A Look at BHP Billiton’s Capital Allocation Priorities

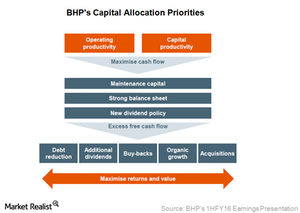

BHP Billiton (BHP) (BBL) has reframed its capital allocation priorities, including sustaining capex, maintaining balance sheet strength, and cutting dividends.

Feb. 25 2016, Published 12:27 p.m. ET

Capital allocation priorities

BHP Billiton (BHP) (BBL) has reframed its capital allocation priorities as follows:

- sustaining capex (capital expenditures) – BHP has lowered its capital expenditure guidance by a combined $3.5 billion, $7 billion in fiscal 2016 and $5 billion in fiscal 2017. This capex includes $2 billion in sustaining capex for each year. The rest is growth capex. Management stated during the call that all the projects deserving funding are included in the new capex plan. With the exception of reduced spend on shale and some improvement projects, the decline reflects increased capital productivity.

- maintaining balance sheet strength – BHP remains committed to maintaining the strength of its balance sheet to weather the current downturn. This the major reason for the company’s decision to cut capex and dividends.

- dividends – Dividends (DVY) will be based on a minimum of 50% payout of earnings. It’ the board’s discretion to announce additional dividends when it seems fit, based on the free cash flow generation. The new dividend policy gives the company flexibility to suit itself more to the period of prolonged low prices. BHP’s mining peers, including Freeport-McMoRan (FCX), Glencore (GLNCY), and Anglo American (AAUKY), suspended their dividends to survive the downturn.

- additional investment or shareholders returns – After meeting the above three commitments, the excess free cash flow will be used for additional returns to shareholders, buybacks of dividends, and organic and inorganic value creation projects.

Rio Tinto’s (RIO) capital priorities are sustaining capex, dividends, and growth projects, and paying off debt, in that order.

Next, let’s see why analysts are changing their recommendations for BHP Billiton.