Comparing HollyFrontier’s Valuation with Peers’

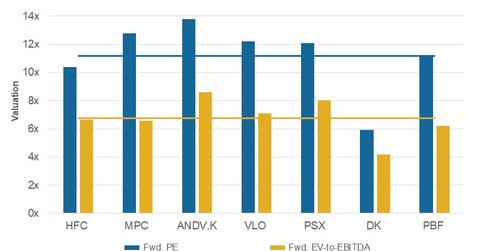

HollyFrontier’s (HFC) forward PE ratio is 10.4x, below peers’ average of 11.2x. Marathon Petroleum’s (MPC), Andeavor’s (ANDV), and Phillips 66’s (PSX) forward PE ratios are higher than the average, at 12.8x, 13.8x, and 12.1x, respectively.

Sept. 28 2018, Updated 7:30 a.m. ET

HollyFrontier’s valuation

HollyFrontier’s (HFC) forward PE ratio is 10.4x, below peers’ average of 11.2x. Marathon Petroleum’s (MPC), Andeavor’s (ANDV), and Phillips 66’s (PSX) forward PE ratios are higher than the average, at 12.8x, 13.8x, and 12.1x, respectively. HFC’s forward EV[1.enterprise value]-to-EBITDA ratio of 6.6x is also below the peer average, which is 6.8x. While Valero Energy’s (VLO) EV-to-EBITDA ratio is higher than the average, at 7.1x, Delek US Holdings’ (DK) and PBF Energy’s (PBF) are lower, at 4.2x and 6.2x, respectively.

Why HFC’s valuation is lower

Whereas HollyFrontier’s valuation is lower than peers’ average, its stock was trading at a premium in the second quarter. Its below-average valuation may be due to its lower-than-expected second-quarter earnings. HFC’s Q2 2018 adjusted EPS of $1.50 missed Wall Street’s estimate by almost 10%. The decline in HFC’s refining index values this quarter have also impacted its valuation.

Based on its average July and August metrics, its Midcontinent and Southwest refining values have fallen by $2.10 YoY (year-over-year) and $1.70 YoY, respectively, to $18 and $21.40 per barrel in Q3 2018. However, its Rockies value has risen by $3.90 YoY to $30.10 per barrel. As the Midcontinent and Southwest regions together accounted for 86% of HFC’s total throughput in Q2 2018, those regions’ declining refining index values suggest a likely contraction in HFC’s refining margin in Q3 2018.