Why WallStreetBets, Hedge Funds, and Jim Cramer Love PSFE Stock

Paysafe (PSFE) stock is getting popular on Reddit group WallStreetBets as retail traders attempt another short squeeze.

June 25 2021, Published 8:39 a.m. ET

Paysafe (PSFE), which went public earlier this year through a SPAC, is getting popular on Reddit group WallStreetBets. Even the slightest hint of a stock getting popular on WallStreetBets triggers a buying spree and this is what seems to be happening with PSFE stock. What’s the forecast for PSFE stock and can Reddit traders trigger a short squeeze in the stock?

PSFE stock was trading sharply higher in pre-market trading on June 25. The stock is down 43 percent from its 52-week highs. There was a sell-off in SPAC and fintech stocks earlier this year and PSFE was a victim.

Paysafe stock forecast

Wall Street analysts are bullish on Paysafe stock. According to the estimates compiled by TipRanks, the stock has an average target price of $17.29, which is a 55 percent upside over the closing prices on June 24. PSFE’s highest target price is $19.

It even trades below the lowest target price of $15. All seven analysts covering the stock have rated it as a buy or some equivalent.

PSFE stock forecast on Reddit group WallStreetBets

PSFE stock is among the top seven discussion topics on WallStreetBets. Currently, Tesla is the top discussion topic among WallStreetBets members followed by ContextLogic (WISH). The group has taken several stocks to the “moon.” Many investors wonder whether it's PSFE’s turn to take a ride to the moon.

A post on WallStreetBets, which was upvoted over 1,000 times, said that hedge funds are bullish on PSFE and pointed to the number of hedge funds with long positions on the stock. The post also pointed to the massive opportunity in the iGaming market and harped on the fact that PSFE is posting revenues and profits. Most other companies that have gone public through the SPAC route are posting losses and some are in the pre-revenue stage.

Another post on WallStreetBets analyzed the company’s first-quarter earnings where it has missed estimates. However, the user, who has over 2,800 “karma points,” talked about the company's strong cash flow generation. They also discussed PSFE's higher institutional ownership.

Why everyone is so bullish on PSFE stock

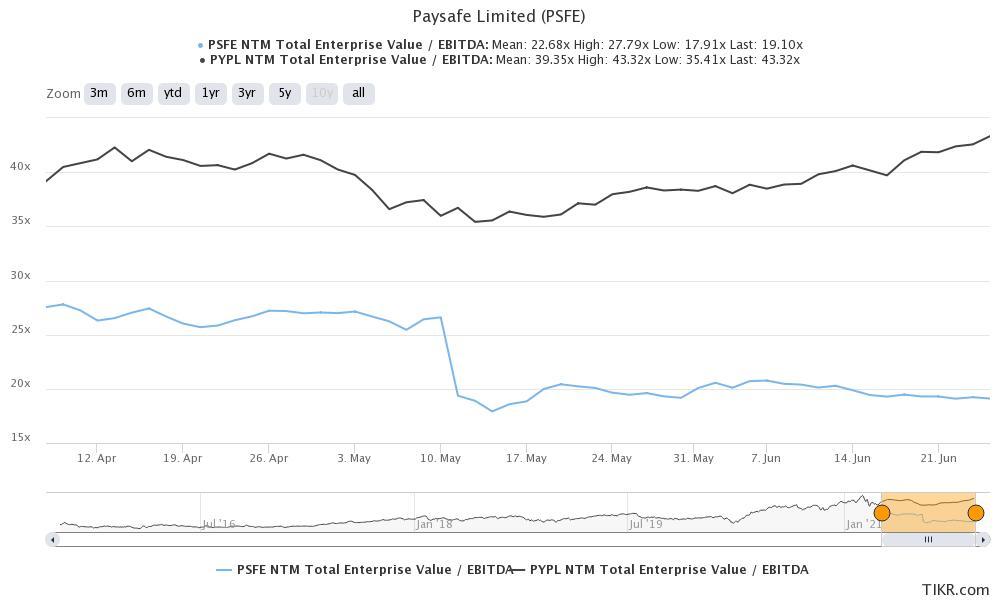

Previously, I talked about why PSFE is a great stock to buy even though it hasn’t been discovered by WallStreetBets ninjas yet. The stock trades at an NTM EV-to-EBITDA multiple of 19.1x, which is less than half of the 43x that PayPal trades at.

The valuation gap between PayPal and Paysafe has widened and is currently at the highest level since PSFE listed. The valuation discount for PSFE doesn't look warranted. However, like with some of the other names like WISH, it took Reddit traders to uncover the value in a beaten-down stock. Previously, I discussed the possibility that WISH stock could get popular soon on WallStreetBets.

Several other observers including Jim Cramer are bullish on PSFE stock. However, the market looked the other way and PSFE stock is trading near its all-time lows.

Paysafe stock short squeeze

According to the data from Fintel, PSFE had a short volume ratio of just under 16 percent on June 24. The short interest looks high enough to trigger a squeeze. PSFE looks like a quality stock with a good margin of safety. The stock could surge in the near term due to positive fundamentals and pumping by Reddit traders.