Raina Brown

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Raina Brown

Key Drivers of Extra Space’s 2018 Performance

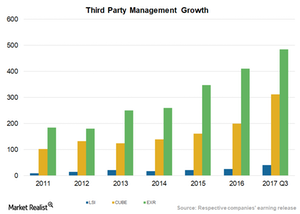

Extra Space (EXR) holds 12% of its total properties in the form of joint ventures and 32% managed for third parties—the largest in the industry.

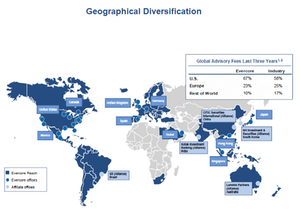

A Look at Evercore’s Business Model

Evercore generated 25% of its fees from its technology, media, and telecom sector, 20% from its energy sector, and 17% from its financials sector in 4Q17.

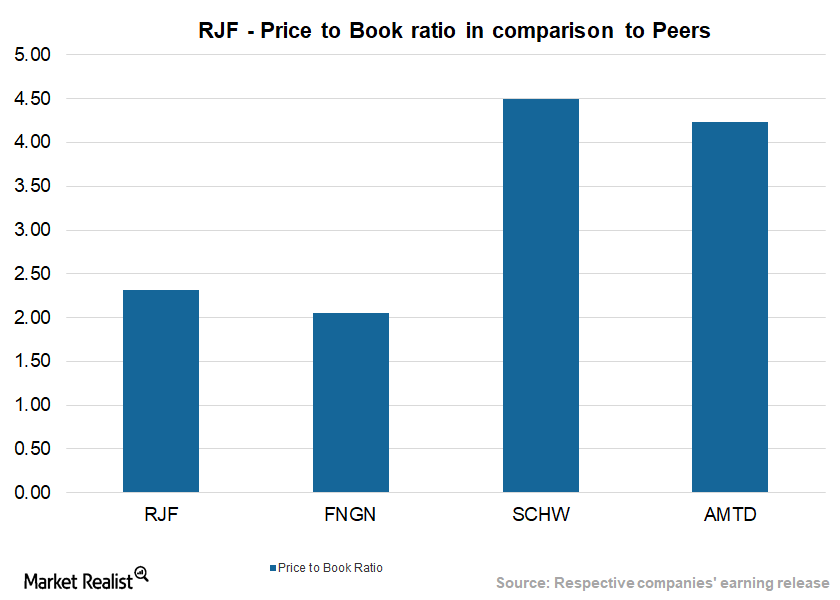

Raymond James Financial Compared to Its Peers

Raymond James Financial (RJF) generated a return of 4.8% in the last three months and 17.6% in the last year.

