Could Royalty and Streaming Companies Stay Strong in 2018?

Royalty and streaming companies Royalty and streaming companies’ business model differs greatly from that of other precious metal miners (RING), mainly because royalty and streaming companies do not own mines. These companies make upfront payments to gain a right to a fixed percentage of future silver or gold mine production. Additional payments are then made […]

Dec. 4 2020, Updated 10:53 a.m. ET

Royalty and streaming companies

Royalty and streaming companies’ business model differs greatly from that of other precious metal miners (RING), mainly because royalty and streaming companies do not own mines. These companies make upfront payments to gain a right to a fixed percentage of future silver or gold mine production. Additional payments are then made to mine owners as they deliver precious metals.

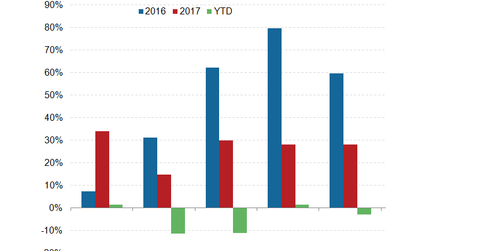

Stock performance and gold prices

After significantly outperforming gold and the VanEck Vectors Gold Miners ETF (GDX) in 2017, royalty and streaming companies have fallen this year. As of February 12, 2018, they had fallen 6.1%, whereas GDX had fallen 5.5%.

Royalty companies’ prospects

Among the four major streaming companies, stock-wise, Royal Gold (RGLD) has been the outperformer this year, rising 1.4%. The rest of the stocks have fallen. Franco-Nevada (FNV), Wheaton Precious Metals (SLW), and Sandstorm (SAND) have fallen 11.5%, 11.2%, and 3.0%, respectively.

Royal Gold released its 4Q17 results on February 7, 2018, and they were in line with consensus expectations. After its results announcement, Canaccord Genuity upgraded the stock from “hold” to “buy” due to tax reform being approved and upwardly revised assumptions for Mount Milligan.

The rest of the stocks fell following the broad equity sell-off that started February 2, 2018. The Direxion Daily Junior Gold Miners Index Bull 3x Shares ETF (JNUG) is an alternative way for investors to gain exposure to increasing gold prices. Since JNUG is a leveraged ETF, it comes with significant risks, so investors should invest according to their risk appetites. In the next part, we’ll look at silver equities’ performance.