Anglo American

Latest Anglo American News and Updates

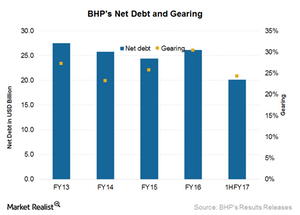

BHP’s Balance Sheet: The 2017 Outlook

BHP’s net debt was $20.1 billion at the end of December 2016, as compared to $26.1 billion on June 30, 2016.

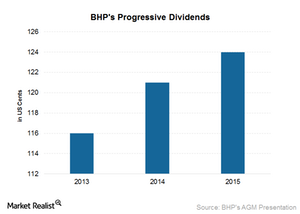

Can BHP Maintain Its Dividends in 2016?

BHP Billiton is facing pressure in all the commodity businesses it’s involved in. At spot prices, free cash flow doesn’t cover the company’s dividends.

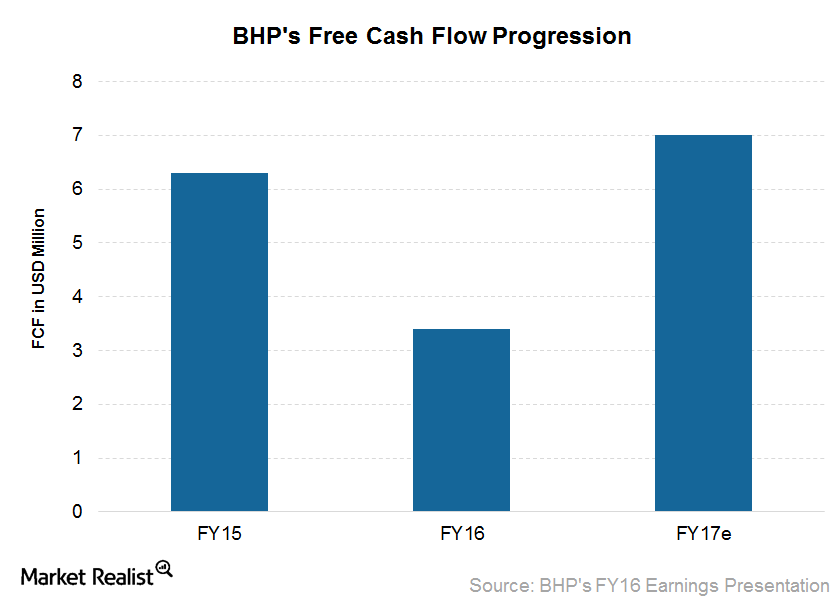

What Could Drive BHP Billiton’s Free Cash Flows for Fiscal 2017?

BHP Billiton’s (BHP) (BBL) unit costs declined by 16% in fiscal 2016, supported by increased capital efficiency. This helped BHP generate strong free cash flow.

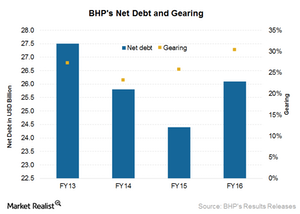

A Look at BHP Billiton’s Balance Sheet after Fiscal 2016

BHP has a strong balance sheet in this depressed commodity environment. Standard & Poor’s cut its rating by one notch from A+ to A in February 2016.

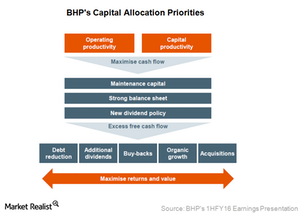

A Look at BHP Billiton’s Capital Allocation Priorities

BHP Billiton (BHP) (BBL) has reframed its capital allocation priorities, including sustaining capex, maintaining balance sheet strength, and cutting dividends.

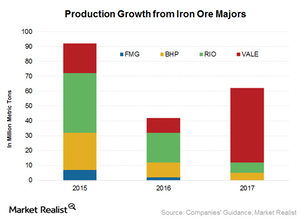

Are Curtailments Enough to Offset New Capacity in Iron Ore?

The Nullagine joint venture, where BC Iron owns 75% and Fortescue Metals (FSUGY) owns 25%, will cease production in 2016 due to weak iron ore prices.

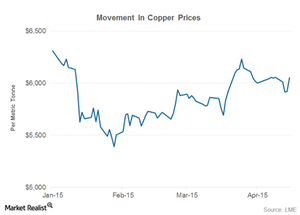

Supply Disruptions in 2015 Support Copper Prices

Copper prices have traded largely sideways in April. Copper prices fell sharply in January but have recovered smartly since then. Year-to-date, copper prices are down ~4%.