Analysts’ Views on Valero

Analysts’ ratings for Valero Previously, we looked at analysts’ expectations for Valero Energy’s (VLO) dividend payment next quarter. In this part, we’ll look at analysts’ ratings for Valero. As shown in the chart above, nine (or 43%) of the 21 analysts covering VLO have rated it a “buy.” The remaining 12 analysts have rated Valero a “hold,” and […]

Nov. 20 2017, Updated 7:31 a.m. ET

Analysts’ ratings for Valero

Previously, we looked at analysts’ expectations for Valero Energy’s (VLO) dividend payment next quarter. In this part, we’ll look at analysts’ ratings for Valero.

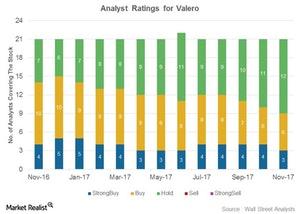

As shown in the chart above, nine (or 43%) of the 21 analysts covering VLO have rated it a “buy.” The remaining 12 analysts have rated Valero a “hold,” and there have been no “sell” ratings.

Since November 2016, ratings have weakened, with a drop in “buy” ratings and a rise in “hold” ratings. However, Valero has recently observed a rise in its target prices. After its 3Q17 earnings release, Barclays raised its price target for Valero from $86 per share to $108 per share, and Raymond James raised its price target from $85 per share to $92 per share.

Since November 2016, Valero’s implied gains based on its mean target price have widened marginally, from 3.6% to 3.8%. VLO’s current mean price target of $85 per share implies a ~3.8% gain. Implied gains have risen due to its mean target price rising more steeply than its actual price. In the past year, Valero’s stock price has risen 30.0%, whereas its mean target price has risen 30.4%.

Analysts’ ratings of peers

Peers Marathon Petroleum (MPC), Phillips 66 (PSX), and Andeavor (ANDV) have been rated “buy” by 74%, 42%, and 79% of analysts, respectively. Delek US Holdings (DK), PBF Energy (PBF), and HollyFrontier (HFC) have been rated “buy” by 50%, 35%, and 29% of analysts, respectively.

Why are analysts’ ratings for VLO weakening?

Valero has robust financials with low debt and surplus cash flow, and it has steadily paid dividends and repurchased shares. However, unpredictable RIN (renewable identification number) expenses have been impacting Valero’s earnings on a quarterly basis. In 3Q17, VLO incurred $230 million towards the purchase of RINs, around $32 million more than in 3Q16.

Plus, it does not look like the issue is going to end soon. In the company’s 3Q17 earnings conference call, Valero Europe vice president Jason Fraser stated that “still the White House, the EPA[1.Environmental Protection Agency] and Congress have all acknowledged that high RIN prices are a problem for the refiners. This is not the way the program is supposed to work. So, they’re going to continue to get pressure until we get the situation addressed. We’re going to continue to pursue our legal, regulatory, and legislative options, as are others, and we’re going to keep up the fight.”

Thus, most analysts may have assigned “hold” ratings due to the volatile and continuous RIN burden. In the next part, we’ll discuss how Valero’s stock has performed in 4Q17.