BTC iShares Select Dividend ETF

Latest BTC iShares Select Dividend ETF News and Updates

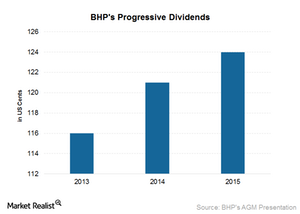

Can BHP Maintain Its Dividends in 2016?

BHP Billiton is facing pressure in all the commodity businesses it’s involved in. At spot prices, free cash flow doesn’t cover the company’s dividends.

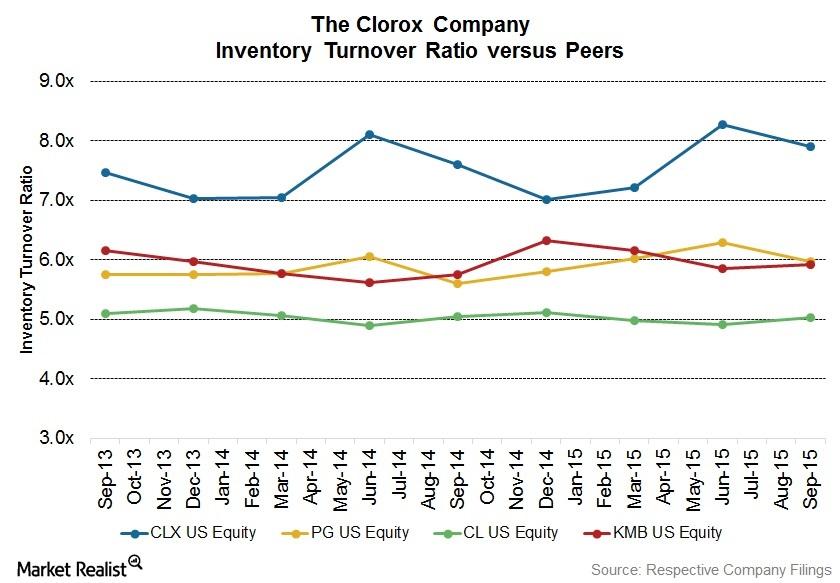

How Is Clorox Improving Product Distribution?

For distribution in the United States, Clorox (CLX) sells or markets its products primarily through mass retail outlets, e-commerce channels, wholesale distributors, and medical supply distributors.

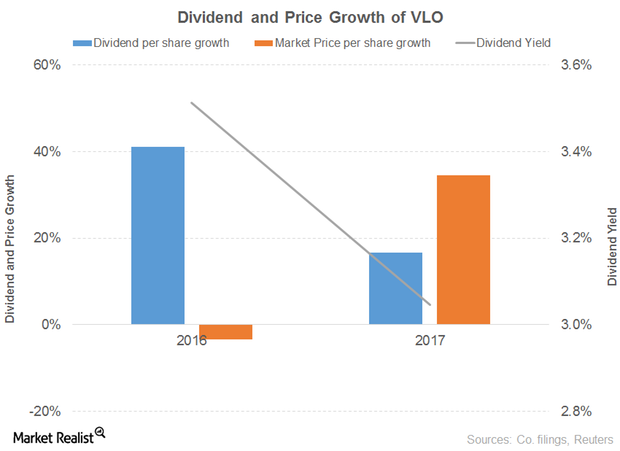

What Has Influenced the Outlook for Valero Energy?

Valero Energy’s operating revenue fell 14% in 2016 before rising 23% in 9M17. Refining revenues drove the decline in 2016, offset by ethanol revenues.

