Bitcoin Skeptic Jamie Dimon Has a Bullish Price Prediction

Jamie Dimon's Bitcoin quotes reveal the JPMorgan CEO is deeply skeptical of cryptos but still has a bullish price prediction.

Sept. 30 2021, Published 6:41 a.m. ET

JPMorgan Chase's CEO has earned a reputation as one of the most outspoken Bitcoin skeptics on Wall Street. A look at Jamie Dimon’s Bitcoin quotes reveals the bank executive has no interest in cryptocurrencies, but he wouldn’t stand in clients’ way if they wanted to experiment with crypto investments.

Dimon, a cancer survivor, joined JPMorgan in 2004 and became the bank’s CEO in 2005. He previously worked at Citigroup but had to leave after falling out with the boss there. Dimon joined the billionaires’ club in 2015, and his fortune is estimated at $2 billion.

Jamie Dimon’s Bitcoin quotes

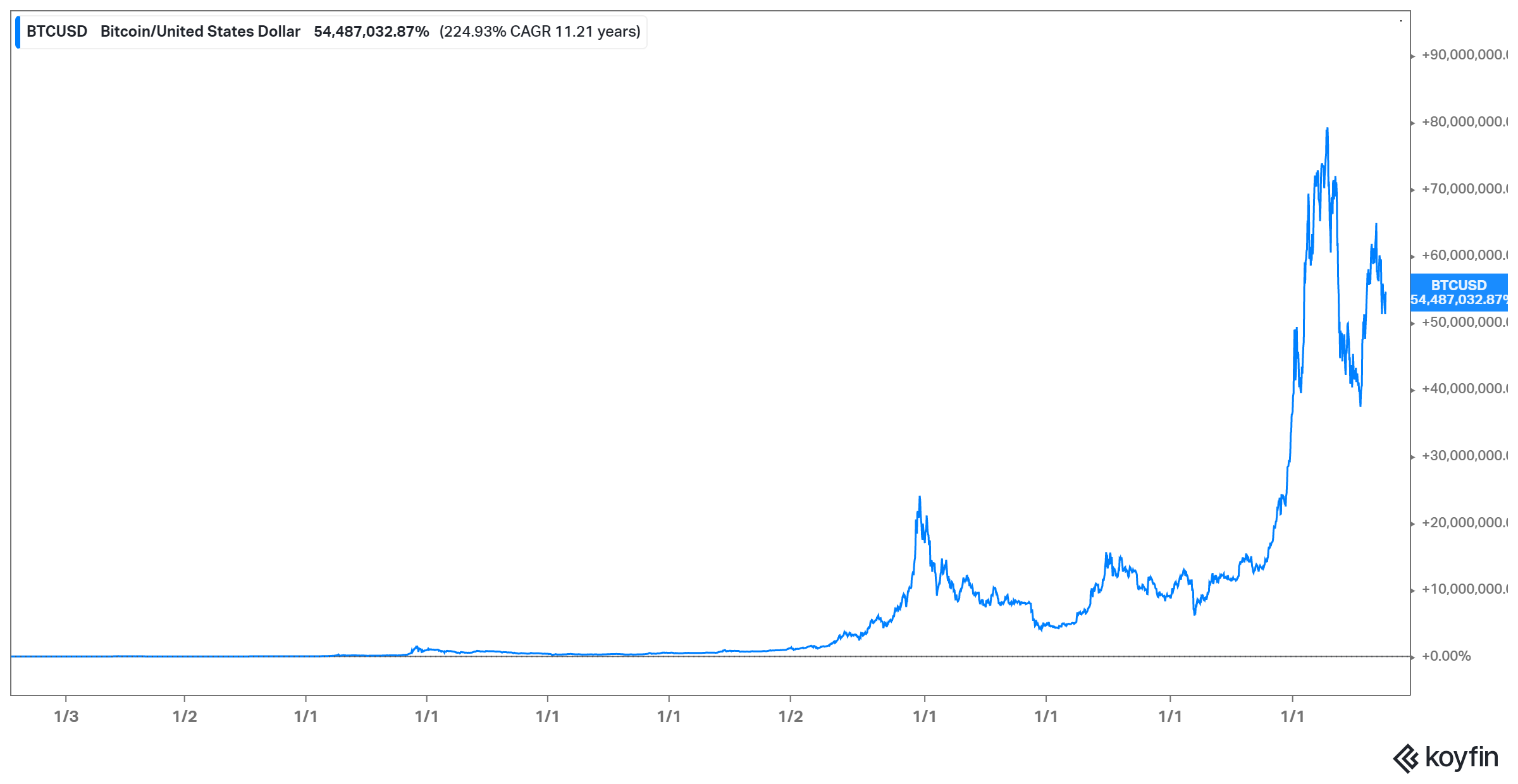

Bitcoin has made many investors rich—someone who had invested just $10 in the flagship cryptocurrency early on would now be a millionaire. Individual and institutional investors alike continue to buy Bitcoin as they expect its price to appreciate. For example, Suze Orman owns some Bitcoin and she won’t sell it, no matter what happens. It's also Jack Dorsey's favorite cryptocurrency, and Elon Musk-led Tesla made a huge bet on Bitcoin, of $1.5 billion.

But Bitcoin’s growing acceptance hasn’t changed Dimon’s views. The JPMorgan boss has said harsh things about Bitcoin, calling it a fraud and Bitcoin investors fools. Some of his quotes on the cryptocurrency:

- “My daughter bought Bitcoin, it went up and now she thinks she’s a genius.”

- “It’s [Bitcoin] worse than tulip bulbs. It won’t end well. Someone is going to get killed.”

- “If you're stupid enough to buy it, you'll pay the price for it one day,” Dimon warned JPMorgan traders in 2017.

- "I think if you borrow money to buy Bitcoin, you're a fool," Dimon said in a Sep. 2021 interview with The Times of India.

- “I don’t care about bitcoin. I have no interest in it…On the other hand, clients are interested, and I don’t tell clients what to do.”

Is JPMorgan invested in Bitcoin?

While Dimon is against Bitcoin, those are his personal views. JPMorgan, the bank he leads, has embraced the cryptocurrency and offers its wealth management clients access to several Bitcoin funds.

JPMorgan rivals Morgan Stanley and Goldman Sachs have also joined the Bitcoin bandwagon. Morgan Stanley has even purchased a large stake in MicroStrategy, which has invested billions of dollars in Bitcoin.

Is Bitcoin a good investment?

As the Bitcoin community continues to grow, so does the crypto’s investment appeal. El Salvador has given Bitcoin a huge endorsement by making it legal tender. A growing number of businesses, such as AMC Theatres, are also lining up to accept Bitcoin payment.

Although Bitcoin transactions can be slow, multiple DeFi projects have come up with ideas that could change that and bolster its appeal as a payment method. That could further boost its demand and value. Another major appeal of Bitcoin is its limited supply. The crypto’s supply is capped at 21 million coins, making it digital gold for many investors.

However, there are threats to Bitcoin as well, namely regulation. Governments around the world are deeply skeptical of cryptocurrencies, believing they facilitate criminal activity. Bitcoin's environmental impact is another concern. In China, all crypto transactions have been banned and mining activities stifled. Other countries may follow, slowing Bitcoin's adoption and limiting returns for investors.

Amid these pros and cons for Bitcoin as an investment, Dimon has offered a bullish price prediction for Bitcoin to contrast his views: the JPMorgan boss has predicted Bitcoin could be worth more than $400,000 in five years (or ten times its current value).