Best Oil Stocks to Buy Now, Buffett and Druckenmiller Increase Energy Bets

Warren Buffett and Stanley Druckenmiller have increased their exposure to the energy sector. What are the best oil stocks to buy now?

May 17 2022, Published 10:40 a.m. ET

Oil and gas stocks soared in 2021 and are looking strong in 2022 as well. Only about a year ago, fund managers were shying away from investing in oil and gas stocks. Instead, they focused on green energy companies.

Things have changed over the last year and several fund managers including Berkshire Hathaway chair Warren Buffett and Stanley Druckenmiller have increased their exposure to the energy sector. What are the best oil stocks to buy now as crude oil prices continue to rise amid the Russia-Ukraine war?

The forecast looks strong for oil and gas stocks.

While green energy is the future, the shift towards cleaner energy will be a long process. The forecast for oil and gas looks good in the short to medium term. The world economy needs oil and gas to fulfill energy needs in the near term even as countries globally scale up renewable energy generation capacity.

While the Russia-Ukraine war has led to a spike in energy prices in the short term, the global energy markets are headed for a structural shift. Many countries globally are shunning Russian oil. Europe, which is the biggest buyer of Russian oil and gas, is looking to decisively replace the country with alternate suppliers.

Crude oil prices spiked after the Russia-Ukraine war.

Oil and gas prices might remain high in the medium term even if the Russia-Ukraine war ends. The oil and gas industry is also reeling from years of underinvestment as companies were circumspect about adding capacities amid the pivot towards green energy.

Buffett and Druckenmiller increased their stake in Chevron.

Buffett has been scooping shares of energy companies. Chevron is now the third-largest holding for Berkshire Hathaway and the conglomerate holds an 8.1 percent stake in the company. Berkshire has also been increasing stakes in Occidental Petroleum and it's now the company’s seventh-largest holding.

Druckenmiller’s Duquesne Family Office added to its stake in Chevron in the first quarter of 2022. The fund also took a new position in Coterra Energy and Canadian mining company Teck Resources, which also has interests in oil sands.

What are the best oil stocks to buy now?

With a dividend yield of 3.28 percent and an NTM EV-to-EBITDA multiple of 5.7x, Chevron (CVX) looks among the best oil stocks to buy now. BP looks like another oil stock worth considering. While the company has taken a massive hit as it exited its business in Russia, its pivot towards green energy would drive long-term value for investors.

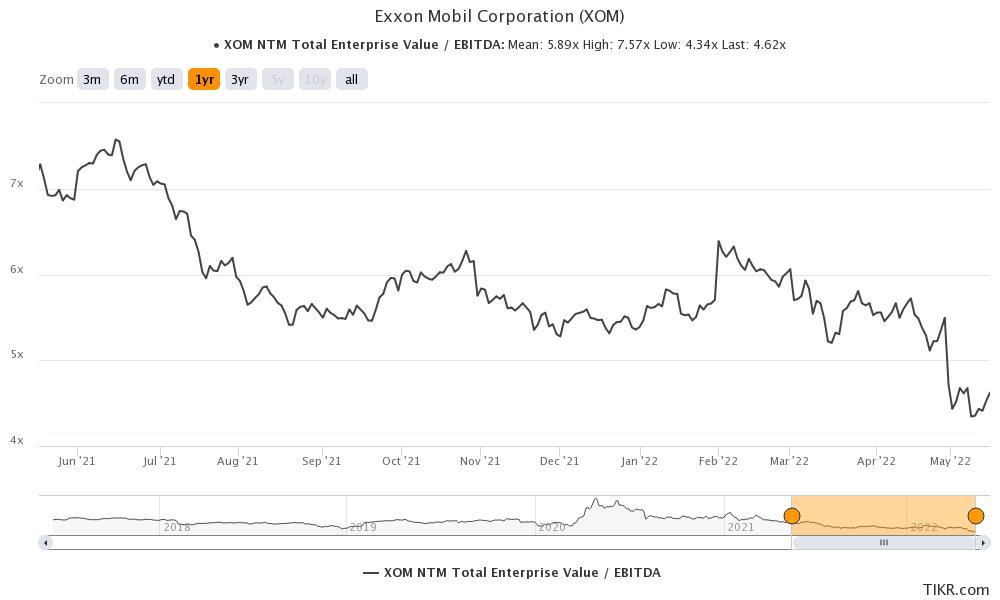

XOM stock also looks a good buy.

ExxonMobil (XOM) is another good oil play. The stock has a dividend yield of 3.8 percent and looks attractively valued at an NTM EV-to-EBITDA multiple of 4.62x. XOM stock has gained 49 percent in 2022 and could continue to outperform if crude oil prices sustain at higher price levels.

Investors can consider oil and gas ETFs.

If you want diversified exposure to the energy sector, there are multiple ETFs that you can choose from, including:

- The Energy Select Sector SPDR Fund (XLE) gives exposure across the energy value chain.

- The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) gives exposure to upstream energy companies.

- The VanEck Oil Services ETF (OIH) gives exposure to oil services companies and is a play on an increase in energy capex.