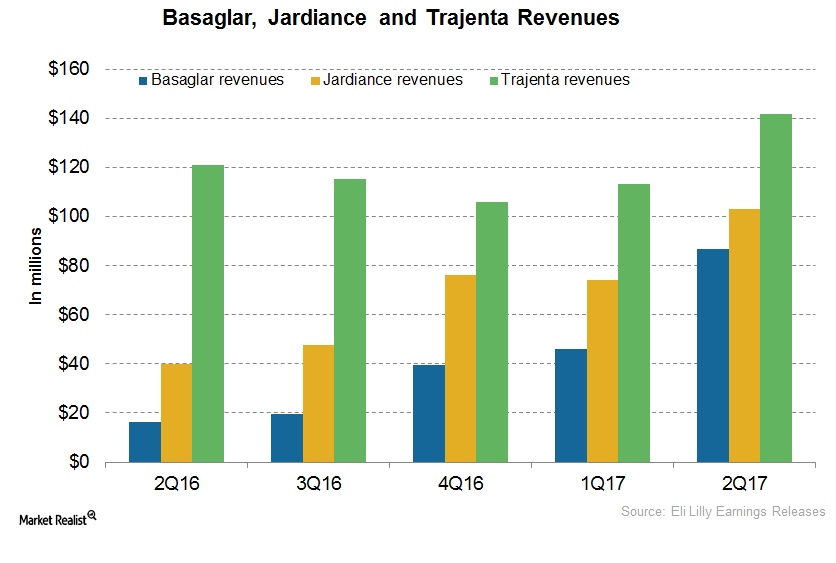

Why Eli Lilly’s Basaglar, Jardiance, and Trajenta Could Witness Steady Growth in 2018

In 1H17, Eli Lilly’s (LLY) Basaglar generated revenues of around $132.6 million, compared with $27.2 million in 1H16.

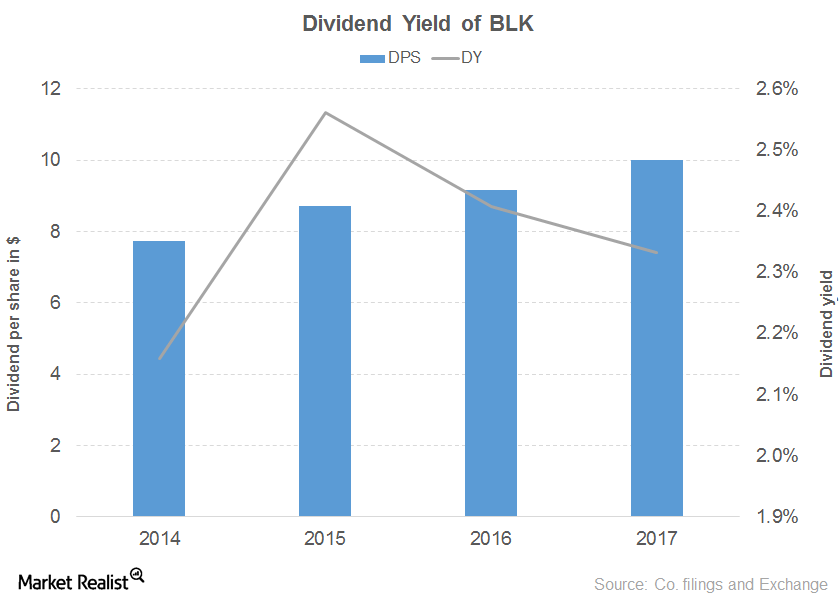

What Led to BlackRock’s Downward Sloping Dividend Yield Curve?

BlackRock posted a 7.0% revenue growth in the first half of 2017, driven by every segment except multi-asset and alternatives, which reported flat growth.

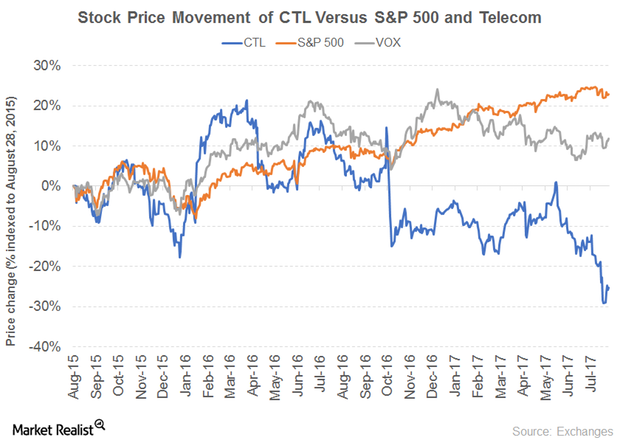

How CenturyLink is Maintaining Its Dividend Yield

The story behind CenturyLink’s 8% yield Another acquisition-driven telecom company is CenturyLink (CTL). The cohesive communications company provides a wide range of services to its residential and business customers. Like Frontier, it has been impacted by the slowing traditional phone business. The company’s operating metrics, excluding those of Prism TV, are trending downwards. This trend has […]

