Naked Brand Group (NAKD) Stock Is a Risky Bet for Investors

Naked Brand Group stock is down 85 percent from its 52-week high. Why is NAKD stock dropping and is it a good stock to buy now?

April 16 2021, Published 2:08 p.m. ET

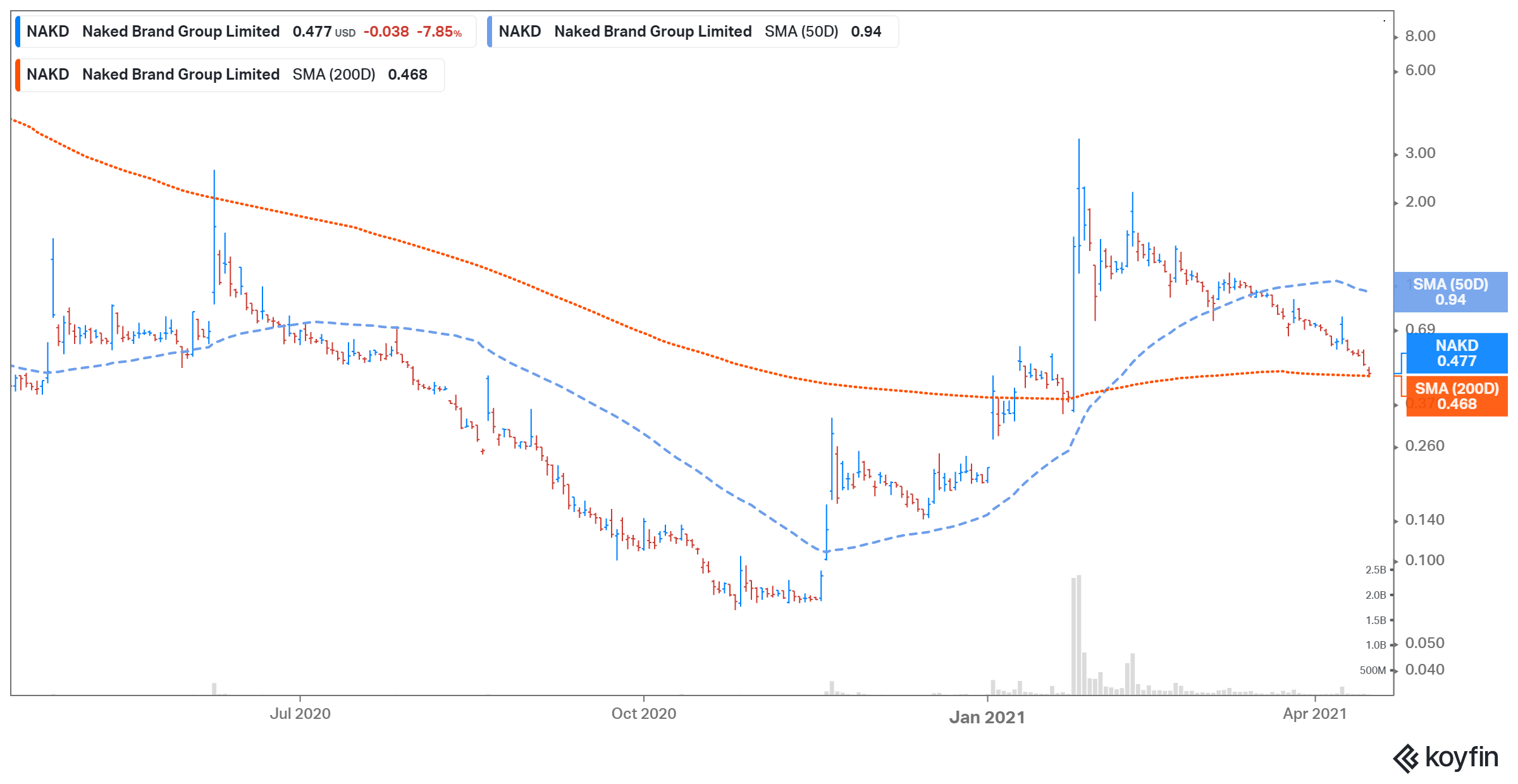

Naked Brand Group (NAKD) stock has been very volatile in 2021. The stock rose to a high of $3.40, but it has looked weak since then. The stock is down 85 percent from its 52-week high. What’s the forecast for NAKD stock in 2021? Is it a good stock to buy now or will it fall more?

Naked Brand is an intimate, apparel, and swimwear company. The company designs, manufactures, and markets a range of its own and licensed products. The products are distributed through specialty stores, department stores, independent boutiques, and third-party e-commerce.

NAKD stock is dropping

On April 16 as of 10:21 a.m. ET, NAKD stock is down 6 percent at $0.48. The stock is off more than 85 percent from its 52-week peak. The stock has fallen for the last six days and is down 44 percent over the last month.

NAKD stock is dropping despite no company-specific news or analyst downgrades. The significant fall in the stock could be because the Reddit-driven short squeeze is losing steam. A WallStreetBets-fueled short squeeze boosted NAKD significantly at the end of January 2021, which pushed it to a 52-week high of $3.40 per share. After more wild fluctuations, it's currently trading near $0.50, but is still up 168 percent YTD and has a market capitalization of $330 million.

According to Koyfin, NAKD’s short interest as a percentage of outstanding shares was 8.3 percent on April 15—down from 8.7 percent on March 15. On Jan. 28, NAKD stock had a short interest ratio of 75 percent.

NAKD’s stock forecast

Since NAKD is a penny stock, none of the Wall Street analysts cover the stock right now. Naked Brand has a lot of room to grow. The global intimate wear market is forecast to reach $325 billion by 2025 compared to $176 billion in 2017.

NAKD stock rose after Ault Global investment

On April 9, NAKD stock rose as much as 20 percent after the intimate apparel company revealed that Ault Global bought over 41 million shares in NAKD stock. Ault Global now owns a nearly 6.4 percent stake in Naked Brand. Ault Global is a diversified holding company that invests in undervalued stocks.

NAKD Stock Price

Outlook for NAKD stock

Investors can anticipate a certain weakness in NAKD stock over the next few trading sessions as the Reddit-fueled party is about to end. As a result, retail investors should avoid buying NAKD stock because the recent surge in its stock price isn’t based on the company’s fundamentals.

NAKD stock doesn’t look like a good buy right now.

Naked Brand’s financials look weak. In fiscal 2020, the company’s net sales decreased by 20 percent YoY to $58.5 million. Additionally, the stock faces the threat of being delisted from Nasdaq.

From a valuation perspective, NAKD’s fiscal 2020 price-to-sales multiple is 5.6x, which looks expensive compared to its peers despite the recent price drop. In comparison, VF Corporation (VFC) has an NTM EV-to-sales multiple of 3.3x.