How to Buy Cathie Wood’s ARKX ETF and Whether You Should

Cathie Wood's ARK Investment has launched the ARK Space Exploration ETF (ARKX). How can you buy the ETF and should you?

March 30 2021, Published 8:50 a.m. ET

Cathie Wood’s ARK Investment Management has launched its eighth ETF. The ARK Space Exploration ETF (ARKX) will start trading on March 30 and will be an actively managed ETF. How can you buy the ARKX ETF and should you based on the recent performance of Wood's other ETFs?

There has been a notable shift from growth to value stocks in 2021 and it's also reflected in the performance of ETFs. ETFs focused on value or deep value strategy are outperforming the growth ETFs in 2021.

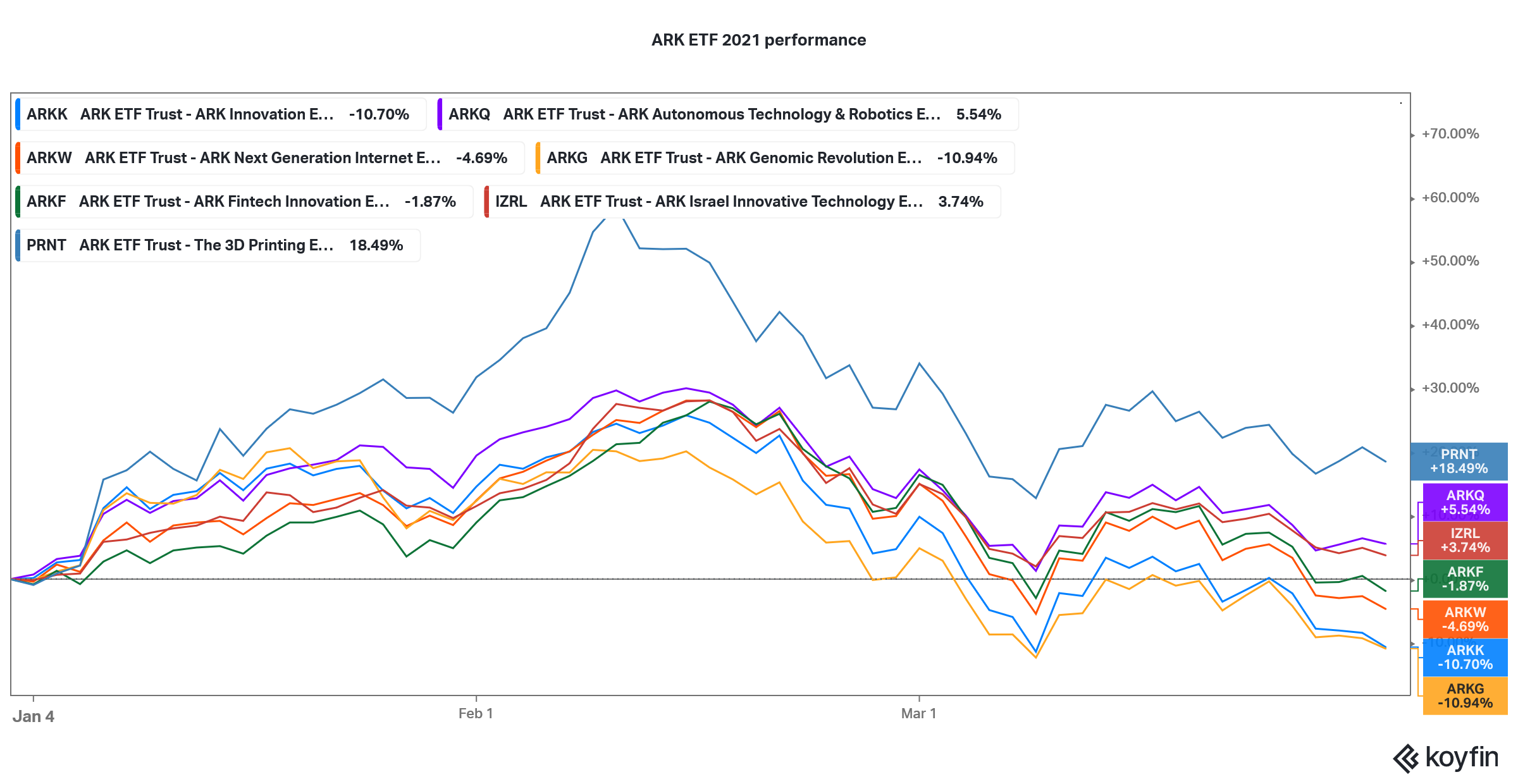

How Cathie Wood’s ARK ETFs have performed in 2021.

Among the seven funds managed by ARK Investment, only three are in the green in 2021. The ARK 3D Printing ETF (PRNT) is the best-performing ARK ETF in 2021 with a YTD gain of 18.5 percent. The ARK Israel Innovative Technology ETF (ISRL) and the ARK Autonomous Technology and Robotics ETF (ARKQ) have gained 3.7 percent and 5.5 percent, respectively, in 2021.

ARK ETFs performance in 2021

All of the other ARK ETFs, including the flagship fund ARK Innovation ETF (ARKK), are in the red in 2021. Talking of ARKK, its 2021 performance has been impacted negatively by the fall in Tesla stock—its largest holding.

Should you buy the ARK Space Exploration ETF (ARKX)?

ARKX will invest in the space exploration theme. The ETF has released the list of its holdings, which shows that Trimble is the largest holding followed by PRNT, which happens to be the best-performing ARK ETF in 2021.

The space exploration theme looked red hot at the beginning of 2021 and many companies including Momentus and Rocket Labs have announced reverse mergers with SPACs. However, the theme has come under pressure over the last month. Markets are getting apprehensive about growth stocks' valuations.

