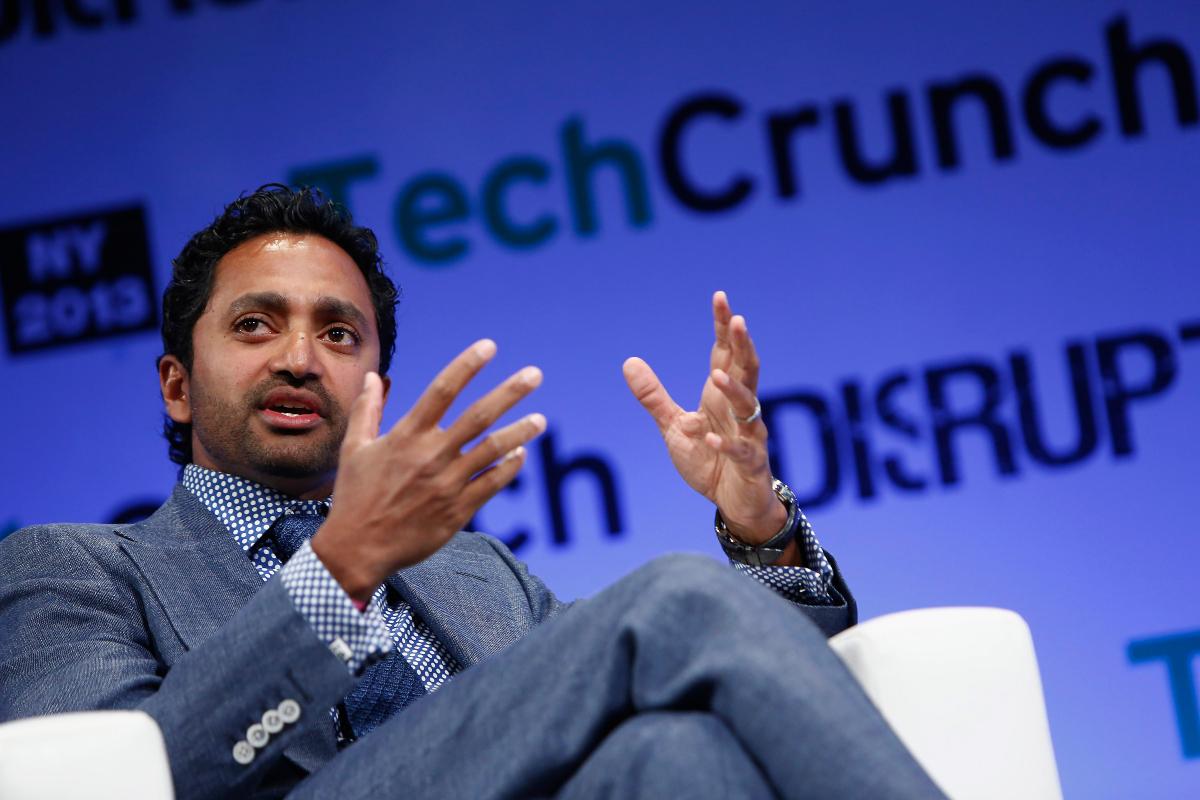

IPOF Merger News: Is Musk’s SpaceX a Target for the Palihapitiya SPAC?

There are rumors that IPOF might merge with Elon Musk’s space company SpaceX. What’s the latest news on the IPOF merger and will Musk take SpaceX public?

Feb. 23 2022, Published 10:02 a.m. ET

Social Capital CEO Chamath Palihapitiya was in news in 2020 and 2021 amid the SPAC euphoria. However, he has been absent amid the crash in SPACs as well as de-SPACs. Two of his SPACs, Social Capital Hedosophia Holdings IV (IPOD) and Social Capital Hedosophia Holdings VI (IPOF) are still hunting for merger targets.

While most of the SPACs, including IPOD, are trading below the IPO price, IPOF has stayed above the IPO price. The recent euphoria has been driven by rumors that IPOF might merge with Elon Musk’s space company SpaceX. What’s the latest news on the IPOF merger and will Musk take SpaceX public through a SPAC merger?

Palihapitiya’s SPACs have crashed.

Companies that merged with Palihapitiya’s SPACs have also plunged amid the sell-off. While SoFi and Opendoor are holding above $10, Clover Health and Virgin Galactic have fallen below $10. Until 2021, Virgin Galactic was the best-performing company among the names that merged with a Palihapitiya SPAC. However, it has since fallen.

Clover Health deserves a special mention here. While Palihapitiya called it a “10x idea,” it has turned out to be the opposite and the stock has lost 80 percent from the IPO price. The drawdown from the peaks is even more severe, and Clover Health stock has lost over 93 percent from the 52-week highs

IPOF is the largest Palihapitiya SPAC.

IPOF has a market cap of just under $1.5 billion and is the largest SPAC from Palihapitiya. SPACs also come up with PIPE (private investment in public equity) transactions. These deals are usually priced at the IPO price and help increase the money that the merger target receives.

What are the IPOF merger rumors?

IPOF is among the most active SPACs. There have been multiple rumors about the merger targets that the blank-check company is considering. In May 2021, there were rumors that IPOF was in talks with luxury gym operator Equinox Holdings for a merger. However, the talks didn't go through.

In November, there were rumors that IPOF was considering Discord as a merger target. Like Equinox, even the Discord rumors soon dissipated. Now, there are rumors that IPOF is looking to merge with SpaceX.

What’s fueling the IPOF-SpaceX merger rumors?

Palihapitiya has backed green energy, disruptive companies, and space companies in the past. SpaceX would fit the criteria that Palihapitiya looks for in merger targets. Apart from the social media chatter, Palihapitiya’s decision to quit Virgin Galactic's board is fueling the speculation that IPOF is looking to merge with SpaceX. SpaceX’s decision to split its shares is a rarity for private companies.

How much is SpaceX worth?

In 2021, SpaceX became the second-largest private company behind TikTok owner ByteDance. The valuations can be debatable for two reasons. First, there's a difference between the private market and public market valuations. Second, the valuations of growth names have tumbled.

Musk might not merger SpaceX with IPOF.

In a world where there are possibly more SPACs than merger targets, as is evidenced by scores of SPACs hunting for targets, Musk would be spoilt for choice. There are multiple reasons why he might not take SpaceX public through a merger with IPOF, or for that matter any SPAC.

First, the USP of SPACs was to identify and add credibility to small startups that might not otherwise have found traction among investors in a traditional IPO. SpaceX doesn't face any such issues.

Second, Musk might not be willing to leave money for SPAC investors, including the sponsors. Given his persona, an IPO or direct listing might turn out to be a better option to list SpaceX. Finally, given the slump in growth names, including Tesla, Musk might want to delay SpaceX listing for a more opportune time.

This would basically mean that the IPOF-SpaceX merger rumors might also fade away, just like Equinox and Discord in the past.