Why MLPs’ Sluggishness Continued Last Week

MLPs’ sluggishness continued last week despite strong crude oil. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, fell 1.2% last week.

Nov. 20 2020, Updated 3:40 p.m. ET

AMZ fell 1.2% last week

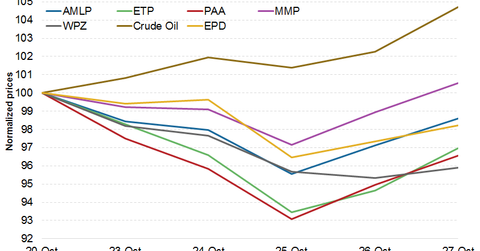

MLPs’ sluggishness continued last week despite strong crude oil. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, fell 1.2% last week. At the same, crude oil rallied 4.7% to end the week at an eight-month high of $53.9 per barrel. The recent rally in crude oil could be due to the OPEC-led supply cut and the slight fall in US drilling activity. For recent updates and the outlook on crude oil prices, see Will US Crude Oil Hit a New 2017 High?

Out of the total 95 MLPs, 63 ended in the red, two remain unchanged, and the remaining 30 ended in the green. MLPs’ recent weakness despite strong crude oil could be due to the continued decline in drilling activity. Midstream MLPs’ throughput volumes are linked to drilling activity and production growth. According to the recent rigs reports by Baker Hughes, the total US rig count fell by four to 909 last week. The total US rig count has fallen by 31 since the end of the third quarter.

Among the top MLPs by market capitalization, Williams Partners (WPZ), Plains All American Pipelines (PAA), Energy Transfer Partners (ETP), and Enterprise Products Partners (EPD) fell 4.1%, 3.4%, 3.0%, and 1.8%, respectively. We’ll look into performance drivers for the top MLP losers and gainers in the next part of this series.

The Alerian MLP ETF (AMLP) comprises 25 energy MLPs. It fell 1.4% during the week. The ETF underperformed both the Energy Select Sector SPDR Fund (XLE) and the SPDR S&P 500 ETF (SPY)(SPX-INDEX). XLE fell 0.6% while SPY rose 0.2%.

Fund flows

Despite last week’s weakness, MLPs saw a net inflow of funds, which could be due to MLPs’ attractive valuation. We’ll look more into this topic in a later part of this series. The Alerian MLP ETF saw a net inflow of $70.0 million funds. On the other hand, the JP Morgan Alerian MLP Index ETN (AMJ) saw a net inflow of $45.4 million.