SNDL Is Crashing, No Redditors or Robinhoods to the Rescue

SNDL stock is in a free fall and is down 78 percent from the highs. Why is Sundial Growers stock dropping and will it recover in 2021?

April 19 2021, Published 8:58 a.m. ET

Sundial Growers (SNDL), which was once the poster child of the short squeeze-driven rally led by the Reddit group WallStreetBets has been in a freefall. The stock is trading down in pre-market trading on April 19. SNDL stock is down over 78 percent from its 52-week highs. Why is SNDL stock dropping and will the marijuana company recover in 2021?

Despite falling sharply from its peaks, SNDL stock is still up over 78 percent YTD. While it's a penny stock based on the stock price, its market capitalization is around $2 billion.

Why SNDL stock is dropping

SNDL stock is dropping for four main reasons. First, all of the marijuana stocks have come off their 2021 highs. The sector-wide sell-off is also weighing on SNDL stock. Second, there has been a sell-off in speculative growth names. Investors have found solace in beaten-down value stocks amid the rise in bond yields.

SNDL stock has dropped below 50-day simple moving average

Third, the rally in SNDL stock was always speculative due to the pumping from WallStreetBets. Most of the stocks pumped by WallStreetBets are down sharply from their highs as sanity has returned after the irrational exuberance. Investors now seem to be looking at fundamentals rather than momentum and speculation.

Finally, while SNDL did a good job of selling stocks at inflated prices, it went a bit too far, which has led to its outstanding share count rising multifold to 1.66 billion its March presentation revealed.

While the company used the cash to repay debt and had $719 million as cash, it made some strange decisions like lending to a fellow marijuana company Zenabis Global. It also extended a term loan to Indiva Limited, which is another Canadian marijuana company.

Sundial Growers has turned into a lender for last resort for marijuana companies.

While Sundial Growers lent the money to Zenabis at 14 percent, which looks juicy, the company isn't in the business of lending and that wasn't the reason it has been selling shares in a frenzy. However, SNDL isn't the only company grappling with too much cash. Even Tesla turned net debt negative in 2020 after the $13 billion share issuance and eventually ended up investing $1.5 billion of that cash in bitcoins in the first quarter of 2021.

Incidentally, in its annual report, Sundial Growers said that it risks being classified as an “investment company” under the Investment Company Act of 1940. It also listed not been able to recover the lent money as a risk for the business. The companies that SNDL is lending to are financially weak.

Sundial Growers' sales fell in 2020.

Looking at SNDL’s 2020 earnings, there are several intriguing aspects. First, the company’s revenues fell almost 4 percent in the year, which looks surprising given the strong top-line growth other marijuana companies are reporting.

Second, it reported 45.9 Canadian dollars as obsolete inventory in 2020, which is a sign that it has been producing far more than it can sell. The company also had to discontinue some of its products.

Interestingly, while the revenues fell 4 percent, the sales and distribution expenses fell over 28 percent in 2020. The R&D expenses fell almost 80 percent between 2019 and 2020, which is a sign that the company is investing less in R&D.

Overall, the company's financials look weak and things aren't expected to get much better anytime soon. The analysts polled by TIKR expect Sundial Growers’ revenues to rise 14.5 percent and 33.3 percent, respectively, in 2021 and 2022. The company is expected to post an EBITDA loss in 2021 and 2022.

Sundial Growers stock looks overvalued.