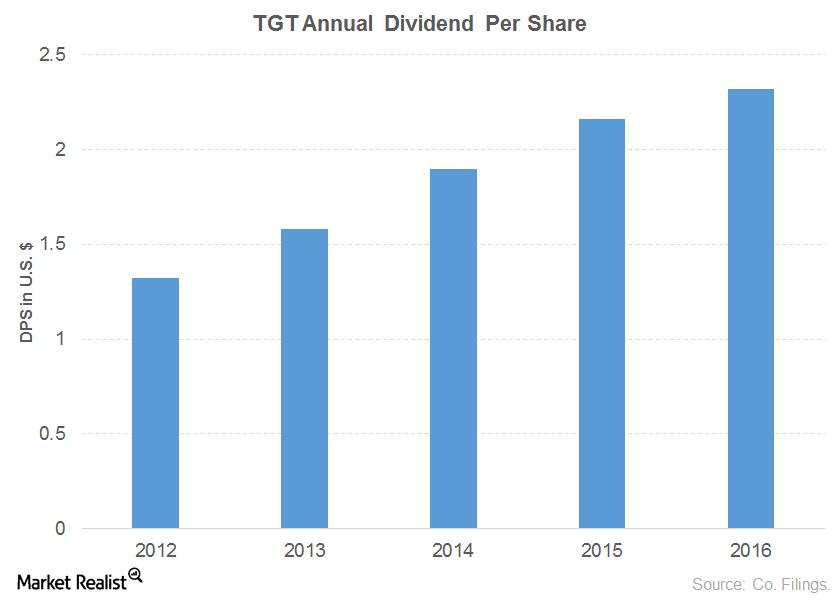

Consumer Discretionary: Which Are the Top Dividend Growers?

Consumer Discretionary Select Index sales, earnings, and dividends have grown at a CAGR (compound annual growth rate) of 6%, 7.2%, and 10.7%, respectively between 2012 and 2017.

Demographics Driving Conservative Investment? Bernstein Says No

After stating that the market isn’t in a low return environment, Richard Bernstein moved on to discuss the reasons cited by many for conservative asset allocation.

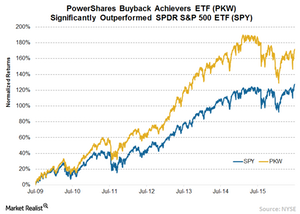

Buyback Achievers Strategy Significantly Outperforms Benchmark

Historically, we have seen Buyback does perform very well across all interest rate environments. Looking at the data back to the mid-80s, it does well.

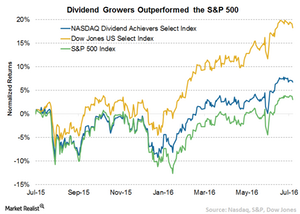

Do Dividend Growers Look Appealing?

Historically, dividend growers have often performed better than the S&P 500 (IVV) and provided higher income during Market volatility.

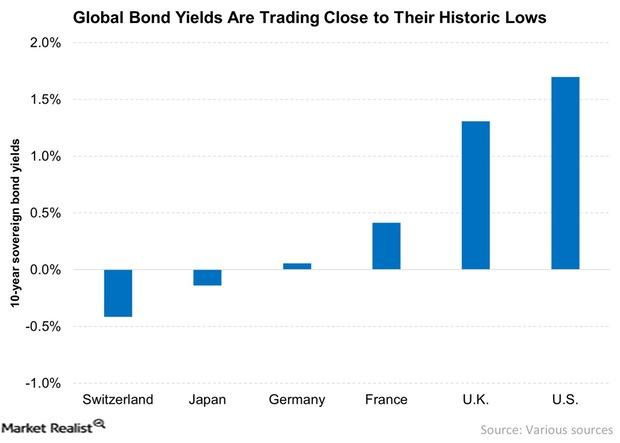

Yield-O-Philes Face a Difficult Challenge

Yields remain at unattractive levels. This has caused yield-thirsty investors to flock to high-dividend-yielding stocks, driving their valuations higher.

