Will China Target NIO and Xpeng (XPEV) Stock After DIDI and BABA?

China is clamping down on its tech giants like DiDi and Alibaba (BABA). Will it also target its EV companies like NIO and Xpeng (XPEV)?

July 8 2021, Published 9:38 a.m. ET

China is clamping down on its tech giants and DiDi Global (DIDI) and Alibaba (BABA) have especially borne the brunt. EV (electric vehicle) companies also fancy themselves as “tech companies.” Will China also clamp down on its EV companies like NIO and Xpeng like the other tech giants?

China decided to block new downloads for the DiDi app in China just days after it went public. The move has rightly infuriated investors and even U.S. lawmakers seem irked. Republican Sen. Marco Rubio called Didi an “unaccountable Chinese company.” There's bipartisan support against China. More oversight of Chinese companies among U.S. lawmakers and events like Didi only make things worse.

Why did China go after BABA?

After China’s crackdown on the tech giants, many investors wonder whether the country will target EV companies next. NIO and XPEV are among the most popular Chinese EV companies listed on U.S. exchanges. Previously, China cracked down on domestic EV companies but it was done with the intent to eliminate small zombie companies and push towards fewer but bigger manufacturers.

First, it's important to understand the intent behind the recent crackdown on BABA and DIDI. Alibaba’s case stands out since the company got on Chinese authorities' radar after its founder Jack Ma made critical comments about regulators. China’s antitrust probe against tech companies looked “Alibaba-focused” from the very beginning.

Why China cracked down on DIDI

As for DiDi, China is worried about the massive amount of Chinese citizens' data that it possesses. China is concerned that the data might get shared with a foreign government considering the company’s U.S. listing.

To maintain authority, the Chinese government imposed strict data policies. The massive data that companies like DiDi and Alibaba process seem to be making authorities apprehensive.

Will China target EV companies like NIO and Xpeng next?

Coming back to EV companies like NIO and Xpeng, it looks highly unlikely that China will target them since the country has gone after companies like BABA and DIDI. First, China sees EVs as a strategic industry under its “Make in China 2025” program. Arms of Chinese governments have invested in both NIO and XPEV, which highlights their strategic importance for the country.

Second, NIO gets its cars made at JAC Motors, which is an SOE (state-owned enterprise). Targeting NIO would target a large SOE. China has given NIO special privileges. The country’s EV subsidiary policy has a special category for companies with battery swapping, which has been created to make NIO for the EV subsidy.

Finally, EV companies like NIO and Xpeng don’t have the kind of customer data that the other tech companies have. This makes it highly unlikely that China will go after EV companies. However, it doesn't mean that Chinese EV companies don’t face geopolitical risks.

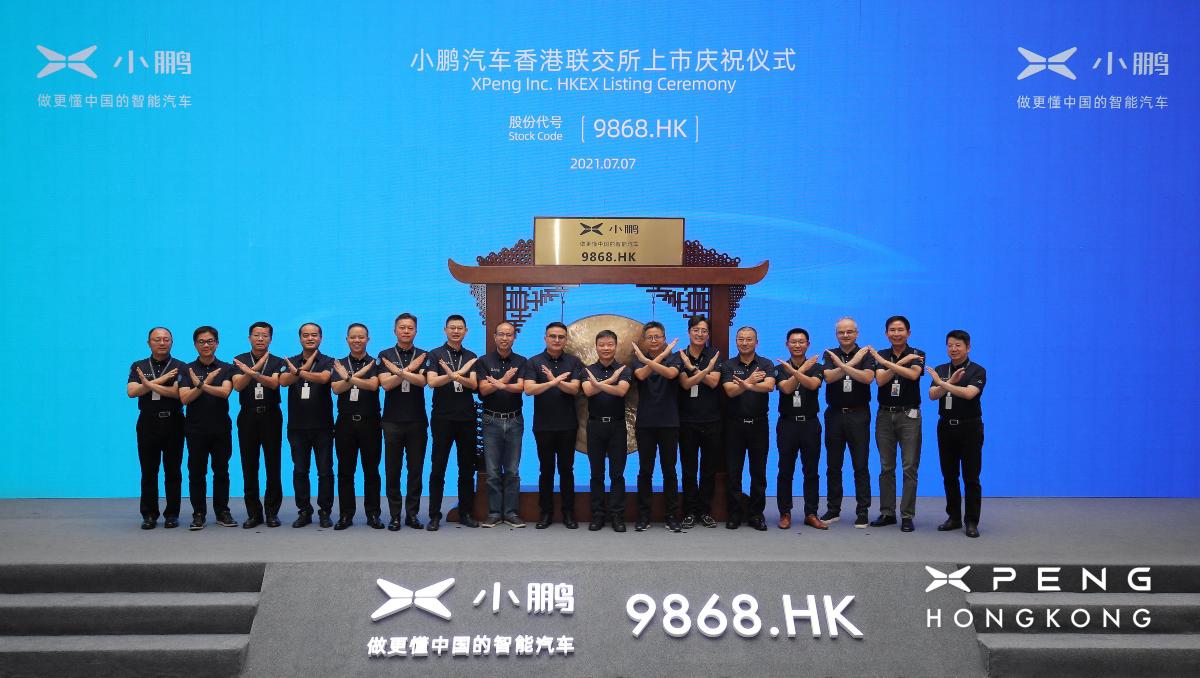

Xpeng went for a dual primary listing in Hong Kong

So far, Xpeng has raised $1.8 billion through a dual primary listing in Hong Kong. Several Chinese companies including BABA have opted for a dual listing. XPEV didn't mince any words and said that geopolitical tensions between the U.S. and China are among the key reasons for the Hong Kong listing.

Will NIO stock also list in Hong Kong?

It wouldn't be surprising if NIO also follows XPeng and lists in Hong Kong. Unlike Xpeng, which wasn't eligible for a secondary listing and instead went for a dual listing, NIO could even opt for a secondary listing in Hong Kong. There could be increased scrutiny of Chinese companies listed in the U.S. after the DiDi crackdown, which could push more Chinese companies for a dual listing in Hong Kong.

While China might not crack down on companies like NIO and XPEV, the risk premium of investing in Chinese companies has increased after the DiDi ban in China. It has always been risky to invest in foreign companies and the recent events in China only exemplify the fact.