What Has Influenced the Outlook for Valero Energy?

Valero Energy’s operating revenue fell 14% in 2016 before rising 23% in 9M17. Refining revenues drove the decline in 2016, offset by ethanol revenues.

Jan. 12 2018, Published 10:41 a.m. ET

What drove Valero Energy’s operating revenue recovery?

In this series, we’ll focus on Valero Energy (VLO), Alaska Air Group (ALK), Lam Research (LRCX), Nasdaq (NDAQ), Southwest Airlines (LUV), and Extra Space Storage EXR).

Valero Energy’s operating revenue fell 14% in 2016 before rising 23% in 9M17. Refining revenues drove the decline in 2016, offset by ethanol revenues. Every region, including the United States, Canada, the United Kingdom, and Ireland, recorded declines in their 2016 revenues.

Revenue from refining drove revenue growth in 9M17, offset by ethanol revenues.

How much did EPS recover?

Gross profit for VLO declined 21% in 2016 before gaining 2% in 9M17. Operating expenses increased 1% and 7% in 2016 and 9M17, respectively. As a result, operating income fell 44% and 3% in 2016 and 9M17, respectively. Adjusted operating income fell 60% in 2016 before rising 21% in 9M17.

Interest expense increased in both periods. Adjusted net income shed 63% in 2016 before gaining 25% in 9M17. Diluted EPS (earnings per share) fell 60% in 2016 before rising 31% in 9M17. Share buybacks enhanced EPS.

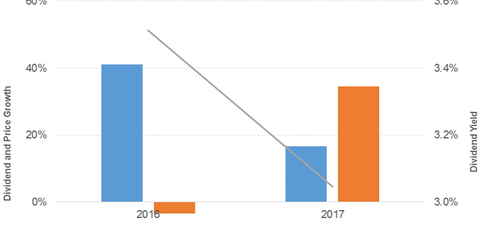

Dividend and price

Dividends per share rose 41% and 17% in 2016 and 2017, respectively. Prices fell 3% in 2016 and rose 35% in 2017. That led to a downward sloping dividend yield curve. A forward PE (price-to-earnings) ratio of 18.4x and a dividend yield of 3.1% compare to the sector average forward PE ratio of 10.9x and a dividend yield of 7.5%.

How VLO compares to the broader indexes

The S&P 500 (SPX-INDEX) (SPY) offers a dividend yield of 2.2%, a PE ratio of 23.4x, and a YTD (year-to-date) return of 19.6%. The Dow Jones Industrial Average (DJIA-INDEX) (DIA) has a dividend yield of 2.2%, a PE ratio of 22.3x, and a YTD return of 25.1%. The NASDAQ Composite (COMP-INDEX) (ONEQ) has a PE ratio of 28.2x and a YTD return of 24.8%.

What’s VLO’s operating revenue and EPS outlook?

Valero Energy is being projected to have an 18% operating revenue growth in 2017 followed by a 3% decline in 2018. Its diluted EPS is projected to rise 34% in 2017 and 32% in 2018.

Dividend ETFs with exposure to Valero Energy

The iShares Select Dividend (DVY) has a PE ratio of 20.3x and a dividend yield of 3.7%. The SPDR S&P 500 High Dividend ETF (SPYD) has a PE ratio of 16.8x and a dividend yield of 3.8%.