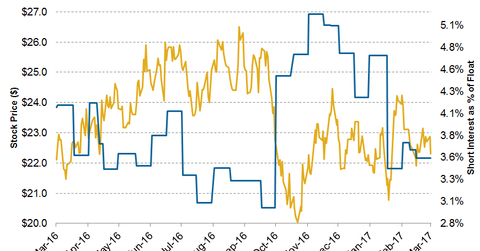

How Short Interest in COG Stock Has Been Trending

On March 14, 2017, Cabot Oil and Gas’s (COG) short interest as a percentage of its float (or its short interest ratio) was ~3.5%.

March 20 2017, Updated 9:06 a.m. ET

Short interest in Cabot Oil and Gas’s stock

On March 14, 2017, Cabot Oil and Gas’s (COG) short interest as a percentage of its float (or its short interest ratio) was ~3.5%. Its short interest ratio a year ago was 4.1%.

COG’s stock closed at $22.10 on March 14, 2016, and $22.31 on March 14, 2017. COG peers EQT (EQT), Antero Resources (AR), and Rice Energy (RICE) have short interest ratios of ~4.5%, 6.3%, and ~8%, respectively. These companies make up ~3% of the iShares North American Natural Resources ETF (IGE).