Will Non-OPEC and US Crude Oil Production Impact Oil Prices?

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 46,000 bpd to 9,553,000 bpd on October 20–27, 2017.

Nov. 3 2017, Published 11:08 a.m. ET

US crude oil production

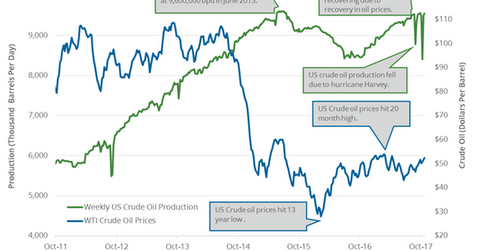

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 46,000 bpd (barrels per day) to 9,553,000 bpd on October 20–27, 2017. Production rose 0.5% week-over-week and by 1,031,000 bpd or 12.1% year-over-year.

US crude oil production is near a 28-month high. So far, high US oil production has been weighing on crude oil (USL) (UCO) prices in 2017. US oil (UWT) prices have fallen 4.1% year-to-date. However, crude oil prices have risen ~30% since the lows in June 2017. Oil and gas producers (VDE) (IEZ) like EOG Resources (EOG), Whiting Petroleum (WLL), and Sanchez Energy (SN) benefit from higher oil prices.

Non-OPEC crude oil production

The US, Canada, Russia, Brazil, and China are the significant non-OPEC (Organization of the Petroleum Exporting Countries) crude oil producers. The EIA estimates that non-OPEC oil production averaged 58.48 MMbpd (million barrels per day) and 57.99 MMbpd in 2015 and 2016, respectively. It’s expected to average 58.63 MMbpd and 60.12 MMbpd in 2017 and 2018, respectively. The US, Canada, Brazil, and Kazakhstan would be the major contributors to a rise in non-OPEC production in 2018.

Goldman Sachs estimates for US crude oil production

According to Goldman Sachs, US crude oil production could average between 9.6 MMbpd and 9.7 MMbpd by the end of 2017. It would be the highest production in the last 30 years.

The EIA estimates that US production averaged 9.4 MMbpd in 2015 and 8.86 MMbpd in 2016. It’s expected to average 9.24 MMbpd in 2017 and 9.92 MMbpd in 2018.

Impact

The rise in non-OPEC and record US crude oil could cap the upside for crude oil (SCO) (BNO) prices. It could also offset some of the impacts of the ongoing production cuts. Meanwhile, production cuts are shrinking the global crude oil glut.

Next, we’ll analyze how US gasoline inventories impact oil prices.