Jessica Stephans

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Jessica Stephans

General Electric’s Mission, Vision, and Strategy

General Electric’s strategy is to reshape its portfolio from a broad conglomerate to a more focused industrial leader.

How Has Roper Technologies’ Stock Fared ahead of Its 2Q16 Earnings?

Roper Technologies’ stock has declined since July 2015, after touching a high of $195.93 per share on November 30, 2015.

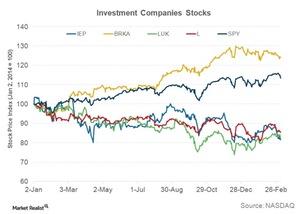

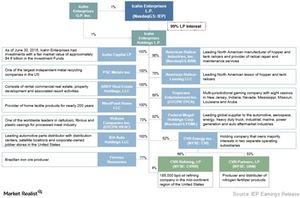

Will IEP Maintain Its Record of Delivering Superior Returns?

Icahn Enterprises’ (IEP) stock price corrected by 33% from April 20, 2015, to April 20, 2016. On April 15, 2016, the company was trading at $61.3.

Graphical Representation of General Electric’s Business Model

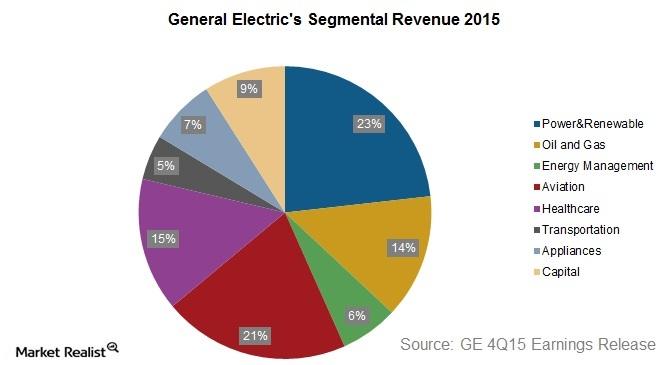

General Electric’s industrials and finance services are its two broader divisions, contributing 91% and 9%, respectively, to its consolidated 2015 earnings.

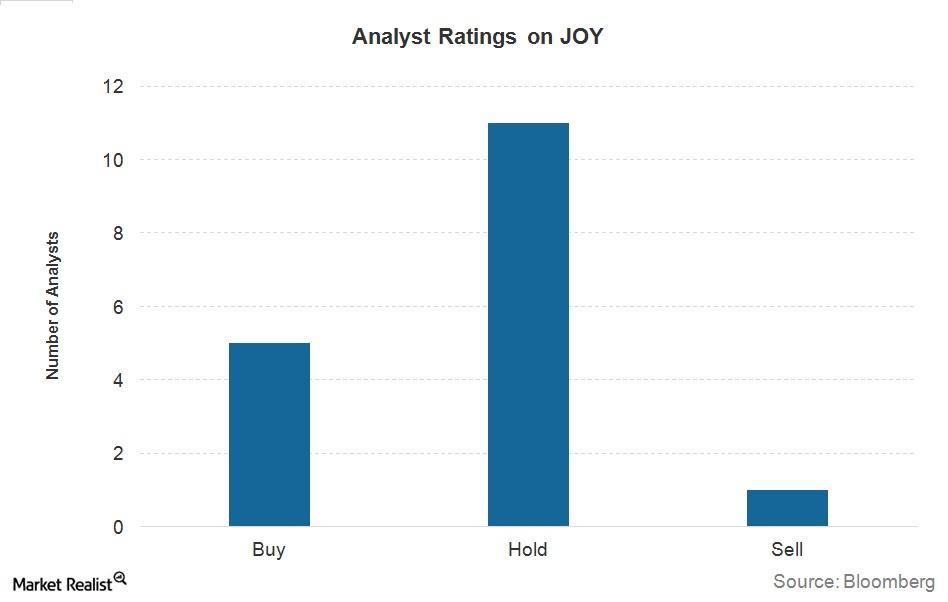

The Word on the Street: What Analysts Are Recommending for Joy Global Now

Of the 17 analysts surveyed by Bloomberg, only five issued “buy” recommendations for Joy Global, while 11 issued “holds,” and one issued a “sell.”

