Apply for a Robinhood Account and Get Approved Quick and Easy

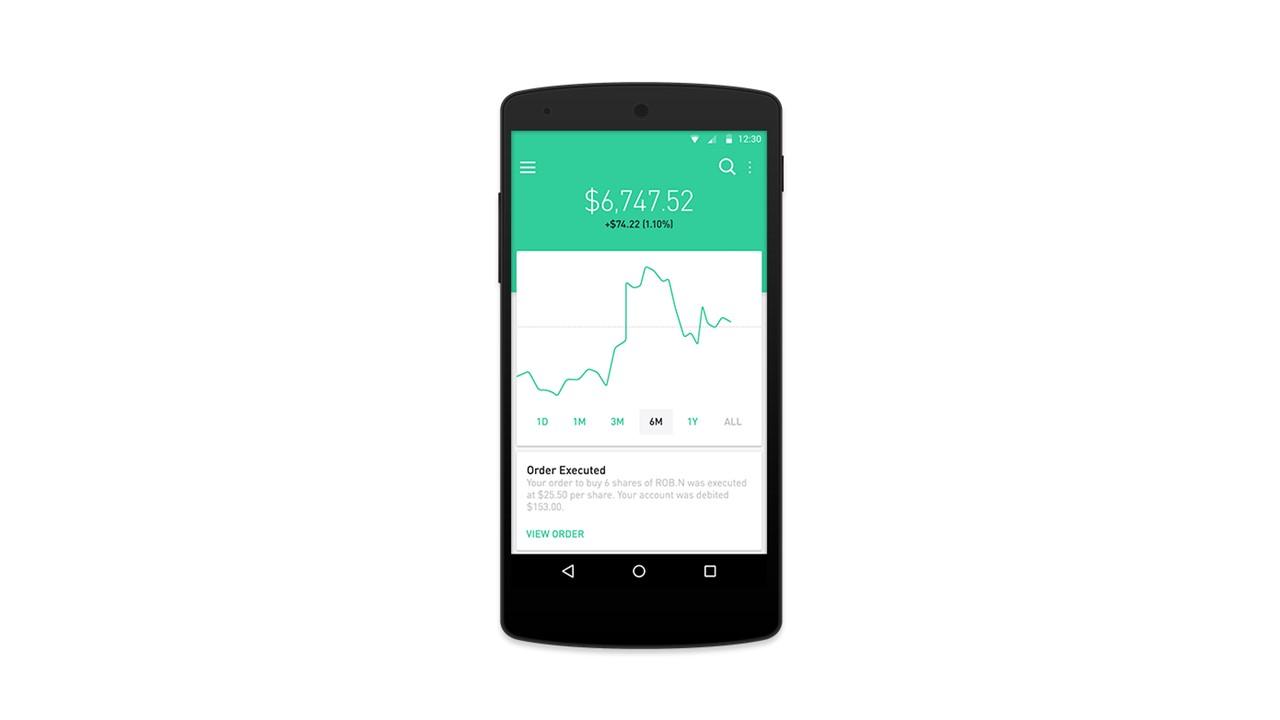

Getting an account and trading on the Robinhood investment platform can move fairly quickly. How do investors apply for a Robinhood account?

Jan. 29 2021, Updated 2:26 p.m. ET

Robinhood, the online investment platform known for zero-commission trading, came under fire the week of Jan. 25 for shutting out customers from certain stock trades. The subreddit WallStreetBets led to massively skyrocketing prices of GameStop, despite the brick-and-mortar retailer’s struggles to compete with the digital marketplace.

Many investors have a Robinhood account. If you want to open an account, it's a fairly simple process. According to Robinhood, opening a new account can take anywhere from one to seven business days from the time you submit your application.

How to open a Robinhood account

To open a new Robinhood brokerage account, customers must be 18 or older, have a valid Social Security Number, and have a legal U.S. address. You must also be a U.S. citizen, U.S. permanent resident, or hold a valid U.S. visa.

After filling out the application, Robinhood will email you within one trading day to either notify you of account approval or request more information. The company might request more identity verification documents. Once the company gets the documents, it can take five to seven days for Robinhood to review them and open your account.

Robinhood offers a variety of investments, including stocks, ETFs, options, and cryptocurrencies. Some people have criticized the platform for not providing enough information to would-be investors about potentially risky investments.

Since many other investment platforms have adopted the zero-commission model that Robinhood uses, there's less to distinguish it from competitors. TD Ameritrade, Charles Schwab, and Fidelity also offer $0 commissions on trades.

How long options trading approval takes on Robinhood

Robinhood is a broker-dealer regulated by both the SEC and FINRA (Financial Industry Regulatory Authority), which aims to protect investors and maintain fair financial markets.

Options trading, like Robinhood’s other trading types, doesn't charge commissions, monthly fees, or exercise and assignment fees. However, other fees might apply.

Investors don’t have to pay for a Robinhood Gold membership to utilize options trading. Instead, they can select options trading in a Cash account to be automatically upgraded to an Instant account.

There are multiple reasons for delays in fulfilling a stock order, including limited volume, high volatility, unstable market conditions, and limited support at execution venues.

The Robinhood Instant account provides instant trade settlements, which means that you can access stock sale proceeds immediately instead of waiting three days.

Robinhood has a blog where the company updates users on new policies and procedures. Its recent update on options trading stated that customers can “exercise options contracts directly in the app to help avoid delays and trade restrictions.” During market hours, these funds and shares are available immediately.

When an investor requests an option, Robinhood prompts them to review their investment strategy and consider the associated risks. It encourages users to think and research carefully before exercising options.

The company also says that it has a self-service option where users can buy shares even if they are in a short position because of an early assignment.

Now, Level 3 options strategies require customers to meet revised criteria, which might add to the time it takes. Robinhood requires the customer to disclose financial information like income as well as their investment experience, knowledge, and objectives.