Sandstorm Gold Ltd

Latest Sandstorm Gold Ltd News and Updates

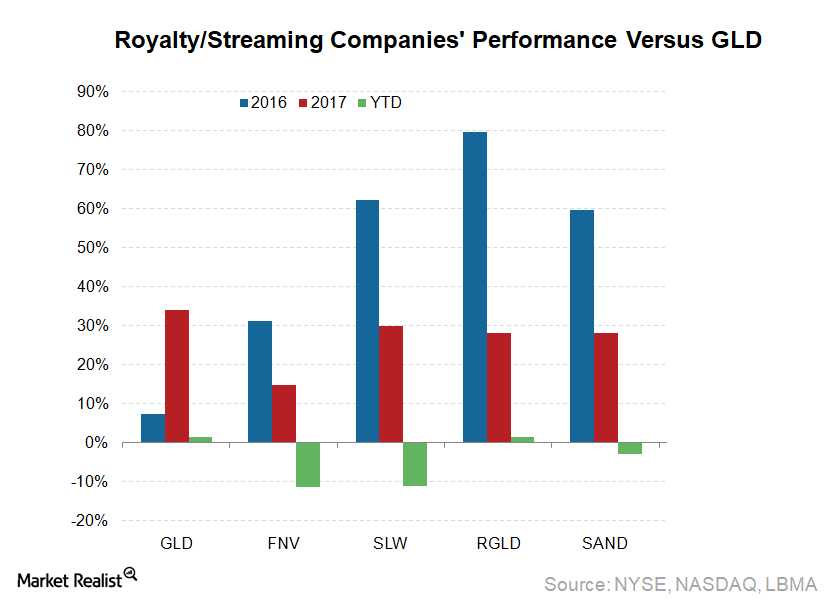

Could Royalty and Streaming Companies Stay Strong in 2018?

Royalty and streaming companies Royalty and streaming companies’ business model differs greatly from that of other precious metal miners (RING), mainly because royalty and streaming companies do not own mines. These companies make upfront payments to gain a right to a fixed percentage of future silver or gold mine production. Additional payments are then made […]

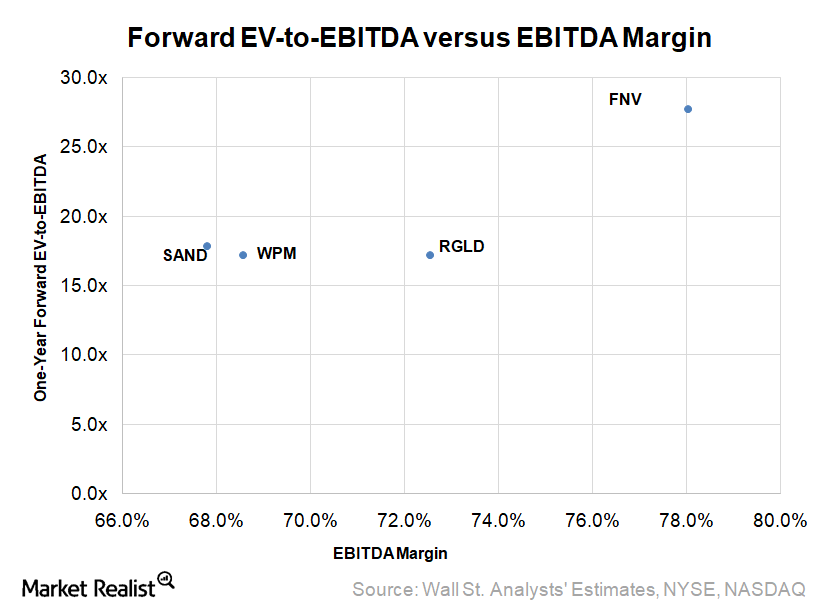

Why Valuation Multiples for Royalty and Streaming Companies Have Risen in 2017

Royalty and streaming mining companies (RING) (SIL) have business models that are considered quite conservative because they don’t own mines.