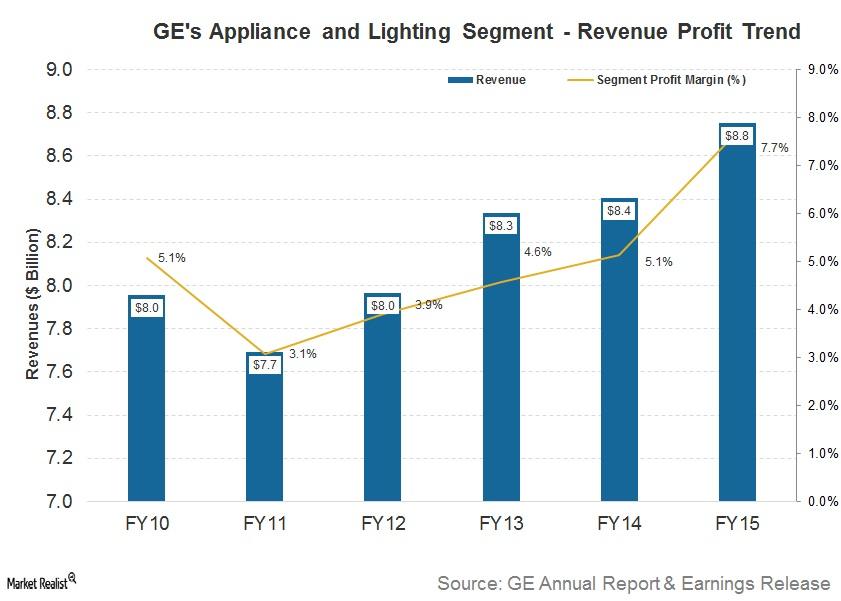

Gauging General Electric’s Appliance Segment

General Electric recently announced that its appliance and lighting division would be sold to Haier.

Why General Electric Sold Its Appliances Business to Haier

General Electric wants to shift away from the appliances business, as this segment doesn’t fit into its core business portfolio.

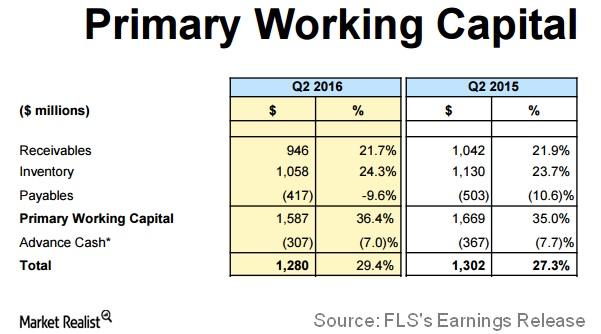

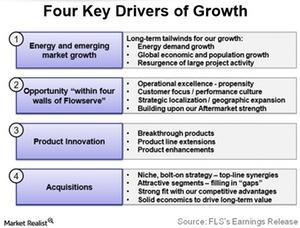

A Glance at Flowserve’s Primary Working Capital after 2Q16

In the current volatile global scenario, Flowserve’s (FLS) 2Q16 revenue and net profit have risen by 11% and 28%, respectively, year-over-year.

