Are Solid-State Battery Stocks a Good Investment?

Solid-state battery stocks have come off their highs. Are solid-state battery stocks a good investment and what stocks look like good buys now?

March 22 2022, Updated 9:00 a.m. ET

Solid-state batteries are thought to be the future. They promise to solve the many drawbacks of conventional batteries. Investors are excited about the prospects, and solid-state battery stocks are getting a lot of attention.

Some companies with solid-state battery programs are established corporations, while others are startups. Some of the companies are directly involved in building solid-state batteries, while others have focused on supplying materials used to make the batteries.

Solid-state battery stocks have fallen.

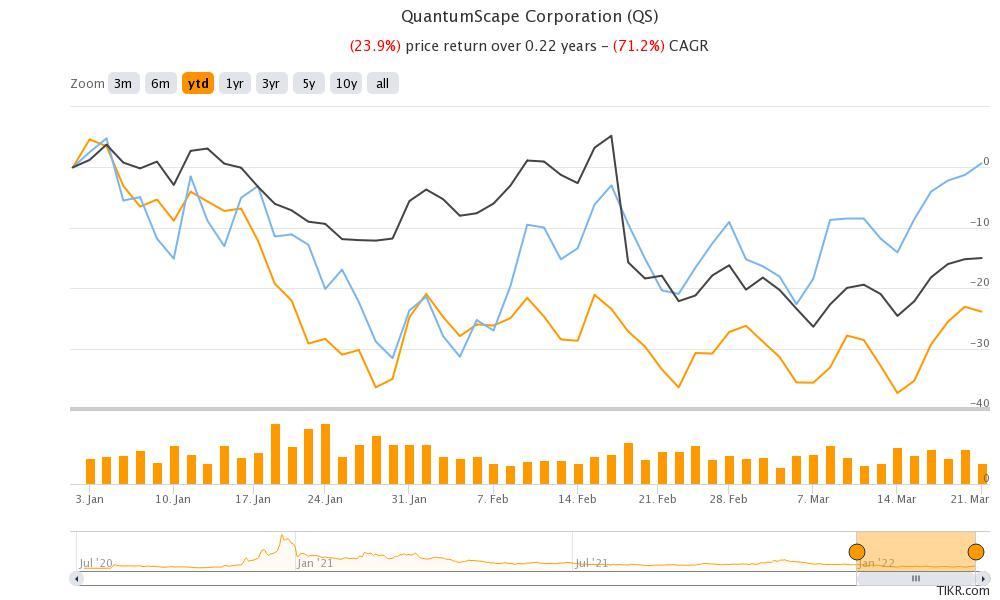

Pure-play solid-state battery stocks have looked weak, and trade way below their all-time highs. What are the best solid-state battery stocks to buy now and how do you go about investing in them?

Solid-state batteries have many benefits.

Solid-state batteries use solid electrolytes instead of liquid electrolytes. Although the current lithium-ion batteries like those used in smartphones and EVs are good, there are many safety concerns. One concern is that conventional lithium batteries contain flammable liquid.

A few years ago, Samsung pulled its flagship Galaxy Note 7 smartphone from the market because its battery could explode and cause a fire. In 2021, GM and Hyundai recalled some of their EVs running on lithium-ion batteries due to the fire risk. A woman was also injured after a hoverboard powered by a lithium-ion battery exploded in her room. Solid-state batteries should eliminate the fire risk, which gives manufacturers and users peace of mind.

Solid-state batteries also have higher energy density than their liquid cousins. Therefore, solid-state batteries can offer a longer driving range when used in EVs. Solid batteries can power devices like smartphones for more hours before requiring a charge.

Also, solid batteries promise to reduce charging time, which could encourage EV adoption. Some drivers have avoided electric cars because they can take hours to recharge when it only takes five minutes to refill the tank at a gas station.

To sum it up, solid-state batteries can help overcome the key drawbacks of a lithium-ion battery. They're lighter, safer, have a longer shelf life, take less time to recharge, and provide a much higher range. If solid-state batteries get commercialized in electric cars, it could be a game-changer and help address range anxiety that can be a key driver for EV adoption.

What are the top solid-state battery stocks?

