A Look at Pfizer’s Market Cap and Shareholding Pattern

The total number of Pfizer’s outstanding shares is ~5.862 billion. Of these, its free-floating shares total ~5.859 billion.

Sept. 27 2018, Updated 9:01 a.m. ET

Pfizer

Pfizer’s (PFE) product portfolio is divided into two segments: Innovative Health and Essential Health. In this article, we’ll take a look at Pfizer’s market cap and shareholding pattern.

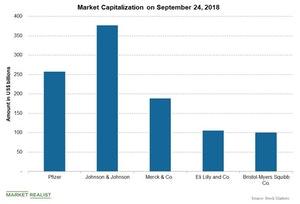

The above chart compares the market caps of Pfizer and its peers.

Market cap

Pfizer’s market cap is ~$257.2 billion as of September 25. Competitors Johnson & Johnson (JNJ), Merck & Co. (MRK), Eli Lilly and Company (LLY), and Bristol-Myers Squibb (BMY) have market caps of ~$376.8 billion, ~$188.2 billion, ~$105.3 billion, and ~$100.5 billion, respectively, as of the same day.

Shareholding pattern

The total number of Pfizer’s outstanding shares is ~5.862 billion. Of these, its free-floating shares total ~5.859 billion, nearly 99.94% of its total outstanding shares. Institutions hold ~72.70% of Pfizer’s total shares, while strategic entities own ~0.06% of its total shares.

As per the latest filings, the Vanguard Group is Pfizer’s largest shareholder. The Vanguard Group holds ~435.17 million shares, nearly 7.42% of Pfizer’s total shares, as of June 30. The total number of shares held by the Vanguard Group fell by ~4.17 million in the last quarter.

State Street Global Advisors is Pfizer’s second-largest shareholder, holding ~287.90 million shares, nearly 4.91% of its total shares, as of June 30. The total number of shares held by State Street Global Advisors decreased by ~5.73 million in the last quarter.

BlackRock Institutional Trust Company holds ~266.66 million Pfizer shares, nearly 4.55% of its total shares, as of June 30. The total number of shares held by BlackRock Institutional Trust Company fell by ~18.66 million in the last quarter.

Pfizer’s top ten shareholders are holding nearly 25.13% of its total outstanding shares.

The iShares Core High Dividend ETF (HDV) holds 5.9% in Pfizer, 3.7% in Merck & Co. (MRK), 1.9% in Bristol-Myers Squibb (BMY), and 1.7% in Eli Lilly and Company (LLY).