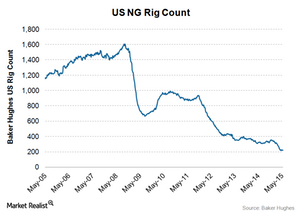

Natural Gas Rig Count Increases: Gas Prices Continue to Rise

On May 15, 2015, Baker Hughes (BHI) reported that natural gas rigs increased slightly by two to 223 for the week ending May 15.

May 18 2015, Updated 5:05 p.m. ET

US natural gas rig count increases

On May 15, 2015, Baker Hughes (BHI) reported that natural gas rigs increased slightly by two to 223 for the week ending May 15. The active natural gas rig counts were at 221 the previous week. Last year, the active rig counts were at 326—a decline of 103 rigs YoY (year-over-year).

The US benchmark natural gas prices have increased almost 6% in May 2015. The marginal increase in the rig count suggests a possible bottom for natural gas rigs. In contrast, lower gas prices and the declining rig count are negative for oilfield services companies like Baker Hughes, Schlumberger (SLB), and Halliburton (HAL).

Gas inventory

Last week, the EIA (U.S. Energy Information Administration) reported that the natural gas stockpile rose by 111 Bcf (billion cubic feet) to 1,897 Bcf—up from 1,786 Bcf in the week ending May 8. Natural gas inventories are 70% more than the inventories last year and 10% below the five-year average of 1,935 Bcf. Even though the inventories are at record levels, natural gas prices rallied on Friday, May 15, 2015.

The EIA’s monthly drilling productivity report projects that natural gas production from the major seven shale plays will decline by 112 million cubic feet per day over May—down to 46.2 Bcf per day in June 2015. The consensus of a marginal decline in production fuels the sentiments of a supply shortage in the near term due to rising demand. Currently, the natural gas markets are oversupplied.

Energy ETFs like the Energy Select Sector SPDR Fund (XLE) and the SPDR Oil & Gas Exploration & Production ETF (XOP) mirrored the natural gas price movements on Friday’s trade.

Upstream players like Newfield Exploration (NFX), Rex Energy (REXX), and WPX Energy (WPX) account for 3.91% of XOP. These companies have a gas production mix that accounts for more than 42% of their production portfolio.