Off Its Highs, GSAH Stock Is an Attractive Bet for Investors

GSAH stock has fallen by 34 percent. What’s the forecast for the GSAH SPAC before it finds a merger target? Will GSAH rise or continue to fall?

March 10 2021, Updated 9:04 a.m. ET

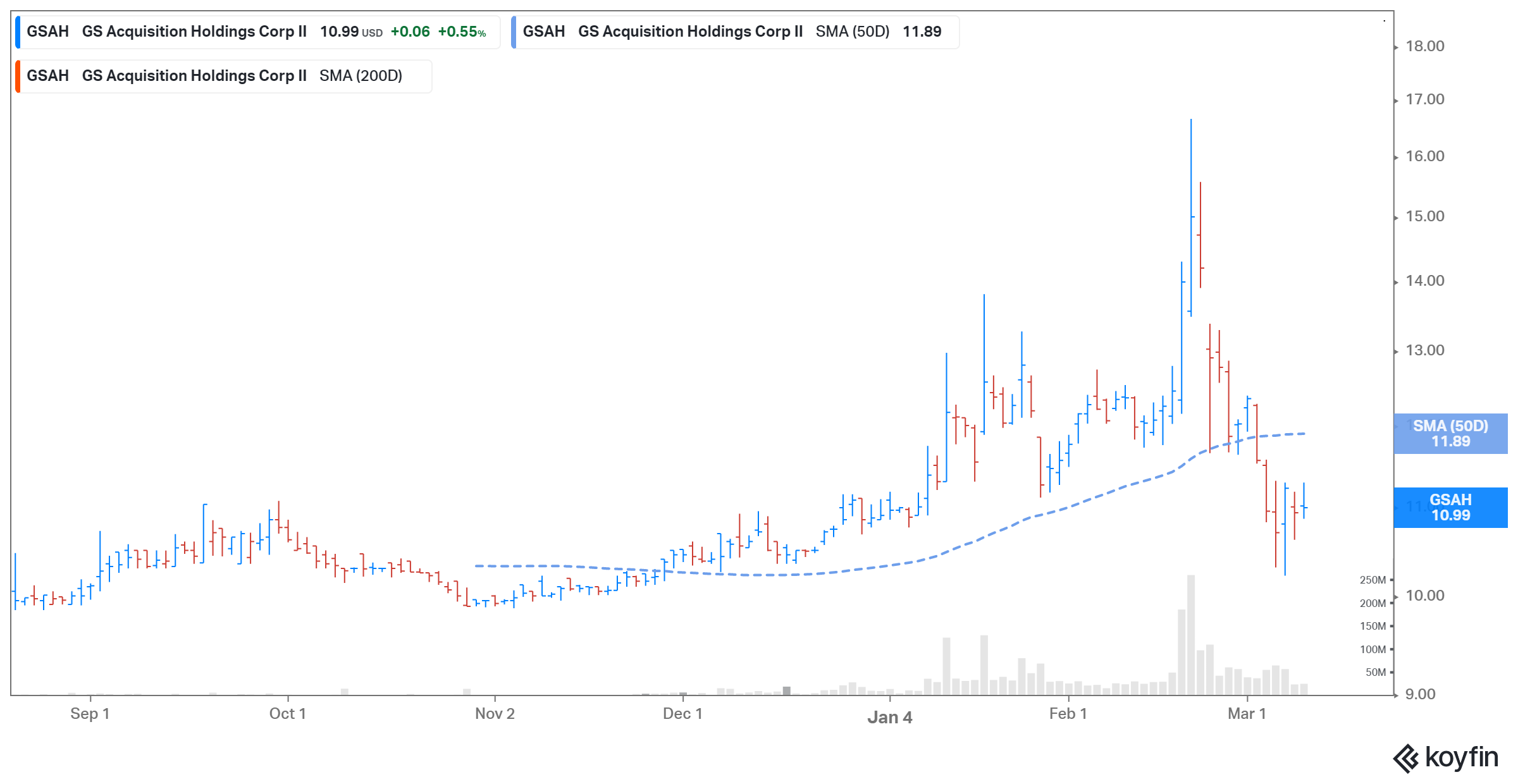

GS Acquisition Holdings Corp. II (GSAH), a SPAC (special purpose acquisition company), saw its stock rise 0.6 percent on Mar. 9. However, the stock is down 34 percent from its 52-week high. What’s the forecast for GSAH stock before the SPAC finds a merger target? Will GSAH rise or continue to fall?

GSAH, backed by renowned investment bank Goldman Sachs, is led by CEO Tom Knott and chairman Raanan Agus. The blank-check company raised about $700 million in its June 2020 IPO.

Why is GSAH SPAC stock falling?

GSAH stock has risen by 10 percent since its IPO. Currently, it's down 34 percent from its all-time high, which it hit on Feb. 19.

Amid fears of a bubble, there's been a massive sell-off in SPACs. The sell-off might have been triggered by the fall in Chamath Palihapitiya-led SPACs and Churchill Capital IV (CCIV). Palihapitiya's Social Capital Hedosophia Holdings IV (IPOD) and Social Capital Hedosophia Holdings VI (IPOF) have fallen significantly over the last month. Neither has announced an acquisition target yet.

Palihapitiya's SPACs fell after short-seller Hindenburg Research accused Clover Health of not revealing material facts to investors. Clover went public through a reverse merger with Palihapitiya’s Social Capital Hedosophia Holdings III (IPOC). The U.S. SEC launched an investigation into Clover Health after the short-seller’s allegations.

CCIV also contributed to the massive sell-off in SPACs. In the two days after CCIV announced a merger with electric vehicle maker Lucid Motors n Feb. 22, CCIV stock fell nearly 50 percent. The stock, which went for $10 at its IPO, hit a 52-week high of $64.86 on Feb. 18 on rumors of the Lucid deal.

When will GSAH merge?

GSAH, which hasn't found a merger target yet, is Goldman Sachs's second blank-check company. The investment bank’s first SPAC acquired data-center solutions provider Vertiv Holdings (VRT) in Feb. 2020. VRT has returned about 82 percent over the last year.

What companies could GSAH merge with?

The GSAH SPAC is still looking for a merger target. The blank-check company has said that it’s looking to invest in the diversified industrial, technology, media, healthcare, or alternative asset management sectors.

Investors continue to speculate about GSAH’s merger targets. Some think it could merge with fintech company eToro, while others think it could merge with sports data giant Sportradar.

GSAH's stock price

GSAH stock looks attractive

Given Goldman Sachs’s track record, the fall in GSAH stock could be a good buying opportunity. The correction has brought valuations of top SPACs more in line with their future prospects. However, the GSAH SPAC stock is a speculative play until a merger is closed.

Which are the best SPACs to buy?

The recent volatility in SPACs is offering great buying opportunities for investors. CCIV and Social Capital Hedosophia V (IPOE) look like the two best SPAC stocks to buy now after the crash. CCIV and IPOE have fallen 62 and 38 percent, respectively, from their 52-week highs of $64.86 and $28.26. CCIV has announced a deal with Lucid Motors, while IPOE is merging with fintech startup Social Finance (SoFi).