How Many Times Has the Debt Ceiling Been Raised?

How many times has the debt ceiling been raised? Lawmakers appear trapped in a cycle of debt limit suspensions and standoffs.

Oct. 7 2021, Published 10:43 a.m. ET

Senate Minority Leader Mitch McConnell is a key player in the debate over raising the debt ceiling.

In addition to working on deals for President Joe Biden’s infrastructure bills, Congress is also facing a serious deadline that many financial experts agree will be catastrophic if certain steps aren’t taken. The issue about whether or not to raise the debt ceiling has been a major one in Washington, D.C. recently.

Secretary of the Treasury Janet Yellen warned that by Oct. 18 (and possibly sooner), the Treasury will run out of money. Lawmakers need to reach an agreement regarding whether the U.S. government should grant a suspension on the debt ceiling, raise the debt ceiling, or default on its debt. Congress has voted nearly 100 times in the past to either raise or suspend the debt limit.

Has the U.S. ever defaulted on its debt?

The U.S. government has operated on a continuous cycle of raising the debt ceiling, waiting until the eleventh hour to vote on an extension or an increase again, then continuing with a higher debt ceiling until the next deadline. Often, the Treasury has used what it calls “extraordinary measures” to keep paying its bills during a delay on debt limit decisions.

The Committee for a Responsible Federal Budget states that the federal debt ceiling, or debt limit, was established in 1917 at $11.5 billion. In 1939, a $45 billion debt limit was created and encompassed most of the government’s debt. The organization says that since World War II, the debt ceiling has been adjusted nearly 100 times.

According to the Congressional Research Service, Congress has made 98 debt limit modifications since the end of World War II. These include both debt ceiling increases and suspensions, which keep the debt limit firm temporarily. Meanwhile, 17 of those debt limit changes have occurred since 2001.

The U.S. has never defaulted on its debt in the more than 100 years since the debt limit has existed. it has only passed suspensions of the debt limit since 2013. Yellen and others have been warning of global market issues, lapsed Social Security payments and military salaries, and delays of other government payments if the debt ceiling isn’t raised, which would result in default.

Update on Congress and the debt limit

Legislators have been working toward reaching a compromise. Senate Minority Leader Mitch McConnell has refused to make a long-term agreement. However, late on Oct. 6, he agreed to vote on a short-term extension of the debt limit.

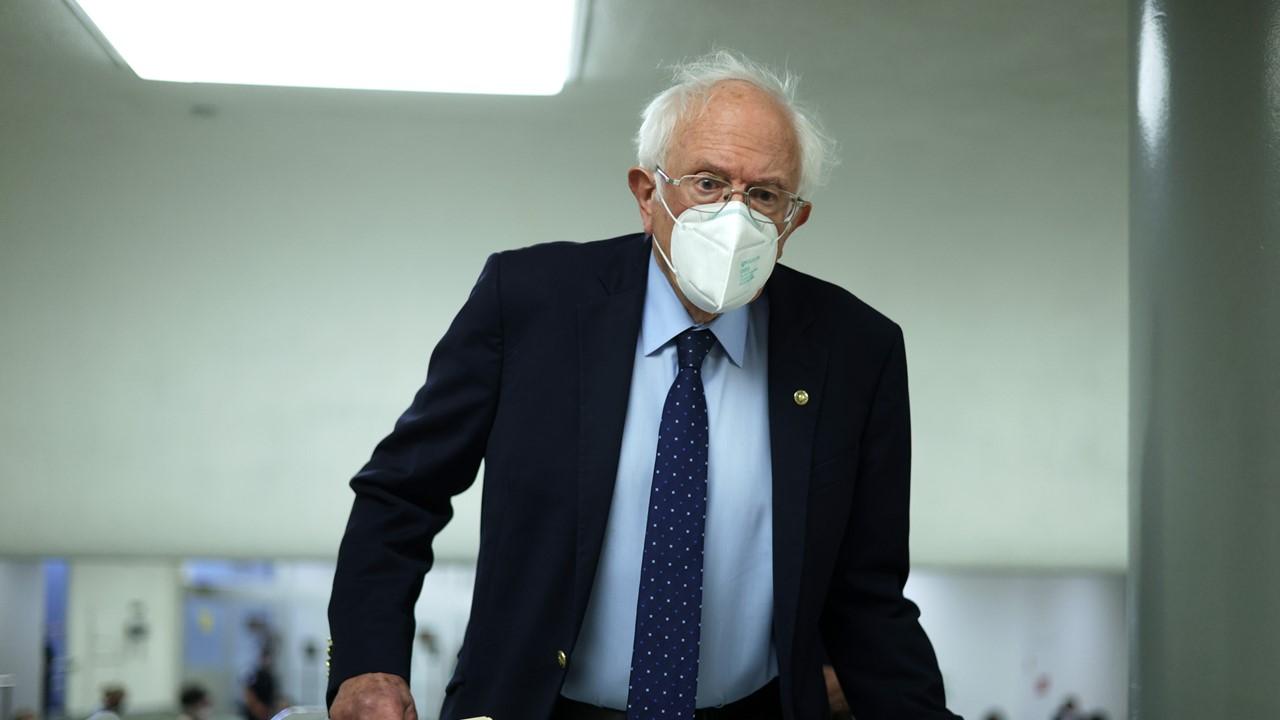

Sen. Chuck Schumer and Sen. Bernie Sanders responded with optimism regarding the temporary victory. Sanders said, “There would have been a global economic collapse if in fact the wealthiest nation on earth did not pay its debts.” He commented that the government has two months to “figure it out,” according to The New York Times.

McConnell might be motivated by a desire to not appear reckless and force the Democrats to use the complex process of reconciliation to raise the debt limit. In budget reconciliation, legislators must specify a dollar amount for the new national debt, which Republicans can then spin as irresponsible spending by the Democratic Party.