Apple Stock Forecast After the iPhone 13 and iOS 15 Launch

There are four new models of the iPhone 13 that will be available starting on Sept. 24. What's the forecast for Apple stock as iPhone 13 sales begin?

Sept. 22 2021, Published 1:00 p.m. ET

Earlier in September, Apple released the iPhone 13 and iPhone mini. The iOS 15 is also available starting on Sept. 20. The iPhone launch is an annual event and new model sales help the company increase sales in its fiscal year-end. What’s the forecast for Apple stock and can the new iPhone take the stock higher?

Apple stock is only up about 12 percent YTD. Among the FAANG pack, Alphabet and Facebook are the top two performers in 2021. Apple and Netflix are jostling for the third and fourth space, while Amazon is the worst-performing FAANG stock in 2021.

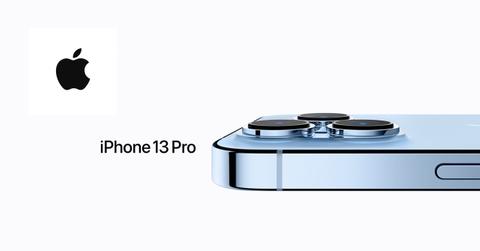

Apple iPhone 13

The Apple iPhone 13 event was held virtually in 2021 due to the ongoing COVID-19 pandemic. There are four new models of the iPhone 13 that will be available starting on Sept. 24. The new models offer incremental improvements in aspects like camera, battery life, and display. While markets were speculating that the iPhone 13 would feature satellite connectivity, that wasn’t the case.

Globalstar (GSAT), which was rumored to be Apple’s partner for satellite connectivity, tumbled after the iPhone 13 didn't feature satellite connectivity.

Will iPhone 13 help Apple boost year-end sales?

Morgan Stanley thinks that early data points reflect growth in the iPhone cycle in 2021. “iPhone 13 Pro and Pro Max lead times are the second strongest in the last 5 years as of the first pre-order date, while 2H CY21 iPhone builds point to 20% Y/Y growth,” Morgan Stanley said in its note.

Earlier this month, Morgan Stanley said that given the somber expectations, the possibility of iPhone 13 data points outperforming expectations looked high.

Barclays has a more nuanced view of the iPhone. The brokerage reiterated Apple stock as equal weight and pointed to “uncertain” iPhone 13 sales outlook in the U.S. However, the brokerage is more constructive on the sales outlook for China and thinks that the sales will be better than expected there.

Piper Sandler surveyed 1,000 Americans and revealed that only 6 percent of them plan to buy or upgrade to the iPhone 13. It added, “In our eyes, we were a bit surprised by the lack of interest in the upcoming iPhone launch.” Usually, Apple launches attract a lot of attention. The only other company that attracts similar attention is possibly Tesla.

Apple stock price forecast

Among the 24 analysts polled by TipRanks, 18 rate Apple stock as a buy, while six rate it as a hold. Apple's median target price of $168.29 is a premium of almost 16 percent over the current prices. The highest and lowest target prices are $185 and $140, respectively.

Will Apple stock go even higher?

We’ll get more details about the sales of iPhones when Apple releases its earnings towards the end of October. Apple's YTD underperformance reflects the general pessimism towards the company. Also, the issues over the company’s supply chain amid the chip shortage situation and localized COVID-19 outbreaks in parts of Asia have been weighing heavy on the stock.

Looking at the medium to long-term forecast, Apple stock looks well placed. The company is benefiting from the digital transformation and the 5G supercycle. Also, if it gets into electric vehicles, which it will likely do by the middle of this decade, it could be a key driver. Warren Buffett has kept Apple as his biggest holding for a reason. Buffett even regrets selling a small number of Apple shares over the last two years.