Considering solid-state batteries' bright prospects, there's a rush to make them. EV startup Fisker (FSR) tried to build solid batteries but gave up on the plans in 2021. Hyundai-backed SolidEnergy Systems (SES) also gave up on its solid battery efforts. Other companies are pressing on with solid-state battery programs. Some of the top solid-state battery stocks right now are:

- QuantumScape (QS)

Solid Power (SLDP)

Toyota (TM)

Mullen Automotive (MULN)

Hyundai (HYMTF)

Albemarle (ALB)

QuantumScape, which makes batteries for EVs, has been working on solid-state batteries and is moving closer to production. The company is backed by Volkswagen, a major automaker focused on producing electric cars. It also boasts a partnership with an established global luxury automaker that it hasn’t identified yet. While some investors have questioned QuantumScape’s solid-state battery breakthrough claims to the extent of shorting the stock, third-party tests have validated its technology.

Like QuantumScape, Solid Power also went public through a SPAC merger in a deal that handed it more than $500 million in fresh capital. The company aims to start delivering its batteries in 2022 to Ford and BMW for prototype cars and start commercial production in 2025. Like many other de-SPACs, Solid Power also trades below the SPAC IPO price.

Toyota is a global automaker that wants to be a leading solid-state battery company. The Japanese auto giant has developed a solid battery that promises to be a game-changer. If used in EVs, the Toyota solid battery can fully charge in 10 minutes and offer more than 310 miles of driving range on a single charge.

Toyota has accumulated more than 1,000 patents related to solid-state batteries. The company plans to invest $13.6 billion in battery technology over the next decade. It intends to use the solid-state battery in a hybrid car first and expects it to hit the roads by the middle of this decade.

All the legacy automakers see zero-emission cars as the future and are investing heavily to compete with pure-play EV companies. Ford has announced a business transformation and separated the legacy ICE (internal combustion engine) from the fast-growing EV business. General Motors intends to sell only zero-emission vehicles by 2035 while Volkswagen aims for the top position in the EV industry by 2025.

Ford has invested in solid-state battery startup Solid Power. The other investors are Hyundai and Samsung. Solid Power has partnered with SK Innovation on a solid-state battery program and it will get an investment of $30 million.

If you're willing to take some extra risk, penny automotive and battery company Mullen Automotive could fit the bill. The stock has been very volatile in 2022 amid its popularity on social media platforms.

Albemarle is among the world’s leading producers of lithium, which is a central material in battery manufacturing. Ford-backed Solid Power uses lithium in its solid-state batteries. Albemarle should see strong demand for its supplies amid the race to build better batteries for EVs and other devices that use electricity.

Hyundai has partnered with Factorial Energy and will jointly develop solid-state battery cars for next-gen EVs. In 2019, Hyundai also produced a solar panel powered electric car.

What's the outlook for solid-state batteries?

Solid-state battery companies should see long-term growth. The global solid-state battery market is on track to grow to $87.5 billion by 2027 from $32.9 billion in 2019. The growing adoption of portable electronics like smartphones and the rise of EVs are some of the factors fueling the solid-state battery market's growth. Another growth driver is the shift to renewable power sources like wind and solar that require batteries for energy storage.

What are the risks of investing in solid-state battery stocks?

Investing in stocks always carries market risk because stock prices are volatile. Talking specifically of pure-play solid-state battery stocks, all of them are pre-revenue companies with actual production still a few years away. Growth stocks like these have been out of favor with markets, which is reflected in the price action of solid-state battery stocks.

Also, while the future of the automotive industry is zero-emission, we have several competing technologies. In the battery-electric space, there are lithium-ion and solid-state batteries. Our Next Energy, a Michigan-based battery startup company, has produced a battery prototype with a range above 750 miles. There are also cars powered by hydrogen fuel cells. Toyota and Hyundai are among the companies investing in fuel cell cars.

How can you invest in solid-state battery stocks?

Many solid-state batteries are publicly traded companies. If you have an account with any of the stockbrokers like Robinhood, Fidelity, Webull, or Schwab, you can buy solid-state battery stocks like QuantumScape and Solid Power.

For private solid-state battery companies, you will need to go through the private capital market to access stocks. Keep in mind that the SEC restricts access to the private market to accredited investors with a net worth of at least $1 million and a certain level of trading experience. You can get exposure to foreign solid-state battery stocks like South Korea’s SK Innovation through Korea-focused ETFs.