Paysafe (PSFE) Isn't a Reddit Stock, Still Looks Like a Good Buy

Paysafe stock hasn't kept up with the expectations after the merger. However, PSFE stock looks like a good buy for investors.

June 8 2021, Published 11:44 a.m. ET

Paysafe (PSFE), which went public through a merger with Bill Foley’s Foley Trasimene Acquisition Corp II (BFT), hasn’t had a nice outing. The stock is down over 36 percent from its pre-merger highs. Is PSFE a good stock to buy now after the crash?

Paysafe is a fintech player that processes over $100 billion worth of transactions annually. The outlook for fintech names is bullish. Recently, Social Finance (SOFI) went public through a merger with Social Capital Hedosophia Holdings V (IPOE). The SPAC was sponsored by Chamath Palihapitiya, who has launched several of these blank-check companies.

Why PSFE stock has dropped

The fall in PSFE stock has been due to negative macro factors. First, there was a sell-off in SPACs, which took a toll on BFT stock before the merger. Also, there has been a sell-off in fintech names. Affirm, which went public earlier this year, only trades 58 percent below its 52-week highs. PayPal is also down over 15 percent from its highs.

Paysafe stock target price—analysts are bullish

Analysts are bullish on Paysafe stock. Its average target price of $17.67 is a premium of 45 percent over the current prices. All six analysts covering the stock have a buy or equivalent rating and its lowest and highest target prices are $16 and $19, respectively. The stock trades below the lowest target price.

While analysts' target prices are never the perfect indicator, the steep discount from the consensus target price for PSFE stock indicates that there's something that either the markets or Wall Street analysts are missing.

Jim Cramer is also bullish on PSFE stock

Jim Cramer is also bullish on PSFE stock due to its association with Foley, who has rich experience in the financial services industry. Cramer advocated buying more PSFE stock.

Paysafe stock looks undervalued

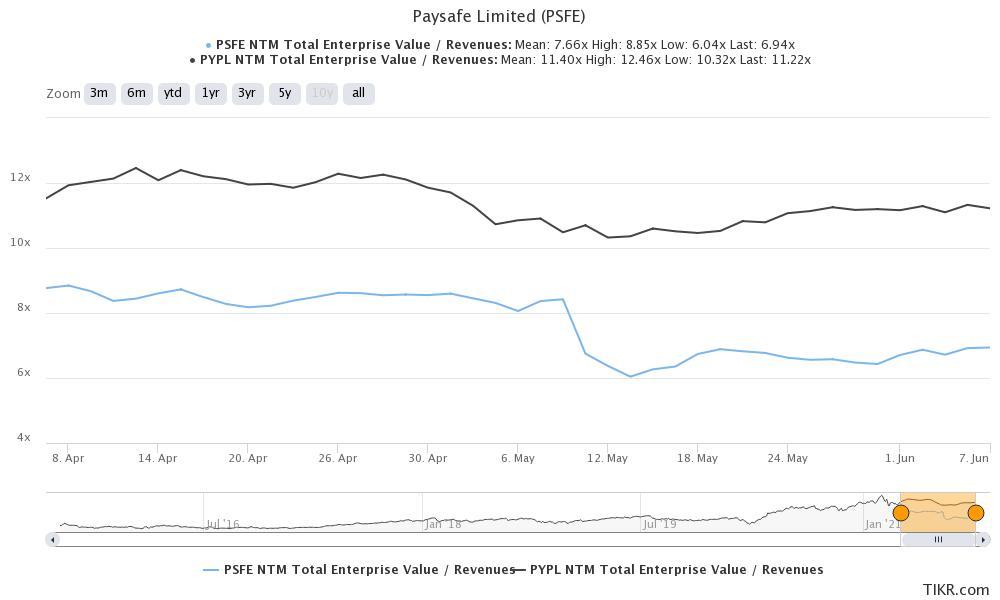

Paysafe stock trades at a NTM EV-to-revenue multiple of 6.9x compared to 11.2x for PayPal. The massive valuation discount for PSFE stock compared to PYPL doesn't look warranted and there appears to be scope for valuation multiple expansion for Paysafe stock in the medium term.

PSFE versus PYPL valuation

Along with the fintech space, Paysafe is also a play on the online gaming market. It has a 10 percent share in the U.S. iGaming market whose TAM (total addressable market) is expected to reach $24 billion by 2025. The iGaming vertical reported 66 percent revenue growth in the first quarter, while PSFE’s total revenues only increased about 5 percent YoY during the period.

Paysafe is also expanding its target market and has forayed into digital wallets and cryptocurrencies. The company has a strong business model and is positive on the EBITDA level, unlike most other newly-listed companies that are posting losses on the EBITDA level. Also, the company has strong management with the added expertise of Foley after the merger.

PSFE stock short interest

There has been a steep rally in several stocks like AMC Entertainment and Blackberry as Reddit traders successfully triggered a short squeeze. While PSFE might not be a short squeeze candidate since its short volume ratio was only about 12 percent on June 7, it looks fundamentally undervalued at these prices.

The stock was in the penalty box amid the sell-off in SPACs and newly listed names. However, it might shed the negative sentiments and move higher looking at the attractive valuations.