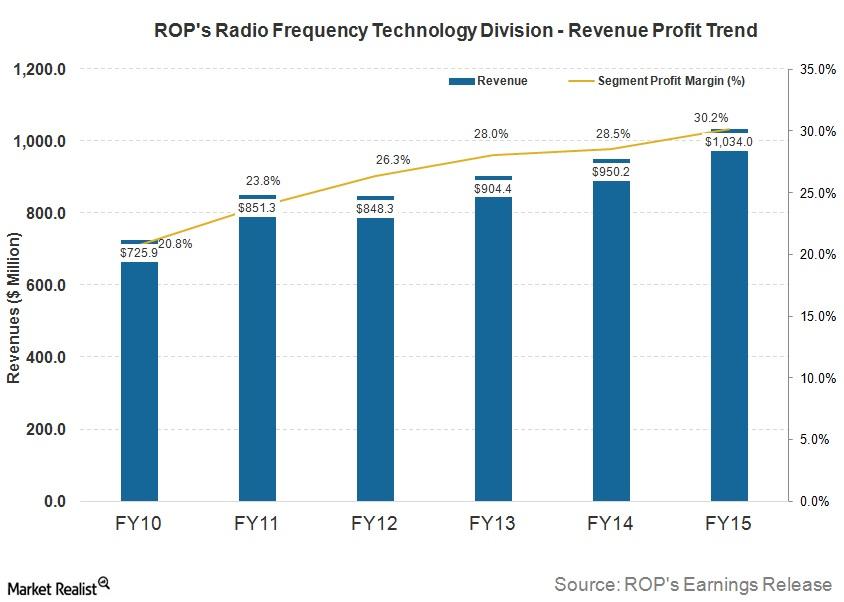

ROP’s Second-Largest Segment: Radio Frequency Technology

In 2015, ROP’s Radio Frequency Technology segment contributed ~28.9% to its total consolidated revenue and ~30.4% to its consolidated operating profit

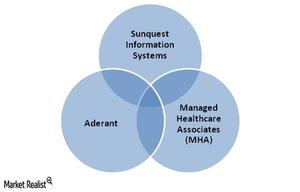

Roper Technologies: Recent Acquisitions That Count

Since its inception, Roper Technologies (ROP) has followed an acquisition-based growth strategy. The company has acquired over 50 companies since 1981.

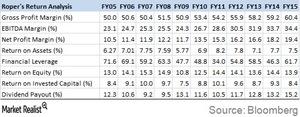

Understanding Roper Technologies’ Business Transformation

Roper Technologies’ Industrial Technology segment’s revenue stood at 21% of its sales in 2015. This segment’s revenue was 41% of its sales in 2014.

Why Do Customers Buy Flowserve’s Products?

After 4Q15, FLS reported that it controlled a market share of 4% of the $130-billion pump, valve, and seal market in 2015.

How Icahn Enterprises Turned Its Home Fashion Segment Around

Icahn Enterprises (IEP) conducts its Home Fashion business through its indirect wholly owned subsidiary, WestPoint Home.

A Look at Icahn Enterprises’ Business Model

Icahn Enterprises’ investment strategy involves identifying and purchasing undervalued businesses and assets at distressed prices.

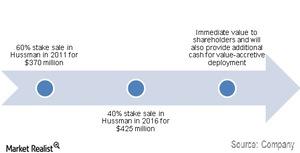

The Brass Tacks of the Ingersoll Rand-Hussmann Deal

Ingersoll Rand has agreed to sell its remaining equity interest of 40% in Hussmann to Panasonic. Panasonic will buy 100% shares according to the agreement.

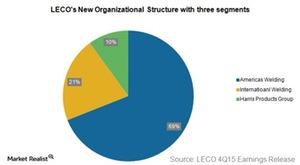

Has Lincoln Electric Outperformed Its Peers?

For fiscal 2015, Lincoln Electric (LECO) successfully gave back $486 million to its shareholders.

Lincoln’s New Organizational Structure and Operational Efficiency

To simplify organizational complexity and drive efficiencies, Lincoln Electric (LECO) is undergoing a transformation toward a new organizational structure.

What Is the Market Outlook for Underground Mining Equipment?

The global underground mining industry is expected to grow at a compound annual growth rate of approximately 7% from 2015 to 2019.

What Is Helping Lincoln Electrics Post an Impressive ROIC??

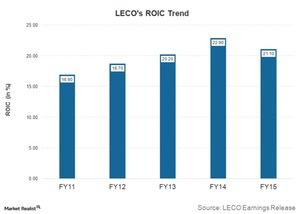

Lincoln Electric (LECO) historically has been able to generate return on invested capital (or ROIC) in the mid-teens.

A Quick Look at Joy Global’s History and Operations

Joy Global operates in two business segments, namely its Underground Mining Machinery and Surface Mining Equipment segments.

Why General Electric Is Focusing on Industrials?

Originally incorporated in 1892, General Electric is one of the largest and most diversified industrials and financial services corporations in the world.