China Bank Run in 2022: Are Chinese Banks Failing?

Recently, there were reports that China sent tanks to scare bank depositors. Is there a bank run in China in 2022? Are Chinese banks failing?

July 27 2022, Published 10:53 a.m. ET

Recently, there were reports that China sent tanks to scare protestors who were demanding their money from some rural banks. While some have doubted the reports and instead called it a military exercise, videos of bank depositors being beaten up by unidentified men, even as the police looked on, have also gone viral. Is there a bank run in China in 2022 and are Chinese banks failing?

For many years, China has invariably been the world’s fastest-growing major economy. However, the growth has structurally slowed down. To make things worse, its strict COVID-19 lockdowns in 2022 are also adding to the economic woes.

What is a bank run?

In a bank run, a large number of depositors simultaneously want their money back from the bank. The way a bank’s business is structured, it borrows money from depositors and lends it to borrowers. While most depositors can immediately demand money from banks, the bank can't do so from the borrowers.

Therefore, a bank run creates a liquidity crisis for banks and they aren't able to immediately repay the depositors. In this case, either the bank has to borrow from another financial institution or the country’s banking regulator.

China’s banking crisis looks localized for now.

The banking crisis in China is currently limited to only a handful of rural banks in Henan and Anhui provinces and the total assets under consideration are only about $6 billion. To put that in perspective, the total bank assets in China at the end of 2021 were just about $51 trillion.

However, the country’s small and medium banks, which number around 4,000, have under a third of the country’s bank assets. The smaller banks, especially the rural banks, aren't as well governed and scrutinized by regulators as the larger banks. Some see the smaller banks as a pain point for the Chinese banking system.

China’s banking crisis could get worse.

There are signs that China’s banking crisis could get worse. A slowing economy is invariably bad for the banking sector and leads to higher delinquencies. Also, after the visuals of protestors being roughed up in Henan went viral, many people might become apprehensive about putting money in banks.

Another crisis is brewing in the Chinese banking system and many mortgage borrowers have stopped repaying banks. These borrowers purchased under-construction housing projects that are running behind schedule. The borrowers are annoyed about paying mortgages even though the houses haven't been built yet.

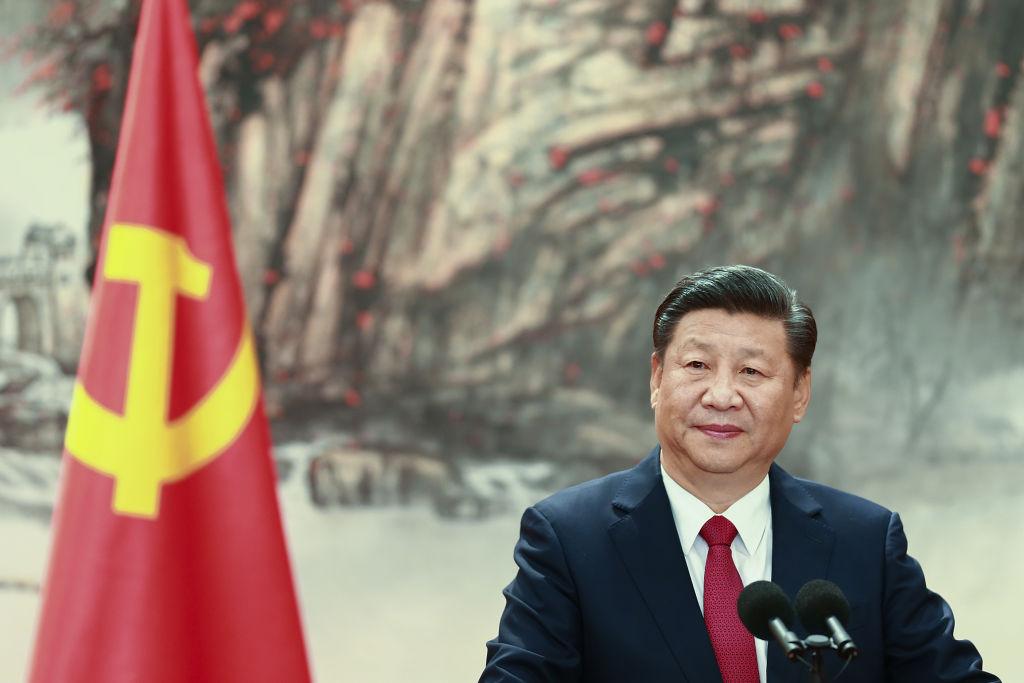

The Chinese economy is already overleveraged and the situation will start to look dire as the growth rate cools off even more. The larger Chinese banks are also exposed to the loans provided for Chinese President Xi Jinping’s ambitious BRI (Belt and Rroad Initiative) under which the country is constructing infrastructure in its neighboring countries.

Many of the countries that participated in BRI are facing a severe economic crisis and will find it tough to repay the loans. Some of the BRI projects weren't economically viable in the first place.

Chinese regulators deny that there's a major crisis in the banking sector.

China’s banking regulator has sought to downplay any systemic risk to its banking sector. Sun Tianqi, chief of PBoC’s (People’s Bank of China) financial stability bureau said, “Financial risks are largely under control, and 99 percent of our banking assets are within a safe range.”

However, what’s troubling is the ambiguity over the depositor protection scheme in China. Most countries have a depositor insurance scheme in place. For example, in U.S deposits, up to $250,000 are insured in FDIC-insured banks.

In China, deposits up to 50,000 yuan (around $7,400) are insured. However, the reserve of the insurance pool is low considering the country’s total bank assets. Also, in some cases, like in a fraud, the depositor might not even get back the insured money.

China has faced several mini-crises over the past decade. These include the construction of ghost cities and shadow banking, but it managed to get past these issues. President Jinping might want the current banking crisis to settle down before he comes up for reelection later in 2022.