Virgin Galactic, which forms 1.95 percent of ARKX, is down almost 54 percent from its 52-week highs. However, Trimble, which is ARKX’s top holding, is trading near its 52-week highs. ARKX has a diversified portfolio. Almost 40 percent of its holdings are classified as “aerospace beneficiaries” like Trimble.

Almost 32 percent of the fund’s holdings have a market capitalization of over $100 billion, while another 38.3 percent have a market cap between $10 billion and $100 billion. The space exploration theme looks interesting, especially after the stocks have crashed amid the recent sell-off.

The ETF has also invested in Netflix, which isn't exactly related to the space exploration theme. That said, given the sell-off in tech and growth stocks, which might not yet be over, ARKX would have a turbulent ride, at least in the near term.

Investing in ARKX ETF is risky.

Investing in stocks and related instruments is always risky. So, investors should familiarize themselves with the risk. In its prospectus, ARKX highlights six risks, including:

- Equity securities risk is the general systemic risk of investing in stocks.

- Foreign securities risk comes from overseas investments. Over one-quarter of ARKX’s investments are in foreign companies.

- Industrials sectors risk—a lot of ARKX’s holdings, like Boeing, are primarily industrial companies.

- Information technology risk—some of ARKX’s holdings are from the sector.

- Aerospace and defense sector risk—the sector is prone to changes in government regulation.

- SPAC risk—ARKX has invested in space SPACs like Atlas Crest Investment (ACIC) and Reinvent Technology Partners (RTP).

One risk, that I would like to add is the risk of sectoral shift. Investors might continue to pivot their portfolios towards value stocks from growth stocks. ARK’s growth-focused ETFs might have a tough time if the sector shift continues.

How to buy ARKX ETF

The ARKX ETF will start trading on March 30 and then you can buy it by placing an order with your broker. The ETF will likely be available to trade on the popular trading app Robinhood. Notably, Robinhood is also said to be contemplating listing and is among the most-awaited IPOs of 2021.