CCIV Stock Could Fall and Test $15 Before Lucid Motors Merger Date

CCIV stock has fallen to new post merger announcement lows. The stock could fall more and might test $15 before the Lucid Motors merger date.

May 7 2021, Published 10:36 a.m. ET

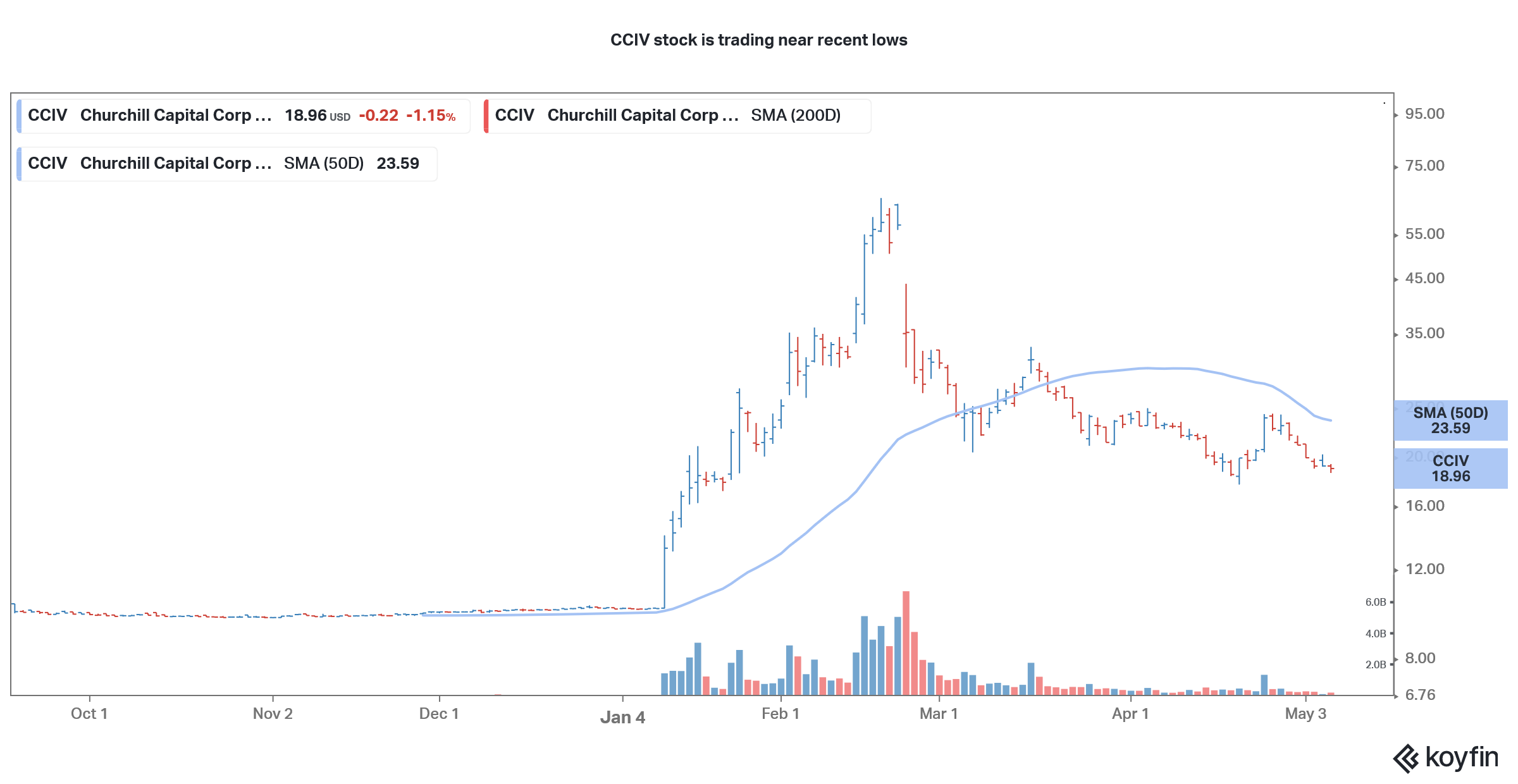

There has been a bloodbath in green energy stocks in 2021 after the massive rally in 2020. Churchill Capital (CCIV), which announced a merger with Saudi PIF (public investment fund) backed Lucid Motors, has now fallen below $19 and is at the lowest level since the merger announcement. CCIV stock could fall more and trend towards the $15 price level before the Lucid Motors merger date.

It isn't prudent to single out CCIV stock, which is now down almost 71 percent from its peaks. There have been significant drawdowns from 52-week highs in other EV (electric vehicle) stocks as well. NIO, Xpeng Motors, and Fisker are down 45 percent, 65 percent, and 65 percent, respectively.

Why CCIV stock is dropping

While all EV stocks have dropped, CCIV has dropped more than others. This is mainly due to the irrational exuberance in CCIV stock even before the merger was announced. The stock went as high as $65 before the merger and the only way it could have continued to rise after the merger announcement was the acquisition of Lucid Motors at very low valuations.

CCIV is trading near post merger announcement lows

What happened was actually the contrary and the acquisition with CCIV valued Lucid Motors at $24 billion based on the PIPE (private investment) in public equity at $15. As I noted in a previous article, CCIV stock might fall towards $15 before the merger with Lucid Motors.

Expected merger date for CCIV and Lucid Motors

Although we don’t have a definitive merger date for the CCIV and Lucid Motors merger, it's expected to be completed in the second quarter of 2021. While investors in some of the SPACs have been apprehensive of approving the mergers and SPACs like Tuscan Holdings (THCB) had to delay the merger vote, I don’t see such a possibility in CCIV because the stock price is comfortably above $10.

CCIV stock might fall more

CCIV stock is expected to drop more before the merger with Lucid Motors. Now, we might throw in a lot of factors like the sell-off in growth stocks, the increase in bond yields, or the shift towards value stocks to explain the fall in CCIV and other EV names.

However, the most important factor behind the fall in CCIV and other EV stocks is the growing recognition that legacy automakers aren't out of the race in the EV and autonomous driving market. Secondly, investors are now (rightly) questioning the exorbitant valuations that EV names trade at as legacy automakers like Ford trade at depressed valuations.

The new models from legacy automakers are garnering good response from buyers and with its ID.3 Volkswagen has beaten Tesla to become the largest electric car seller in Europe. The competition in the premium EV market, which Lucid Motors is targeting, is also heating up with the launch of Mercedes EQS.

CCIV target price

While none of the analysts have given a target price for CCIV ahead of the merger, it shouldn't trade much above $15, which would give it a pro forma market capitalization of $24 billion. Daimler, the parent company of Mercedes, has a market capitalization of $95 billion, while NIO has a market capitalization of $60 billion.

At a stock price of $20, Lucid Motors has a pro forma market capitalization of almost $30 billion, which is higher than Xpeng Motors and nearly twice that of Li Auto. Both Xpeng Motors and Li Auto are delivering cars, while Lucid Motors is still in the pre-revenue stage.

Lucid Motors will deliver its flagship Lucid Air sedan later this year. While Lucid Motors certainly has built a strong brand and hype around its cars, it might not attract the kind of premium valuations that Tesla trades at. While every EV maker strives to be the “next Tesla,” there's a lot that these companies need to do before they get classified as real Tesla killers.