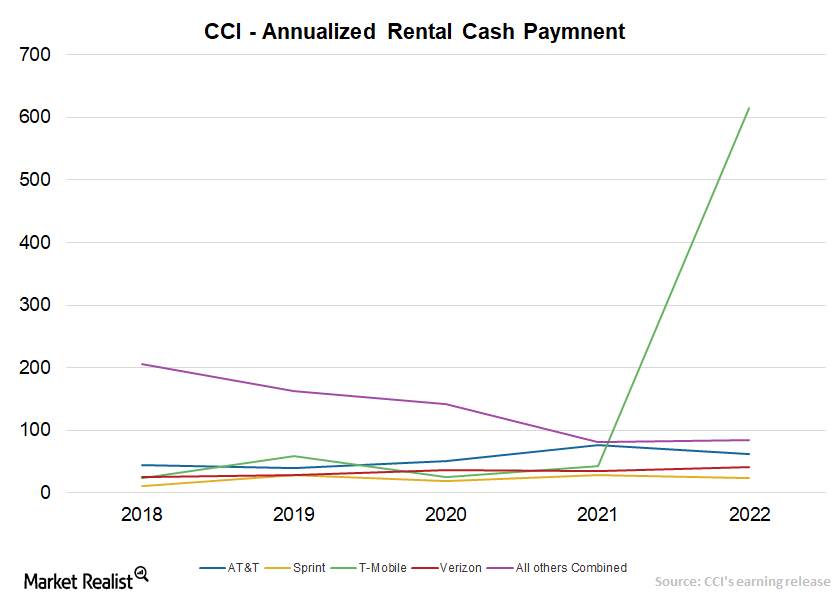

A Look into Crown Castle’s Business Model

Major customers Crown Castle’s (CCI) customer base comprises wireless carriers operating in national networks and carriers renting small cell networks, including those of healthcare, education, and government organizations. Crown Castle’s key strategy is to acquire large tower clusters and leverage its relationships with carriers in US markets. Of its fiscal 2017 revenue, it derived 22% from AT&T (T), […]

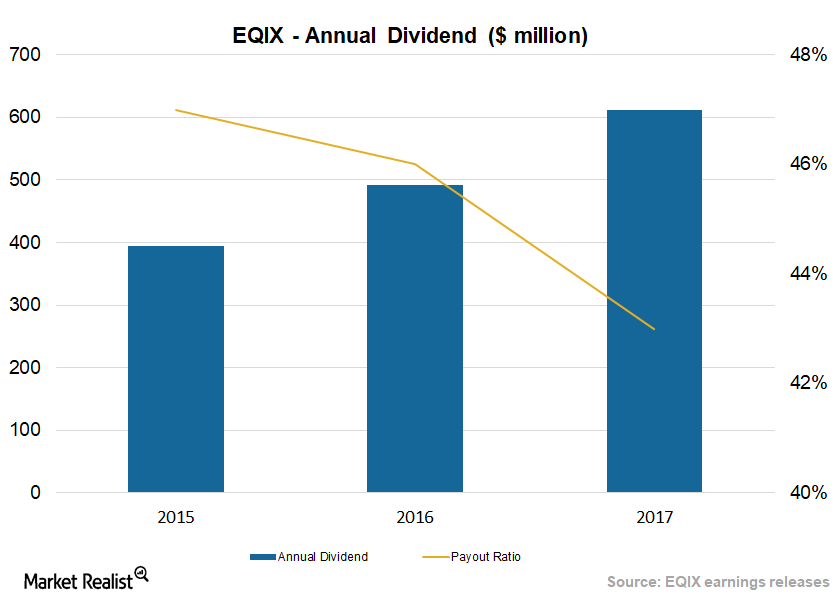

How Equinix Rewards Its Shareholders

Equinix (EQIX) announced a dividend of $2.00 per share for 3Q17, leading to a total of $8.00 for 2017 and up from $7.00 in 2016.

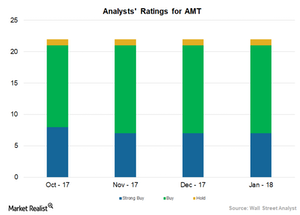

Analysts’ Views of American Tower

As of January 2018, 21 of the 22 analysts covering American Tower stock have given it a “buy” or “strong buy” rating. The remaining analyst gave it a “hold” rating.

