Are Traders Confident about the Oil Supply-Demand Balance?

Between December 29, 2017, and January 8, 2018, the premium and the oil prices rose. The market expects a tightening supply-demand balance for oil in 2018.

Nov. 20 2020, Updated 5:23 p.m. ET

Futures spread

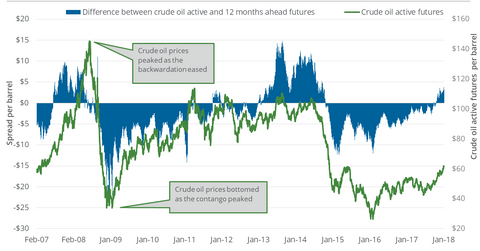

On January 8, 2018, the February 2018 futures contract settled at a $3.1 premium to February 2019 futures. On December 29, 2017, this difference or the “futures spread” was at a premium of $3.02. Between December 29, 2017, and January 8, 2018, US crude oil active futures rose 2.2%.

Oil prices could rise with any expansion in the premium, like in the trailing week. However, any contraction in the premium could damage oil’s gains.

The spread at a discount or an expansion of the discount could cause oil prices to fall. A discount reached $2.60 on June 21, 2017. US crude oil active futures fell to the lowest level in 2017. Any contraction in the discount could be good for oil’s recovery.

Oil supply

Between December 29, 2017, and January 8, 2018, the premium and the oil prices rose. The market expects a tightening supply-demand balance for oil in 2018. Higher oil prices could boost the energy constituents of the S&P 500 (SPY) and the Dow Jones Industrial Average (DIA).

Energy sector

A rising premium in the futures spread could impact US oil producers’ (XOP) (DRIP) (IEO) risk management techniques. It’s also important for midstream companies (AMLP).

On January 8, 2018, US crude oil futures contracts between March 2018 and February 2019 were priced progressively lower. In fact, the United States 12 Month Oil ETF (USL), the United States Oil ETF (USO), and the ProShares Ultra Bloomberg Crude Oil ETF (UCO), which invest in US crude oil futures, might also benefit from this price pattern.