GRSV Stock Is Under $10: Is It a Buy Now?

The GRSV SPAC is merging with Ardagh Metal Packaging, a subsidiary of Ardagh Group. Is GRSV stock a buy before the merger?

March 25 2021, Published 9:12 a.m. ET

Ardagh Metal Packaging (AMP), a subsidiary of Ardagh Group (ARD), is gearing up to go public through a reverse merger with Gores Holdings V (GRSV). Ardagh Group supplies recyclable metal beverage and glass packaging for leading brands. The GRSV SPAC raised about $525 million in its Aug. 2020 IPO. What's the GRSV-AMP merger date, and should you buy the SPAC stock now?

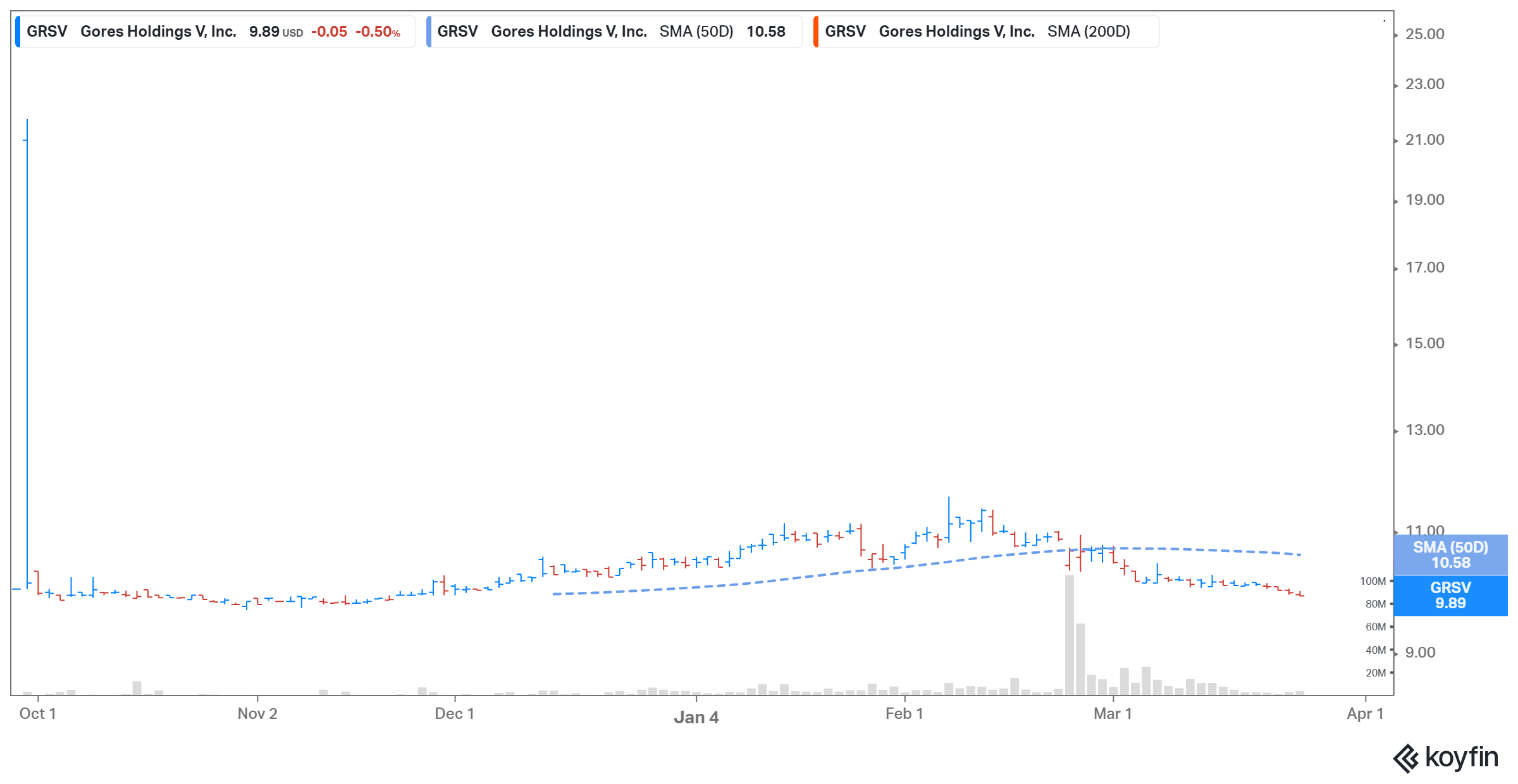

On Mar. 24, 2021, GRSV stock fell 0.5 percent and closed at $9.89, which represents a 1.1 percent discount to its IPO price of $10 per share. The stock is down 54.5 percent from its 52-week high.

Who's the sponsor of the GRSV SPAC?

The GRSV SPAC raised about $525 million in its Aug. 2020 IPO, selling 52.5 million units for $10 apiece. The blank-check company is backed by chairman Alec Gores, the founder and CEO of The Gores Group. Gores, who has announced and completed six transactions worth more than $27 billion, took Luminar Technologies and United Wholesale Mortgage public.

The GRSV-AMP merger date

The GRSV-AMP merger is expected to close in the second quarter of 2021. The transaction, subject to approval by GRSV shareholders and other customary closing conditions, is set to have a pro forma enterprise value of $8.5 billion. The combined entity will be listed on the NYSE under the ticker symbol “AMBP.”

The deal will provide Ardagh Group with $3.4 billion in cash to fund growth initiatives. The amount includes about $525 million in cash held by GRSV in trust and an additional $600 million in PIPE (private investment in public equity) at $10 per share. Ardagh Group will retain about 80 percent of the combined entity when the deal closes.

GRSV SPAC stock is falling

GRSV stock has fallen 1.8 percent in the past week and 7.1 percent in the past month. Investors are rethinking their portfolios amid changing broader factors, resulting in a sell-off.

SPAC share prices are correcting after their speculative run. For example, Chamath Palihapitiya’s Social Capital Hedosophia Hldgs Corp VI (IPOF), which is yet to identify a merger target, has fallen by 27 percent in the last month. Meanwhile, Ajax I (AJAX), which is in talks to take used-car seller Cazoo public, and Foley Trasimene Acquisition II (BFT), which is scheduled to take Paysafe public, have fallen 19 and 10 percent, respectively.

GRSV Stock Price

List of SPACs under $10

Several SPACs are still trading under $10, including:

- Malacca Straits Acquisition (MLAC).

- AF Acquisition (AFAQU).

- Archimedes Tech SPAC Partners (ATSPU).

- Alkuri Global Acquisition (KURIU).

- Kismet Acquisition Three (KIIIU).

GRSV warrants

The GRSV SPAC warrant is trading on the Nasdaq under the ticker symbol “GRSVW.” On Mar. 24, GRSVW was down 2.5 percent at $1.55.

GRSV stock looks like a good buy

GRSV stock seems to be a good buy for investors seeking bargain SPAC opportunities. The global metal packaging market is expected grow 1.8 percent compounded annually to $161.3 billion in 2027 from $142.8 billion in 2020. AMP is expected to generate revenue of $3.8 billion in 2021, $4.5 billion in 2022, and $5.2 billion in 2023.

GRSV has set AMP's pro forma implied equity value at $6.1 billion. Meanwhile, at GRSV’s current stock price, AMP is valued at around $6.0 billion. AMP’s 2021 price-to-sales and 2024 price-to-sales multiples are 1.6x and 1.1x, respectively. In comparison, Ball Corporation (BLL) is trading at a 2021 price-to-sales multiple of 2.1x.