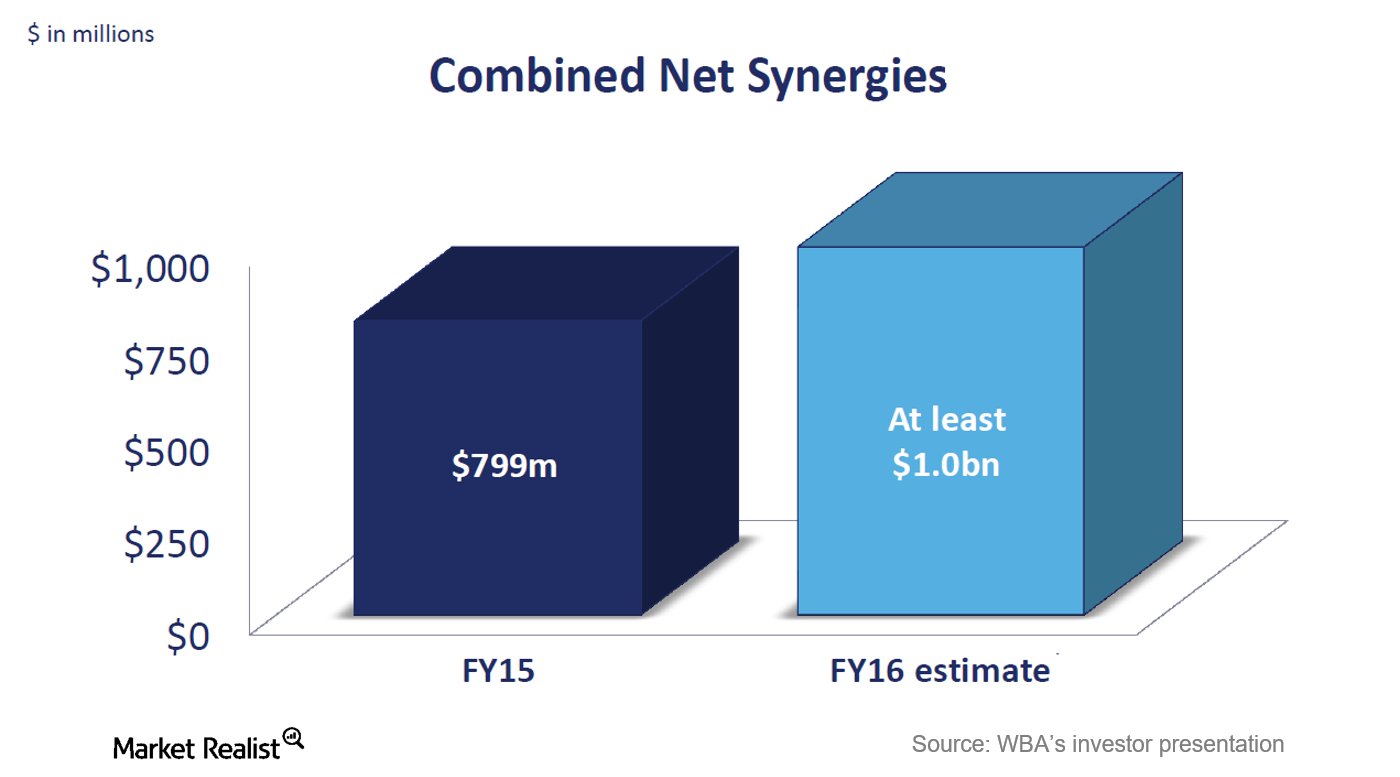

Walgreens Boots Alliance: Merger of Walgreens and Alliance Boots

Walgreens became a wholly owned subsidiary of Walgreens Boots Alliance after a merger.