What Are Corning’s Key Growth Drivers?

Corning’s gross margin grew 3% and 9% in 2016 and 9M17, respectively.

Jan. 12 2018, Updated 7:35 a.m. ET

What drove Corning’s sales?

Corning’s (GLW) core net sales fell 1% in 2016 before gaining 9% in 9M17 (or the first nine months of 2017). The Display Technologies and Environmental Technologies segment drove the decline in 2016, offset by the Optical Communications, Specialty Materials, Life Sciences and Other segments. The company’s net sales grew 3% and 8% in 2016 and 9M17, respectively.

What drove the EPS performance?

Gross margin grew 3% and 9% in 2016 and 9M17, respectively. Operating expenses increased 1% in 2016 before decreasing 3% in 9M17. The difference was due to the absence of restructuring and impairment charges in 2017. As a result, operating income grew 5% and 31% in 2016 and 9M17, respectively. Adjusted operating income fell 6% in 2016 before gaining 10% in 9M17.

A gain on the realignment of equity investment, equity in earnings of affiliated companies, and interest income helped offset the effect of rising interest expenses, translated earnings contract losses, and other expenses in 2016. The company saw lower interest expenses, translated earnings contract losses, and other expenses in 9M17. Adjusted net income fell 6% in 2016 before gaining 2% in 9M17. Adjusted diluted EPS gained 11% and 16% in 2016 and 9M17, respectively. Share buybacks enhanced the EPS numbers.

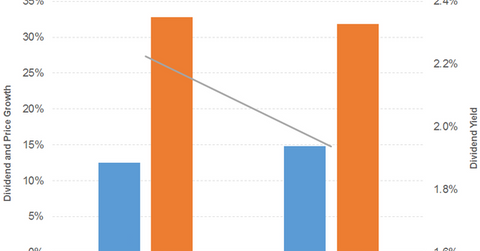

Dividend and price growth

Dividend per share grew 13% and 15% in 2016 and 2017, respectively. Prices gained 33% and 32% in 2016 and 2017, respectively, which led to a downward sloping dividend yield curve. The company’s forward PE of 18.7x and a dividend yield of 1.9% compares to a sector average forward PE of 12.8x and a dividend yield of 2.5%.

How does it compare to the broad indexes?

The S&P 500 (SPX-INDEX) (SPY) has a dividend yield of 2.2%, a PE ratio of 23.4x, and a YTD return of 19.6%. The Dow Jones Industrial Average (DJIA-INDEX) (DIA) has a dividend yield of 2.2%, a PE ratio of 22.3x, and a YTD return of 25.1%. The NASDAQ Composite (COMP-INDEX) (ONEQ) has a PE ratio of 28.2x and a YTD return of 24.8%.

What is the core net sales and EPS outlook?

Corning is projected to grow its core net sales by 7% and 3% in 2017 and 2018, respectively. The diluted EPS is projected to grow by 11% and 6% in 2017 and 2018, respectively.