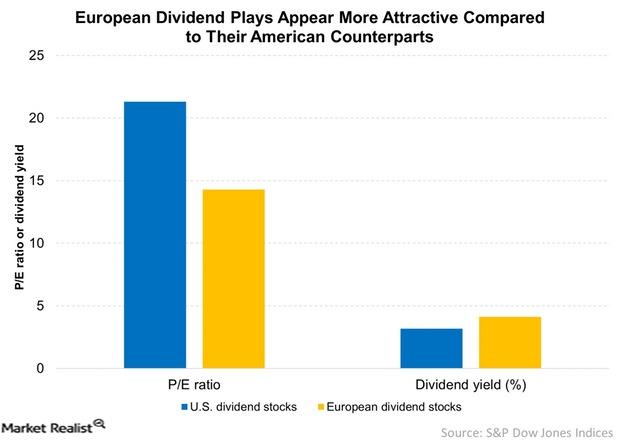

Yield for Yields! Where Can You Find Yields Today?

Not only are European stocks cheaper than American ones, they also offer more attractive dividend yields.

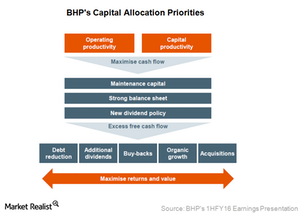

A Look at BHP Billiton’s Capital Allocation Priorities

BHP Billiton (BHP) (BBL) has reframed its capital allocation priorities, including sustaining capex, maintaining balance sheet strength, and cutting dividends.

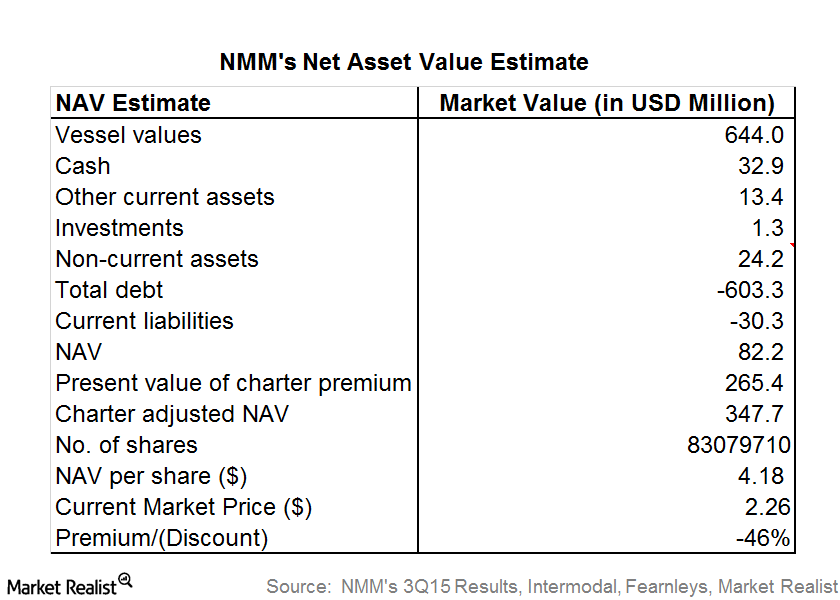

How Does NMM’s Stock Compare with Its Adjusted Net Asset Value?

Navios Maritime Partners’ adjusted NAV (net asset value) shows that it is currently trading at a 46% discount to its NAV.

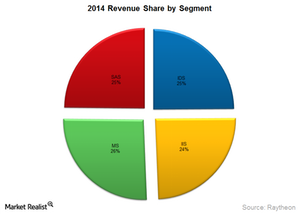

What Should Investors Know About Raytheon?

Raytheon is a leading technology company. It provides products and services in the defense, civil, and security markets globally.Earnings Report Analyzing General Dynamics’ business segments

General Dynamics has four major business segments. In this article, we’ll analyze General Dynamics’ business segments.Healthcare Must-know: 3 key risks in stock market investing

Know the market and know your own appetite for risk before investing. You can’t eliminate market risk, also called systematic risk, through diversification. You can, however, hedge against market risk.