Which Gold Miners Are Ray Dalio and John Paulson Betting On?

Hedge funds increased their net positions in the SPDR Gold Shares ETF during the first quarter.

Nov. 20 2020, Updated 12:57 p.m. ET

GDX isn’t so lucky

Hedge funds increased their net positions in the SPDR Gold Shares ETF (GLD) during the first quarter. However, all isn’t so rosy for the VanEck Vectors Gold Miners ETF (GDX). During the quarter, GDX’s holdings fell 15.4% sequentially.

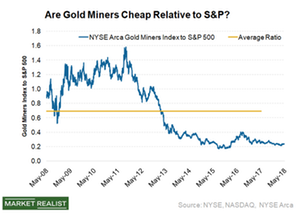

Gold miners lose favor

Gold miners haven’t kept the pace with broader equities and gold prices. In Can Gold Stocks Catch Up to Broader Equities and Gold Prices? we’ve highlighted what could help these miners catch up. Gold miners have lost favor with institutional investors, as they made some merger and acquisition decisions at the peak of the commodity cycle that resulted in high debt. Most of these investments also didn’t work out as expected.

Moreover, as miners got used to higher gold prices, their costs ran amok. Most of these concerns have now been taken care of, and these companies have emerged as much leaner and more profitable organizations. However, it could take some sustainable and consistent operational performances for them to find renewed investor interest.

Gold stock bets

While speaking at the Denver Gold Forum in September 2017, Paulson & Co. partner Marcelo Kim launched an attack on the gold sector. He said, “If we don’t do anything to change, then as investors we will continually be disappointed with shareholder returns and the industry will slowly dig itself into a hole of irrelevance and oblivion.” Paulson’s fund has exposure to Agnico Eagle Mines (AEM), AngloGold Ashanti (AU), IAMGOLD (IAG), and Randgold Resources (GOLD), among others. In the first quarter, the fund added Goldcorp (GG) to its investments.

Bridgewater Associates remains exposed to the precious metals mining sector through AEM, AU, GG, B2Gold (BTG), Barrick Gold (ABX), Freeport-McMoRan (FCX), and Yamana Gold (AUY), among others.

Soros Fund Management has remained out of gold exposure since exiting its position in ABX in the fourth quarter of 2016.

Read Could the Recent Pullback in Gold Be a Buying Opportunity? for a gold price outlook.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!