Valero’s Stock Rose 4.7% Following Its Earnings Release

Valero Energy (VLO) announced its results on July 26, 2016, before the market opened.

Aug. 1 2016, Updated 9:08 a.m. ET

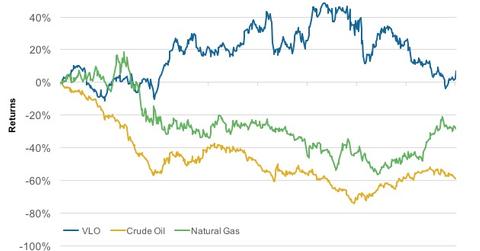

Valero’s stock performance

Valero Energy (VLO) announced its results on July 26, 2016, before the market opened. The stock had a strong opening likely because its earnings surpassed analysts’ estimates.

VLO opened at $50.6 per share, higher than its previous close of $50.3. Valero (VLO) saw highs of $52.8 and lows of $49.9 during the day. Eventually, VLO closed at $52.7, 4.7% higher than its previous day’s close.

On July 26, 2016, crude oil and natural gas fell by 0.5% and 0.9%, respectively. VLO’s peers Alon USA Energy (ALJ), CVR Refining (CVRR), and Northern Tier (NTI) rose by 5.7%, 8%, and 1.1%, respectively, on the day. The PowerShares Dynamic Large Cap Value ETF (PWV) has ~5% exposure to energy sector stocks.

VLO’s 2Q16 capex position

Valero’s capex (or capital expenditure) for the second quarter stood at $461 million. Valero expects its capex to be around $2.6 billion in 2016. Of this, $1 billion will be allocated to growth and expansion projects. The crude unit with a capacity of 90,000 barrels per day at its Houston refinery is now complete, and the unit is working.

Plus, Valero (VLO) reiterated its stand on strengthening its downstream integrated model by purchasing the remaining 50% stake in the Parkway pipeline on June 30, 2016. Valero (VLO) now holds a 100% stake in the pipeline. VLO’s management stated, “This refined petroleum products pipeline connects Valero’s St. Charles refinery to the Plantation pipeline system, with a planned connection to the Colonial pipeline system. This acquisition is consistent with Valero’s strategy of optimizing its refining system through investments in logistics assets.”