US Oil Exports Could Threaten International Oil Prices

In the week ending January 12, 2018, US crude oil exports were at ~1.25 MMbpd—234,000 barrels per day more than the previous week.

Jan. 23 2018, Published 9:41 a.m. ET

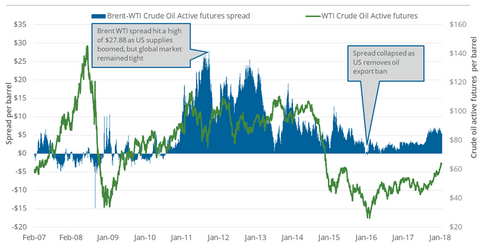

Brent-WTI spread

On January 22, 2018, Brent crude oil (BNO) active futures settled $5.54 above WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures. On the same day, the spread gained $0.30. In Part 1, we already discussed the comments from Saudi Arabia’s oil minister on extending the production cut after 2018. On January 12, 2018, the Brent-WTI spread or the price difference was $5.57. Between these two dates, there was a decline of 1.2% and 1% in Brent crude oil futures and WTI crude oil futures.

Oil exports

In the week ending January 12, 2018, US crude oil exports were at ~1.25 MMbpd (million barrels per day)—234,000 barrels per day more than the previous week and 0.4% below its record high, according to weekly data. Rising US crude oil exports could be a concern for OPEC’s production deal—a bearish catalyst for oil prices. OPEC’s deal was implemented in January 2017. Since January 2017, US oil exports have risen by 0.52 MMbpd, which is ~43.5% of OPEC’s pledged output cut.

If US oil production rises, it could encourage US oil producers (XOP) (DRIP) (FENY) to pump more oil into the international market. It would increase the price realization per barrel of oil. In the domestic market, a higher Brent-WTI spread will decrease US oil producers’ price realization per barrel of oil compared to their international peers. Usually, oil produced in the US follows WTI crude oil prices. Brent crude oil is the benchmark for most of the oil produced outside the US.

At the same time, the price difference gives US refineries (CRAK) an opportunity to take advantage of weaker US crude oil prices. Refineries’ output products follow Brent crude oil prices. So, a higher proportion of US crude oil as input will increase their profit.