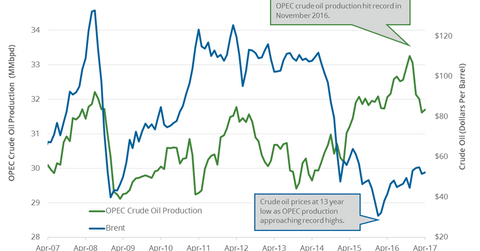

OPEC’s Crude Oil Production: Key for Crude Oil Traders?

A Bloomberg survey estimates that OPEC’s crude oil production rose by 315,000 bpd to 32.21 MMbpd in May 2017—compared to the previous month.

Nov. 20 2020, Updated 4:37 p.m. ET

OPEC crude oil production

A Bloomberg survey estimates that OPEC’s crude oil production rose by 315,000 bpd (barrels per day) to 32.21 MMbpd (million barrels per day) in May 2017—compared to the previous month. Production rose due to higher production from Libya and Nigeria. Nigeria’s crude oil production rose by 100,000 bpd to 1.7 MMbpd in May 2017—compared to the previous month. Libya’s crude oil production rose by 210,000 bpd to 0.76 MMbpd during the same period, according to Bloomberg. Read Why Did OPEC’s Crude Oil Production Rise in May? to learn more.

The rise in production from OPEC is bearish of crude oil (USO) (UCO) (PXI) prices. Lower crude oil prices have a negative impact on oil and gas producers’ earnings like Hess (HES), Carrizo Oil & Gas (CRZO), and PDC Energy (PDCE).

OPEC members’ production

According to a Reuters survey, OPEC members’ crude oil production figures for May 2017 are as follows:

- Algeria – flat at 1.1 MMbpd

- Angola – fell by 50,000 bpd to 1.6 MMbpd

- Iran – fell by 10,000 bpd to 3.7 MMbpd

- Iraq – fell by 30,000 bpd to at 4.4 MMbpd

- Kuwait – flat at 2.7 MMbpd

- Saudi Arabia – rose by 30,000 bpd to 10 MMbpd

- United Arab Emirates – rose by 10,000 bpd to 3 MMbpd

- Venezuela – fell by 10,000 bpd to 2 MMbpd

OPEC meeting and plans ahead

OPEC and Russia extended the production cut deal on May 25, 2017, at OPEC’s meeting. The expectation of a fall in OPEC’s production in 2017 could support oil prices. However, production will rise in 2018 after the production cut deal expires. Read OPEC’s Exit Strategy: Will It Drive Crude Oil Prices? to learn more.

In the next part, we’ll analyze how long Russia might support the production cut deal.