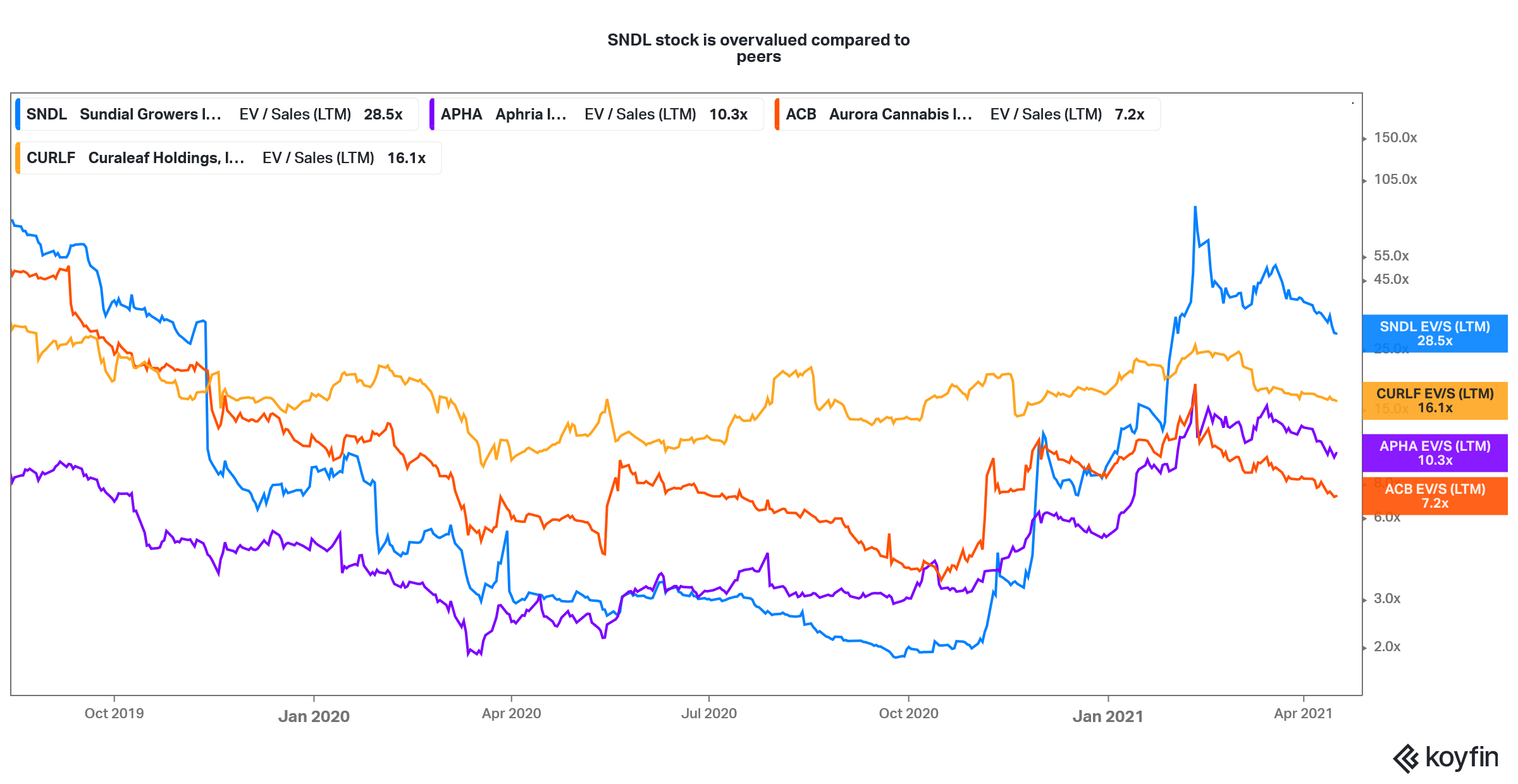

The expected growth looks low, especially considering the company’s bloated valuations. Sundial Growers trades at a 2021 price-to-sales multiple of over 33x, which is much higher than most of the other marijuana companies.

Thanks to the capital raise and the massive cash sitting on Sundial Growers’ balance sheet, its EV (enterprise value) would be around $1.13 billion and we get a still moderate 2021 EV-sales multiple of 20.5x. However, even this multiple is above what most other marijuana stocks trade at.

SNDL stock looks overvalued compared to other cannabis companies

Will SNDL stock recover?

Looking at the bloated valuations and poor financials, I don’t expect SNDL stock to recover anytime soon in 2021. If anything, the rise in the stock can be used to exit your positions, especially if you got stuck at higher levels in this penny marijuana company.

The rally driven by Robinhood traders and Reddit groups has lived its course and SNDL might continue to fall in the absence of pumping.