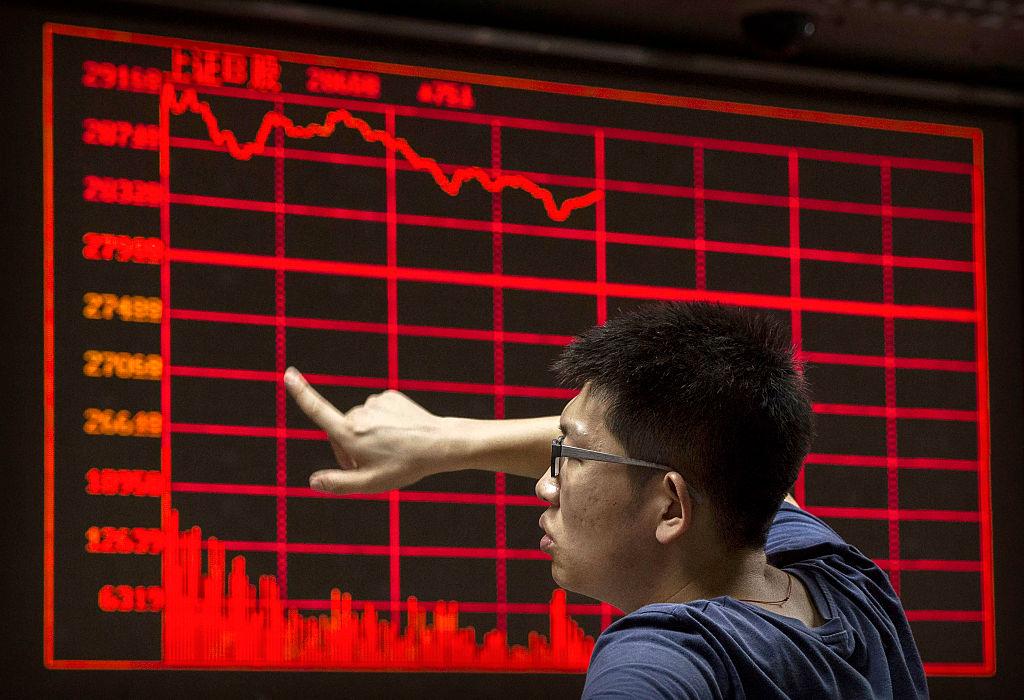

Could the Housing and Banking Crisis Be China’s Lehman Moment?

Trouble has been brewing in the Chinese housing and banking sector. Could the housing crash lead to a collapse in the Chinese economy?

Aug. 12 2022, Published 8:32 a.m. ET

Will the falling GDP in developed countries like the U.S. and now the U.K. get all the attention? Trouble has also been brewing in China, which is the world’s second-largest economy. The country’s housing bubble has burst, which is having repercussions on other sectors of the economy as well. Could the housing crash lead to a collapse in China's economy?

While China was the world’s fastest-growing major economy for years, it has slowed down structurally. To make things worse, its strict zero-COVID policy has increased the woes. The country’s GDP contracted on a quarterly basis in the second quarter of 2022 even though it managed to edge out a 0.4 percent annual growth.

China’s housing market is facing severe stress.

Construction and exports have been the two pillars that catapulted the Chinese economy to become the second-largest economy globally, just behind the U.S. Both these pillars are now facing stress. The housing bubble has burst, which is evident in the Evergrande crisis. The slowdown in the housing sector has negative repercussions on multiple sectors including banking.

While the rural bank crisis in China has mostly withered away from the headlines, there's an impending mortgage crisis. Several Chinese mortgage borrowers have stopped paying their mortgages because the properties that they took the loans for haven't been completed. The country’s banking sector risks getting saddled with billions of dollars of bad debts emanating out of the real estate sector.

China’s exports engine could also feel pressure.

Despite noises in countries like India and the U.S. against Chinese goods, Chinese exports haven't been impacted much. However, a lot of countries are now working on a long-term road map to wean away from overreliance on Chinese goods. While there isn't an overnight fix, it’s a multi-year, if not a multi-decade project.

China doesn't want to provide massive stimulus.

With a total debt-to-GDP ratio above 270 percent, China doesn't have any intention of a debt-fuelled spending boost, as it did previously to tackle the economic slowdowns. The country’s economy is the second most leveraged globally, with Japan of course taking the top slot.

China has been gradually trying to pivot from an investment-led economy to a consumption-led economy. However, the process has been halted due to the COVID-19 pandemic. The trouble in other sectors of the economy is also leading to a slowdown in consumer spending in China.

China is past its peak demographic dividend and the economy is slowly aging. While China has relaxed the one-child policy, its results haven't shown up yet. Overall, both from a short-term as well as a structural perspective, the Chinese economy is facing several challenges, but it doesn't mean that it will come crashing down.

Massive foreign exchange reserves provide China with some cushion.

China has over $3 trillion in foreign exchange reserves, which provides a lot of cushion to the country. As a centrally planned economy, China can make several decisions to support the economy, unlike developed democracies where reforms can get stuck for months and years due to a lack of consensus.

Also, unlike Russia whose economy the West has targeted for its invasion of Ukraine, the world has a stake in Chinese prosperity. China is the biggest exporter to major developed economies and a major importer as well.

While the West would be happy with the natural slowdown in the Chinese economy, not many would want to see the economy crashing given its domino effect on the global economy.