Buy Castor Maritime (CTRM) Stock, Play Uptrend in Global Economy

Castor Maritime (CTRM) stock has been very volatile in 2021. It's still up 72 percent YTD. Is it too late to buy CTRM stock?

June 7 2021, Published 8:10 a.m. ET

Castor Maritime (CTRM) stock has been very volatile in 2021. It's still up 72 percent YTD even though it has dropped 83 percent from its 52-week highs. Is it too late to buy CTRM stock or should you add this penny shipping name to your portfolio?

Castor Maritime has been on an acquisition spree. The company has announced the acquisition of several vessels. It has a fleet of 26 vessels on a fully delivered basis, according to the most recent update, which is up four-fold from what it had at the end of 2020.

What happened to Castor Maritime stock?

There have been several developments related to Castor Maritime stock over the last few weeks. It announced a ten-for-one reverse stock split that became effective on May 28. The stock fell on the reverse stock split announcement. However, it became a necessity for the company to meet the minimum listing requirements as the stock price was below $1.

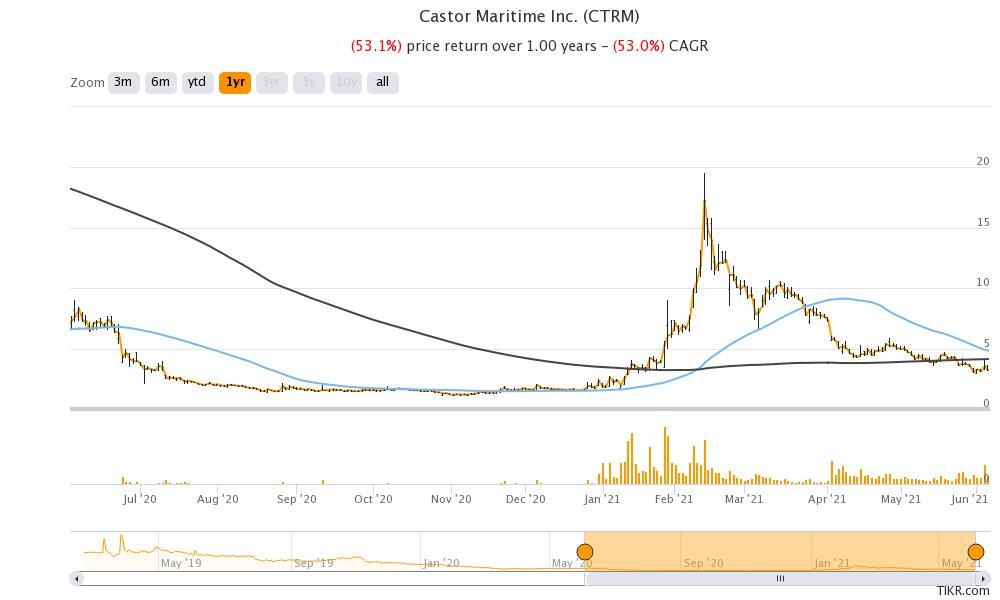

CTRM stock versus 50 and 200-day SMA

On June 3, CTRM released its earnings for the first quarter of 2021, which showed that it posted a net profit of $1.1 million in the quarter. In the first five months of 2021, it has raised $33.3 million as debt and $252.5 million as equity, which has helped fuel its expansion spree.

CTRM stock jumped on the earnings announcement but closed down almost 10 percent the next day as the rally in meme stocks seemed to lose momentum. Other penny meme names like Zomedica and Naked Brands also tumbled on June 4 after rising sharply in the previous few trading sessions.

CTRM short squeeze

According to Fintel, CTRM’s short volume ratio was 36 percent as of June 4 compared to around 29 percent for the previous day. The short volume ratio is the highest since May 25 on a reverse split-adjusted basis. However, CTRM stock isn't very popular on WallStreetBets right now. Blackberry and AMC Entertainment are the most popular discussions on the Reddit group.

CTRM's stock forecast

Shipping rates have come down after peaking in May. The fall in shipping rates is negative for the entire shipping industry including Castor Maritime. The rates still look high enough for shipping companies to make a decent profit in the near future.

Buying Castor Maritime stock

Castor Maritime is a penny name that tends to be riskier and more volatile. The company’s acquisition efforts are bearing fruits and it turned profitable in the first quarter. CTRM could be a good way to play the current uptrend in the global economy.

The company is adding to its fleet even as it comes at the cost of raising debt and equity dilution. If the momentum in the global economy sustains and the commodity supercycle that has been fueling demand for shipping companies holds ground, shipping stocks might deliver good returns.

Castor Maritime is also adding tankers to its fleet, which would benefit from the increased demand for crude oil as the global oil demand continues to recover from the 2020 lows. Overall, Castor Maritime stock looks like a buy at this point. That said, given its volatile nature, investors should weigh their risk appetite before diving into this penny shipping name.