3 High-Yielding Warren Buffett Dividend Stocks to Buy in 2022

Berkshire Hathaway earns billions from dividends every year. Here are the three high-yielding dividend stocks that Warren Buffett holds.

June 3 2022, Published 9:10 a.m. ET

Berkshire Hathaway chairman Warren Buffett hasn’t been a fan of dividends and the conglomerate hasn’t paid one since 1967. However, thanks to the company’s investments in publicly-traded companies, it earns billions of dollars in dividends every year. Here are the three high-yielding dividend stocks that Berkshire Hathaway holds.

In 2021, Berkshire earned $785 million as dividends from its top-holding Apple, despite the iPhone makers’ paltry 0.6 percent yield.

Berkshire Hathaway’s dividend income could rise in 2022.

Overall, Berkshire Hathaway's dividend income in 2022 should be much higher than in 2021. The company has increased its stake in Chevron, which has a dividend yield of 3.2 percent and is now the company’s third-largest holding. Also in 2022, Berkshire Hathaway expanded its investment portfolio by adding several new stocks. Buffett turned into a net buyer of stocks in the first quarter of 2022 after a gap of five quarters.

Should you follow Warren Buffett?

Despite the underperformance in 2019 and 2020, Buffett is among the best value investors of all time. However, it's always advisable to do research and weigh the stocks against the risk appetite.

As for dividend stocks, the “Oracle of Omaha” as Buffett is known, doesn't place much emphasis on dividends and these are mainly incidental. However, there are a few high-yielding dividend stocks in Berkshire’s portfolio that you can consider in 2022.

Three Warren Buffett dividend stocks to buy in 2022

The following Buffett stocks have a healthy dividend yield and also look like good buys after the recent correction.

- Store Capital Corp.

- Citigroup

- Kraft Heinz

Store Capital is the only REIT in Berkshire Hathaway’s portfolio.

Berkshire Hathaway invested $377 million in Store Capital (NYSE: STOR) in 2017. The company listed in 2014 and is the only REIT in the conglomerate’s portfolio. The company is a leader in STORE (Single Tenant Operational Real Estate) and has a diversified portfolio. Store Capital had investments in 2,965 property locations at the end of the first quarter of 2022.

STOR stock is down sharply from its peaks and the current dividend yield is 5.54 percent, which looks quite attractive. While the outlook for REITs looks somewhat muddied in the short term, at these prices, STOR is one high-yield dividend stock that should be on your radar.

Citigroup is the latest bank to join Berkshire Hathaway’s portfolio.

Buffett has had a flair for banking and financial stocks. Banks have always had a major share in Berkshire’s portfolio of publicly traded companies. While the conglomerate has exited names like Wells Fargo, Goldman Sachs, and JPMorgan Chase over the last two years, it still has two financials, Bank of America and American Express, among its top five holdings.

In the first quarter of 2022, Buffett added Citigroup (NYSE: C) to the portfolio and held a 2.8 percent stake at the end of the period. Buffett might add more Citigroup shares in the coming quarters, in a typical Buffett way.

Meanwhile, with a dividend yield of 3.9 percent, Citigroup is one Buffett stock that dividend investors should look at. The stock also looks quite attractive based on its valuations, which are much below other U.S. banks. While Citigroup has been underperforming peers, things could turn out well for the bank if it's successful in its turnaround strategy.

Kraft Heinz is another high yielding Buffett dividend stock.

Berkshire Hathaway is the largest stockholder in Kraft Heinz (NYSE: KHC) stock. The investment hasn’t been overly fruitful and KHC stock has lost over half of its market cap in the last five years. The stock’s outlook has also been impacted by rising inflation, which is taking a toll on the profitability of many U.S. companies.

Buffett also admitted to a mistake in Kraft Heinz and said that he overpaid for Kraft. 3G Capital, which was the other key stockholder, has sold some of the KHC shares and now holds only about an 8 percent stake.

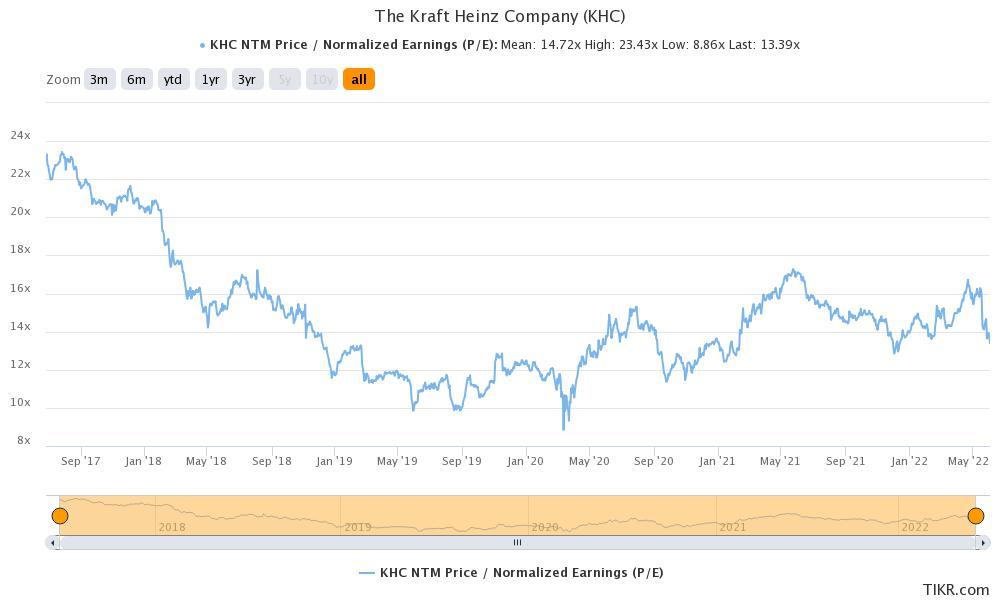

If you're looking for a high-dividend stock in Buffett’s portfolio, KHC is an attractive bet with a dividend yield of 4.4 percent. The stock’s valuations also look a lot more reasonable now with an NTM PE multiple of 13.4x.

While KHC faces multiple issues including the structural shift towards private label brands, at these valuations, KHC is one Buffett stock worth looking at, especially if you crave dividends.