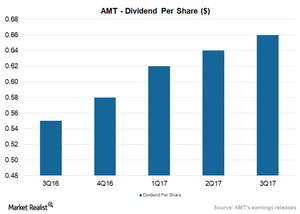

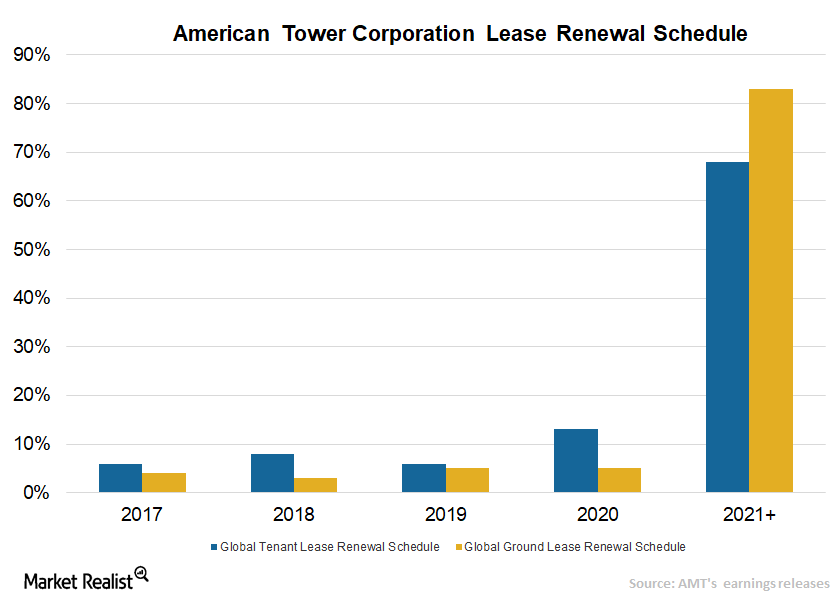

American Tower’s Disciplined Capital Allocation

American Tower (AMT) deployed $600 million of capital in 3Q17, bringing its year-to-date amount to $3.6 billion.

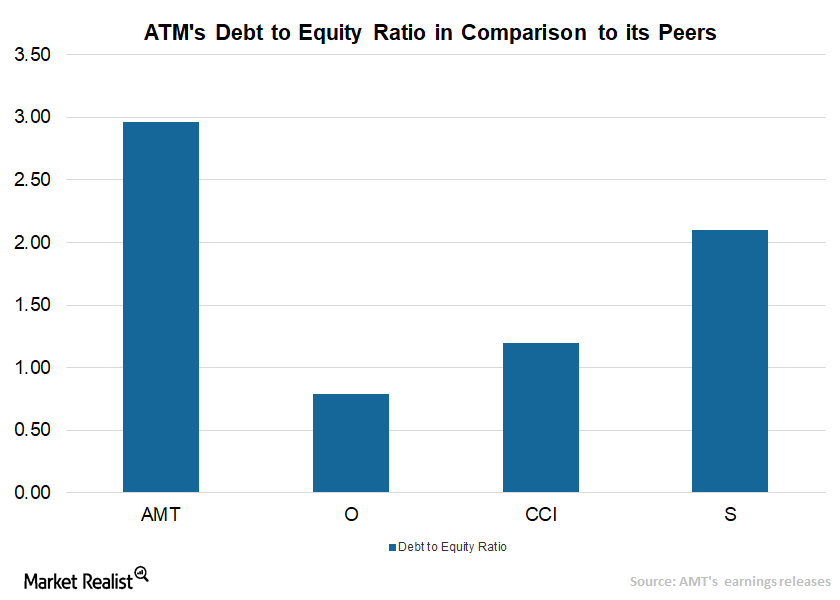

A Look at American Tower’s Well-Built Balance Sheet

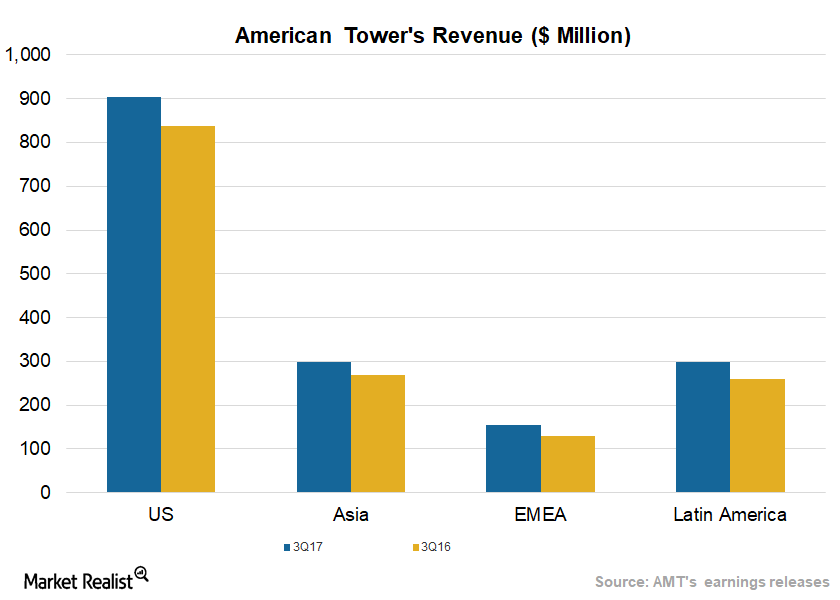

During 3Q17, American Tower (AMT) strengthened its revenues on higher organic growth in domestic and international markets such as India and Mexico.

American Tower’s Strong Hold in the International Market

Mexico is one of American Tower’s (AMT) vital international markets. AMT has entered into an agreement to acquire certain telecommunication assets in Mexico.

These Factors Are Helping American Tower’s Growth

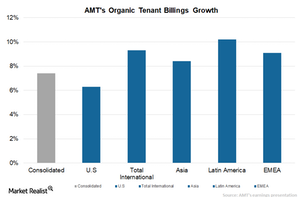

Data usage is increasing in international markets due to smartphone penetration.

American Tower Riding High with Strong Organic Growth

American Tower (AMT) has increased its 2017 revenue outlook to $6.55 billion from $6.53 billion, an addition of $15 million and a 0.2% increase.

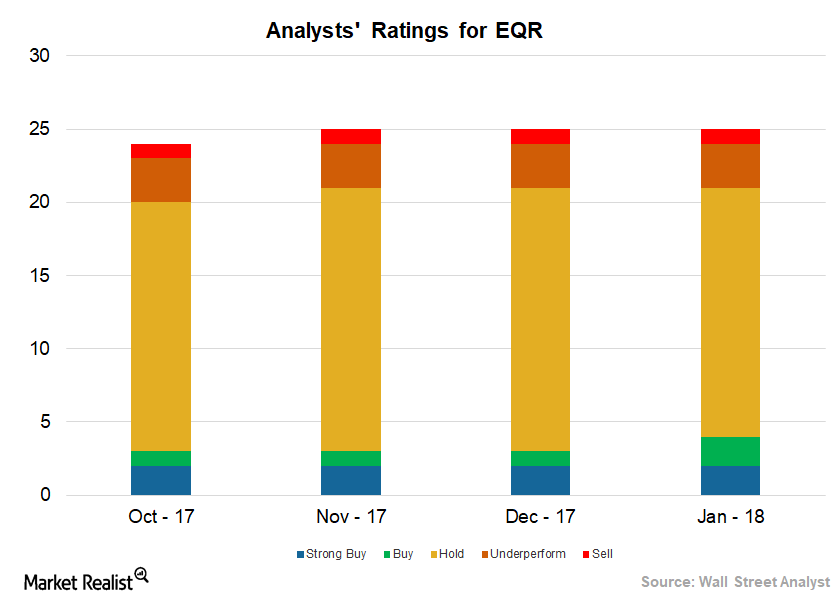

What Do Wall Street Analysts Think of Equity Residential?

Analysts gave EQR a mean price target of $69.08, implying a ~8.3% rise from its current level of $63.77.

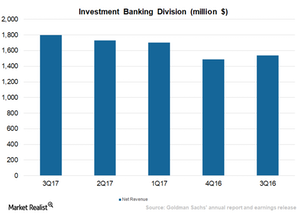

Goldman Sachs and Its Commanding Investment Banking Division

Goldman Sachs’s (GS) Investment Banking segment generated revenues of $1.8 billion in 3Q17, which was a 4% rise compared to 2Q17.